Jim Long Pork Commentary: African swine fever China report

The Chinese swine herd could decrease by 20 percent before the epidemic is under control.African swine fever (ASF) China report

Genesus has been the largest exporter of swine breeding stock to China the last three years.

Many industry contacts tell us they believe that in China the sow herd could be down 20 percent by the time ASF gets somewhat controlled.

In January the latest China Ministry of Agriculture information indicates the Chinese sow herd declined 1.36 million sows. This is in one month!

The decline is greater than the sow herd of Canada, Netherlands, or Denmark.

All gone in four weeks!

The same database indicates since January’s inventory a year ago, China’s breeding herd has declined 5.5 million sows. What’s happening is hard to comprehend. Not sure data is 100 percent accurate, but no doubt huge liquidation underway.

China industry speculation is hog’s will reach 20-23 RMB/kg live weight by second half of 2019 ($1.37 - $1.60 U.S. live weight a lb.).

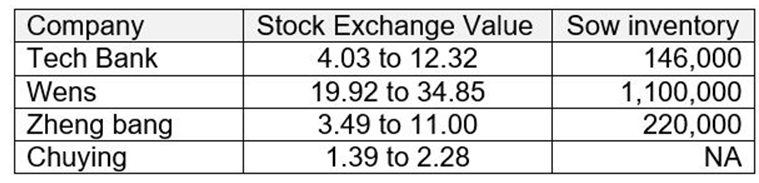

Chinese public traded swine companies (Shanghai Stock Exchange) have seen their stock double to triple as the market speculates on the expected profits that will come from expected record prices.

If 20 percent sow drop, the weekly hog marketing’s will decline about 2.5 million hogs per week. The rest of the world will have great opportunity to help backfill the shortfall.

We believe current US lean hog futures are significantly discounted to what we expect will happen when China starts their needed imports.

We will not be surprised if the worlds hog prices reach record levels.

The longer China’s sow herd liquidation continues, the higher the high and the longer it lasts.

Tough week for lean hog futures

Last week was tough for lean hog futures.

On Friday 15 February, April lean hog futures were at 60.27₵ lb. by Wednesday, 20 February they dropped to 52.25₵ lb. 8₵ lb. The 8₵ lb drop was dramatic and traumatic. Our Industry is losing money currently at a $20 US plus clip. As producers we mostly have an optimistic gene, but a drop of 8₵ shakes even the most optimistic soul.

US packer gross margins have fallen from their record high levels. If we use last Fridays close on US pork cut-outs of 59.01₵ lb. and 53.13₵ lb. for a 53-54 percent lean hog. The spread of about 6₵ lb. probably means packers have next to no money left over after hog harvesting costs. If the packer owns hogs the model of harvesting your own probably means negative margins just like most other hog producers.

More packer capacity is just around the corner with Prestage having an open house 2 March for their new Iowa plant (1,000 head per hour capacity). More capacity probably means record gross packer margins are a thing of the past.

US hog slaughter year to date is up 2.3 percent while the hog price is currently $30 per head less than a year ago. In our opinion, Mexico’s 20 percent tariff and China’s 72 percent tariff on US pork is the blame for much of $30 per head difference.

US trade talks with China and Mexico are ongoing. It is in the US pork industry best interest that somehow there is a resolution. Our sense is that the US industry has stopped net expansion and we would not be surprised if the US sow inventory 1 March is not lower then June last year.

Small pigs

Small pig traders report all pigs moving with barn space available but challenge is buyers’ confidence.

GMO-Gene Editing

Last week we read where the National Pork Producers Council is pushing for the USDA to take over from the US Food and Drug Administration the regulation of GMO-Gene Editing of swine.

We are not sure why as an industry if we believe GMO-Gene Editing is safe why we would not want it to be regulated and approved by the strictest protocols, which undoubtedly the US Food and Drug Administration would provide.

If we want consumers to have the utmost confidence in the pork we sell then why would we not want to have it proven by the strictest protocols. A move to USDA would only make it easier for approval, that’s the reason for the push. Don’t we want to make sure it’s safe for our consumers, ourselves and our children?

Recently we were with European producers. In Europe the courts have ruled gene-editing is to have all rules of GMO. It is GMO.

We asked the producers what they think about GMO-gene editing. Their answer; It will never happen in Europe.

This is about science and safety; but just as importantly it is about being able to sell our Pork. Before NPPC begins pushing for GMO-pork maybe surveys should be done to find out who will buy it? Never seen one?

We still expect a major Packer will come out with a Non-GMO label soon. Why wouldn’t they? Some packers are claiming no hormones on label already. All Pork is Non-GMO currently. When one labels Non-GMO Pork we expect most will follow.