US Pork Exports Looking Positive

US - USDA/FAS has released its weekly update on US beef and pork exports and the data continues to paint a very positive picture for both proteins. Keep in mind that the weekly report only covers sales of beef and pork muscle cuts while the monthly statistics include all fresh/frozen meat exports plus they will also included exports of cooked and processed items, writes the Steiner Consulting Group.The weekly export numbers will always be quite a bit lower than the monthly trade but the benefit is that they are much more current than the monthly statistics that often have a 5 week lag. The challenge often is that weekly numbers can be volatile and add to the overall noise in the marketplace.

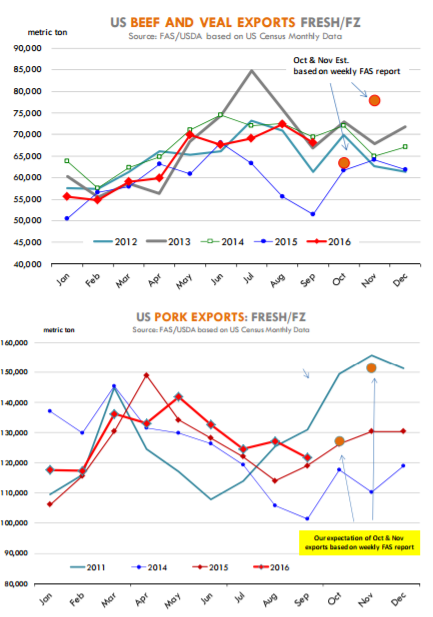

Also, many of the forecasts that USDA and private analysts put together are on a quarterly basis and so it is hard to put the weekly numbers in the proper context. The two charts to the right try to do just that, taking the weekly numbers and showing what they imply for the last two months for which we do not have official statistics. With that in mind, let’s look at some of the details from today’s numbers and what the implications are for the month of November.

Beef: Exports of beef muscle cuts in the past two weeks have averaged 16,808 MT, the highest two week average at any point this year or last year for that matter. Beef exports in the last four reported

weeks have averaged 15,750 MT, 28 per cent higher than the same four week period a year ago.

Extremely strong demand from a number of Asian markets continues to drive exports of US beef this fall. And it is quite impressive that the robust export pace so far has not been impacted much by the strong US dollar (remember a strong US dollar raises the effective price world buyers have to pay for US products).

Exports to South Korea in the last four reported weeks averaged 4,279 MT, 80 per cent higher than a year ago. Exports to Japan averaged 3,894 MT, +34 per cent while exports to Taiwan averaged 1,999 MT/wk, +75 per cent. There is one Asian market where US beef exports have been struggling and that is Hong Kong, with sales there in the last four weeks down 17 per cent from last year. It is not a coincidence that the markets where we have gained ground are also markets that normally buy from Australia but do not allow Brazilian beef. With Australian slaughter down in double digits from a year ago, Korean and Japanese buyers have had to bid more aggressively on US product. Lower prices for US beef in October also helped considerably to increase the pace of shipments to these markets.

Exports to Mexico and Canada were up +6 per cent and +23 per cent, respectively, accounting for about 20 per cent of overall shipments. Asia is by far the major destination for US beef, however. At this point we are projecting US fresh/frozen monthly exports in November at +21 per cent compared to a year ago and a significant improvement over October levels.

Pork: US pork exports also have recovered nicely in the last few weeks. Low prices for a number of pork items in October likely set the stage for a major rebound in November. Mexico has become the top market for US pork recently and exports to that market in the last four weeks averaged 9,705 MT, 48 per cent higher than a year ago. There is speculation that Mexican buyers have accelerated their purchases due to the expected change in the US administration in January.

However, any changes to NAFTA will likely take time so it is curious that this could be the motivation for the jump in exports.

The rise in exports to Mexico helps explain the firm market for hams so far this fall despite very large

slaughter. Exports to China have been quite low so far but if they are buying carcasses those numbers would not show up in the weekly update and we will have to wait for the monthly statistics.

At this point we are projecting November fresh/frozen pork exports at +16 per cent Y/Y.