Japanese Pork Import Growth Slowing

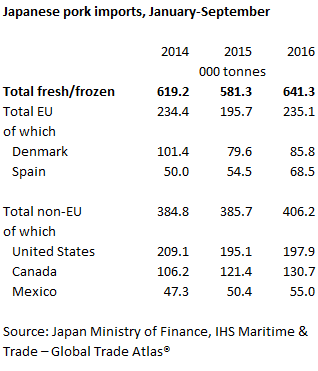

JAPAN - In the first nine months of 2016, Japanese imports of fresh/frozen pork were up 10 per cent on 2015 levels, at 641 thousand tonnes.However, the rise in import volumes has slowed as the year progressed. Volumes for Q2 and Q3 were up only 6 per cent , compared to the 20 per cent increase in shipments seen at the start of the year.

With Japanese pig herd recovery underway, following outbreaks of PEDv in 2014, it is probable that the growth in import volume will continue to tail-off in the coming months.

Increased volumes relative to 2015 have been seen from all the key importing nations. The EU has shown particularly strong growth, with volumes up 20 per cent during this period, resulting in a 3 per cent gain in import market share.

However, this growth was largely based in the first half of the year, with Spain the main driver behind the movement, with shipments up by a quarter. Outside the EU, the US, Canada, and Mexico also moderately expanded their shipments, by 1 per cent , 8 per cent and 9 per cent on the year, respectively.

In yen, average unit prices during the first nine months of 2016 were back 3 per cent year-on-year.

Hence, growth in value terms was behind volume - up 7 per cent at ¥337 billion. However, with the yen appreciating against both the euro and US dollar during this period, major importers have been able to increase prices in their domestic currency, whist maintaining discounts on the Japanese market. This was particularly pronounced in Q3, where unit prices were up 17 per cent in both euro and dollar terms, but back 2 per cent in yen.

However, moving into October attempts by the Bank of Japan to reverse economic deflation have devalued the yen. This could reduce the competitiveness of imported pork on the Japanese market and may contribute to limiting import growth in the coming months.