Jim Long Pork Commentary: China pig herd continues massive decline

Jim Long provides his latest rundown on the impacts of African swine fever and depopulation in China's pig herd.Last week China’s Ministry of Agriculture announced that July’s pig inventory had shrunk 32.2 percent and sow inventory had decreased 31.9 percent from July a year ago. China had its first official break of African swine fever last August.

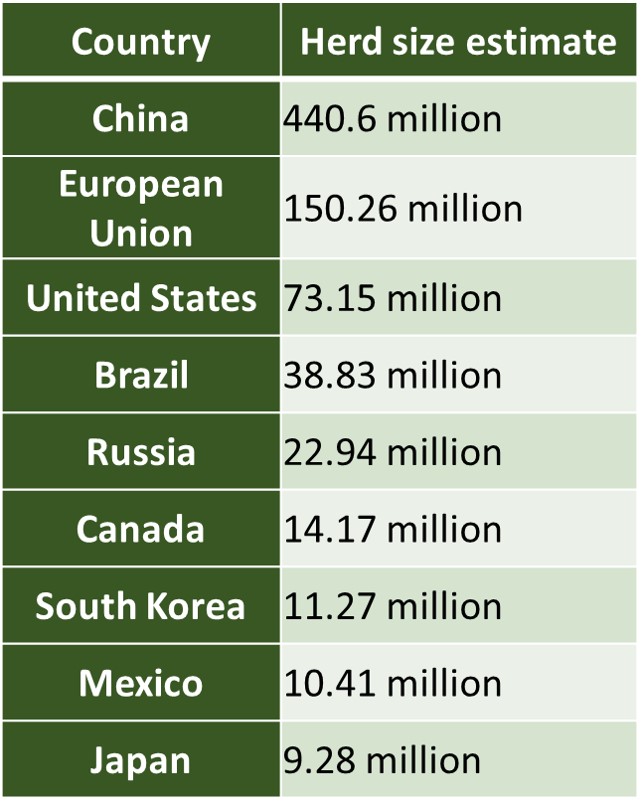

Statista estimates there were 781 million hogs worldwide in March 2018.

If we use China’s inventory of 440.6 million in 2018 that was prior to last August African swine fever break and the Chinese government 32.2 percent decline we calculate a decrease of 140 million swine in China’s inventory compared to a year ago. That decline is almost equal to all the pigs in Europe or double the US Inventory. We suspect China’s government estimate of 32.2 percent decline could be conservative. All observers we are in contact with in China suspect it’s in 50 percent range.

Of note China’s Ministry of Agriculture February Inventory indicated a decrease of 17 percent year over year. To put in perspective China inventory has declined another 15 percent or about 60 million head last 5 months. An average of over 10 million a month. We suspect this decline rate has yet to be abated. The US has marketed year to date 2.5 million more market hogs compared to last year. That is a pittance compared to the massive decline in China’s herd and marketing’s year to date.

Doesn’t take a rocket scientist to see the trajectory of China’s hog price, with prices increasing by 66¢ US liveweight a lb since the end of May. When we returned from China in Mid-May, we wrote that the Chinese producers we met predicted real high prices by August. Reasoning was, numbers of hogs would decrease sharply as a result of huge sow herd liquidation in December to March and liquidation that was ongoing of frozen pork inventory. Most had predicted this price range of 23-24 CNY kg or $1.50 US a lb - very accurate prediction considering in May prices were 14.96 CNY/kg or 96¢ lb. Speculation at that time by people we met with was that when hogs hit 23-24 CNY/kg (which are China record price levels), there would be huge pressure on the Chinese government to increase pork and other meat imports to hold food prices down. We are there and now we see if imports accelerate. We will predict there will be a huge increase in imports.

- Last week the highest price in China was Guangxi at 29 CNY/kg or $1.86 US liveweight a lb.

- Feeder pig price in China is 47 CNY/kg or $3.03 US a lb a 45 lb feeder pig is $136 US.

Some estimates in China to raise a 115 kg (253 lb) market hog in a farrow to finish system it costs 1200 CNY ($170 US). At current hog price 23.49 CNY/kg ($1.52 lb) a 115 kg (253 lb) pig would bring 2700 CNY. The profit margin on this calculation is 1500 CNY per head ($212 US). Big big profit. The reality is if you have lost half your pigs you are still making money, so the large swine corporations can drive on. The real challenge is the thousands of farmers that have no pigs due to ASF-related issues. It’s hard to believe many of these individual farmers will jump back into swine business.

US market

The US hog market we have a hard time understanding. Lean hog futures declining in the face of the massive pork and meat imports from around the world. China will need to hold down food inflation and feed these people doesn’t make any sense to us.

Last week it was announced that China ordered 10 million tonnes of US pork. Trade is ongoing. There is another 100 million tonnes plus already on order of pork. China won’t need soybeans or canola for pigs that don’t exist but pork is something there is definitely a need for.

Time will tell but the massive decline of pork supply in China is real. As we quoted last August, a foreign veterinarian who does business in China just after ASF broke said, “We will find out if the rest of the world has enough food to feed China.”