Boneless Hams Trading at Larger Than Normal Premium

US - We would like to remind our readers that starting next week USDA will implement changes to the way in which USDA calculates the ham primal value. That change will then also impact the calculation of the daily pork cutout value, write the Steiner 0Consulting 0Group.At the end of this article we include a link to the USDA calculations and the rationale for making this change. But the reasoning is simple enough. Packers no longer sell just bone‐in hams that processors then use to harvest boneless muscles. They now also sell boneless product and therefore in order to best calculate the value of the entire pork cutout it is important to roll up the value of pork cuts that have become more significant with time.

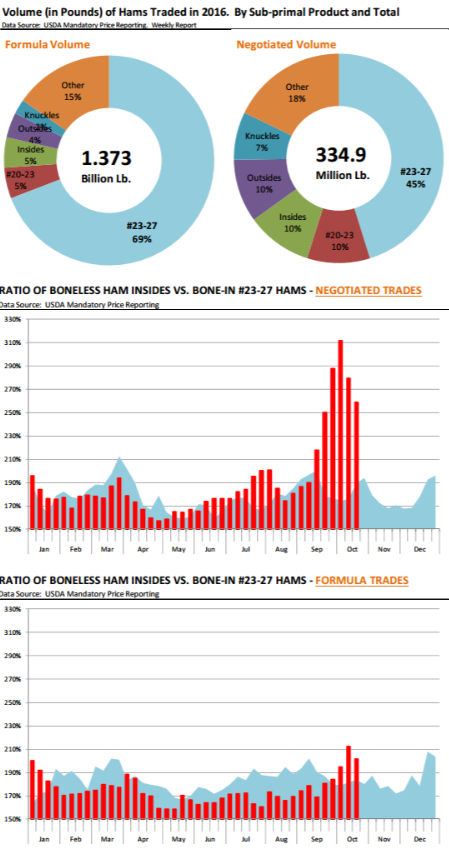

The pie charts below show the volume breakdown for the various ham primal components. When we talk about changes to the pork cutout and primal changes we are largely talking about the negotiated market.

For reference purposes we also included the trades that are done on a formulated basis. USDA is absolutely correct that boneless ham muscles today make up a significant portion of the amount of total hams traded on a negotiated basis.

We calculated the ham volume using the weekly USDA sheet from January 1 through last week. In total the amount of all hams traded during this period on a negotiated basis was around 335 million pounds. Bone‐ in large hams made up about 45 per cent of the total while boneless muscles accounted for 27 per cent of the total volume. The remainder was either smaller bone‐in hams, boxed product and other smaller muscles.

But notice that the amount of hams traded on a formula basis is about 4 times larger. And in that much larger bucket, bone‐in hams are by far the dominant product that is traded. USDA noted in their analysis that by including boneless ham trades in the cutout calculation this would on average (using Oct 2015—May 2016 data) lower the ham primal value by $5.75/cwt and the overall cutout in turn would be lower than current levels by around $1.41/cwt. But it is possible this overstates the impact on packer margins, largely because most of the hams they sell still are bone‐in products and they sell those on a formula basis using the negotiated market for #23‐27 pound hams.

The second thing we want to highlight are recent price trends. Since August boneless hams have traded at a much larger than normal premium to bone‐in product. The two charts to the right paint the picture by calculating the ratio of boneless ham inside prices relative to the value bone‐in hams.

We put the two charts on the same scale so you can see how much more dramatic the shift has been in the negotiated market. Why are boneless hams trading now at such a big premium to the bone‐in product? We think this is a function of the large number of hogs that have been coming to market in the last two months.

Processing lines are limited and therefore you have a relatively stable amount of boneless hams produced each week. On the other hand the amount of bone‐in hams has been increasing significantly, thus widening the spread between these two products. This basically means that even though over time the value of the cutout will be lower probably by the amount that the USDA has calculated in their analysis, at this time the inclusion of boneless hams in the cutout will not have as big of an effect because they are trading at such a big premium to the bone‐in product. Click here for the full USDA analysis.