US Red Meat Production Above Year-Ago Levels

US -In the news this past week was the USDA’s posting of “The Farmer Fair Practices Rules“, which they had in recent years been precluded from putting forward by Congress. This rulemaking is commonly referred to as the GIPSA Rule, writes the Steiner Consulting Group.Responses to the latest GIPSA Rule by various industry and some other groups have already captured media attention and there will likely be much more.

Also this past week, the Federal Reserve, in a highly anticipated move, raised their benchmark short-term interest rate (Federal Funds Rate) from 0.25 per cent to 0.50 per cent. That was the first increase in one year. Even though the rate-hike was very modest and fully telegraphed, the US dollar responded by increasing relative to several key currencies important to the livestock and poultry industries. Of course, the higher dollar raises prices for those that want to buy from the US and firms in countries that export beef to the US were pleased.

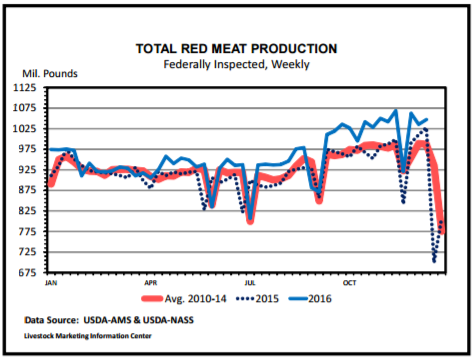

On the second page of this newsletter, is our weekly cash price and production summary. Red meat (both beef and pork) production last week remained above a year ago. The yearover-year increases in beef (up 2.8) and pork (rising 1.2 per cent) production generally moderated compared to weeks earlier this quarter. Still, cattle, hog, and wholesale (cutout) values were higher than in some time.

In the cattle/beef sector, prices gained for the week, but remained below 2015’s. In contrast, hog/pork sector prices were mostly above year ago levels. For the week, the Choice beef cutout value ($192.05 per cwt.) was the highest for any week since early September of this year.

The weekly average pork cutout value at $76.78 was the highest since late September’s. Futures market prices also were higher last week. The weekly average (simple average of the daily closes) Live Cattle contract for December of 2016 was $111.12 per cwt., that was the highest for any week since mid-August (when it averaged $115.53). The January 2017 Feeder Cattle contract averaged

$128.56 per cwt. last week, reaching its highest level since late August of this year. Turning to hogs, the December contract averaged $58.15 per cwt. and the February contract was $62.56, both were the highest since mid-July.

For many cattle already in feed yards and set to be marketed in March or April of 2017, the April Live Cattle futures is offering a price that will cover cost of production plus a little positive margin.

For hog producers, all the 2017 contracts last week offered most producers the opportunity to cover all production costs plus a positive margin. Further, all the 2017 hog futures contracts are at or near the top-end of the price range of most market analysts based on fundamental market analysis (including USDA’s). Fundamental analysts make forecasts based on their best assessment of supply and demand factors. Further, several hog contracts exceed the upper end of forecast price ranges. Of course, the next Quarterly Hogs and Pigs report by USDA’s National Agricultural Statistics Service

(USDA-NASS) may cause some changes in analyst expectations.

This week, there will be several important reports from USDA-NASS. Two major potential market moving reports are bunched-up on Friday afternoon (December 23rd) – Quarterly Hogs and Pigs and monthly Cattle on Feed. Another monthly market influencing report, Cold Storage, also will be released on Friday. Other monthly USDA-NASS reports to be released this week, which help gauge market trends, are Livestock Slaughter and also Poultry Slaughter on Thursday, then Chickens and Eggs comes out on Friday.