The pollution regulations affecting China's pork producers

Recent changes in China’s Environmental Protection Laws have instigated a drastic change in the balance of small-scale and industrial pig producers within the pork industry, with rippling effects on China’s total production values and imports.

In an interview with The Pig Site, Angela Zhang, Head of the Business Intelligence Division at IQC Insights, discusses the laws in more depth, with an insight into the impacts on the industry so far. Angela also shares her predictions on China’s production for 2018 and beyond.

1. Are you able to give an overview of the new regulations?

On January 1 2015, the new Environmental Protection Law was implemented formally in China. It greatly intensifies the punishment for pollution-emitting enterprises, with many small and medium-sized pig-breeding farms below standard being closed or demolished forcibly within a specified time, causing great changes in China’s pork farming structure.

The Law, Guidance on Adjusting and Optimising the Layout of Pig Farming in South China, released by the Ministry of Agriculture on November 26, 2015, states that the breeding area in South China should be reduced and that breeding will be transferred to the middle-west and north-eastern areas in the future. At the same time, the National Environmental Protection Department would strengthen its control over faecal pollution caused by breeding pigs; set higher requirements around farm infrastructure, and have stricter rules on the related documents about running farms.

The regulation covers about 20 provinces in China.

The total number of live pigs for sale in these provinces reached 540 million head, occupying 79% of the total number of live pigs sold in China in 2016. As disclosed by China’s Ministry of Environmental Protection, 213,000 livestock farms have been closed or relocated by mid-2017.

It’s worth mentioning that when it comes to implementation of these environmental regulations, these provinces set up their own sub-clauses based on local conditions. However, most of these local governments have specified the end of 2017 as the deadline for those unqualified pig farms to be closed or relocated.

In addition, according to the resolution by the 12th Standing Committee of the National People’s Congress, China’s first Environmental Tax Law would start to take effect by January 1, 2018. The tax would be only imposed on those farms with more than 500 pigs in stock.

2. In your experience, have you seen producers adapting facilities to meet regulations or closing and relocating?

In my hometown, Zhejiang Province, I have witnessed many small pig farms being closed over the past three years. Due to the new environmental policies, the environmental costs are increased. If small farms want to survive in this market, they have to input money, and upgrade their facilities and breeding technology. This is difficult for them, so they choose to withdraw from this market. Moreover, the new environmental regulations also create barriers to new entrants. The change of live pigs in stock and for sale also verifies this point from 2014 to 2016 in

the following table:

Using the data in 2014 as the baseline, we could find that the live pigs in stock and for sale declined by 41% and 32% respectively in 2016.

However, for those large-scale enterprises, most of them are inclined to upgrade facilities to meet the new regulations or relocate to domestic major grain-producing areas, saving feed costs at the same time. In addition, China’s Ministry of Agriculture published the Action Program for Reclamation of Faeces of Livestock and Poultry (2017~2020) on July 10, 2017. Its major purpose is to promote the sustainable development and virtuous cycle of domestic farming and herding. Therefore, the main trend for domestic large pig-breeding enterprises, after these environmental regulations were published, is to move from the South to the North, and from the East to the West.

3. What impact are the new pollutions regulations already having on pork production, import and export?

The new environmental regulations have directly changed the supply and demand structure of pork in China since 2014. We can see from the following chart that China’s pork production and China’s import acted in opposition from 2014 to 2016:

.jpg)

The domestic pork production has continued to decline, from 56,710 thousand tons in 2014 to 52,990 thousand tons in 2016, with a CAGR of -3%; during the same period, China’s import of pig meat and offal had increased greatly, with a CAGR of 47%. In 2016, China imported 2,970 thousand tons of pig meat and offal, with a y-o-y growth rate of 91%, while it was also regarded as a key year for implementation of the new environmental regulations in 2016.

As for pork export, it is not so important to influence the domestic supply and demand structure because of its low volume these years. Although China’s pork production occupied 49% of the global production in 2016, it was also the largest pork consumer in the world. With the decreased domestic pork production, China’s pork export also continued to fall, from 92 thousand tons in 2014 to 49 thousand tons in 2016.

4. What is your forecast for China’s production in the near future?

Influenced by the new environmental protection policies over the past three years, many domestic small and medium-sized pig farms have been demolished. It has two consequences thereof: on one hand, due to the concentrated sale of pigs by these farms, the total slaughtering volume of fixed slaughterhouses in China from this January to October reached 178.5 million head, with a y-o-y growth rate of 7%; on the other hand, as shown in the following chart, the domestic sow and live pig inventories have hit a record low since January 2015.

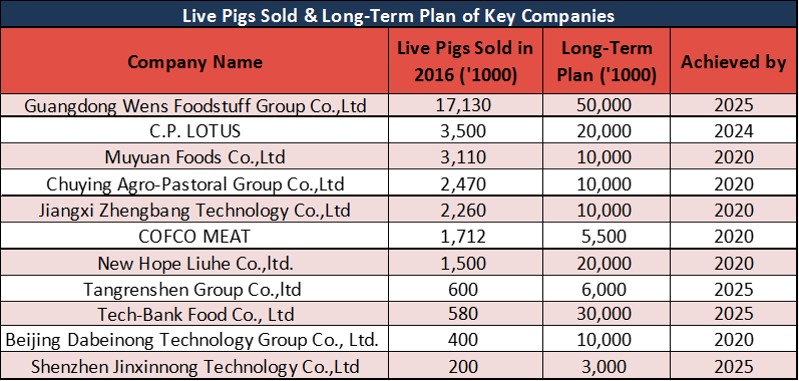

However, this does not necessarily indicate an acute shortfall in pork supply next year, as those large-scale pig-breeding companies are taking this opportunity to expand their production capacity. The following table verifies their ambition in detail:

The increased production capacity is expected to be released from 2018 on. Muyuan Foods has announced that they have 10 million live hogs for sale in 2018, while New Hope Liuhe also plans to sell 3.5 million live hogs next year.

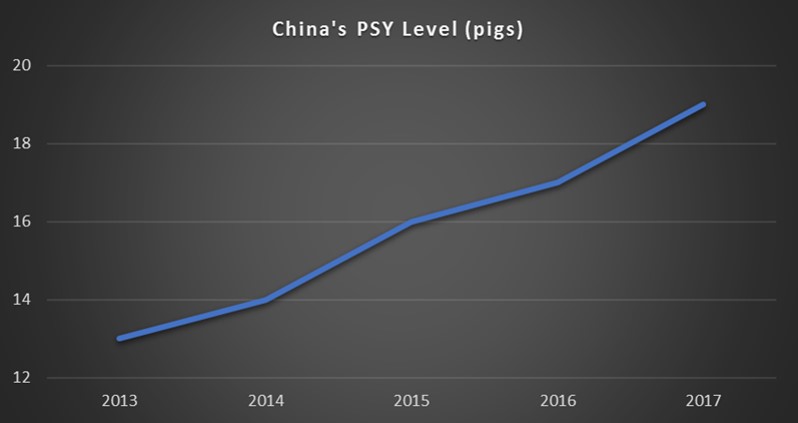

In addition, due to the environmental-protection policies, the domestic farming structure will also change greatly. Whilst the small pig-breeding farms exit from the market, industrial up-scaling is accelerating. Currently, the large-scale farms (more than 500 pigs in stock) occupy about 50% of the total domestic production, growing by nearly 10% than that of five years ago. More importantly, those large-scale enterprises have greater productivity than small ones. The average PSY (Per Sow per Year) level for small and medium-sized farms range from 16 to 18 (pigs), while for large-scale farms, it could reach 20~24 (pigs). The change of farming structure also improves the domestic PSY level as follows:

The increased PSY level could ensure a more rapidly-recovered production capacity despite the current low inventories of sow and live pigs in China. Therefore, the domestic pork production could keep growing by a small margin next year, on the premise that the pork prices do not fluctuate drastically in 2018.

By Angela Zhang