Hog market bulls remain constrained by keen coronavirus anxiety

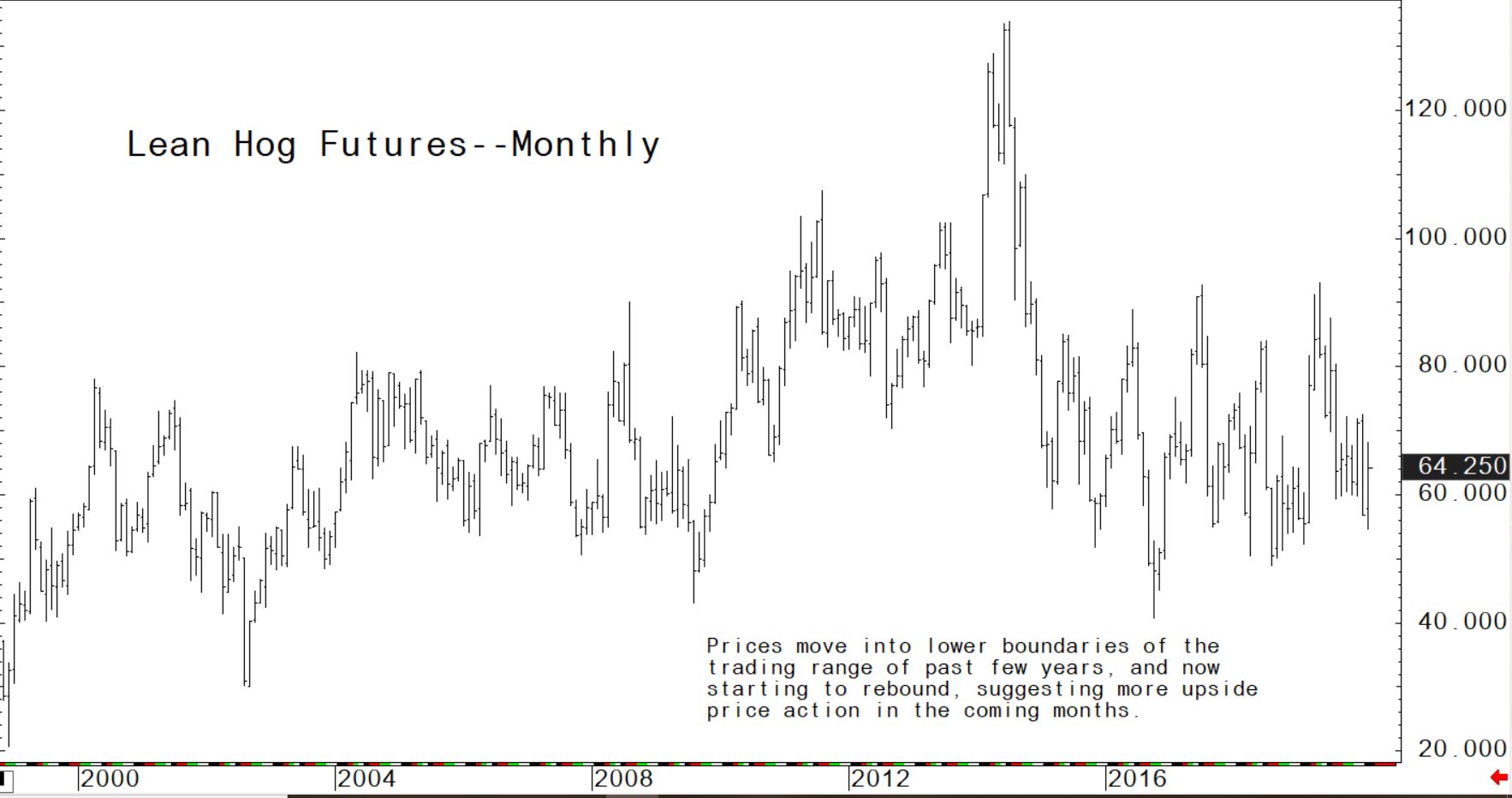

The US hog futures market remains held hostage by the coronavirus scare that has roiled the global marketplace. Do not look for this situation to stabilise anytime soon.There is still too much uncertainty among traders, investors and health officials worldwide. Traders hate uncertainty and that means the hog market bears will remain in control for at least the near term. For perspective on the coronavirus matter: Moody's Analytics has reported it expect the coronavirus outbreak to cause China's economy to contract in the first quarter and reduce full-year growth by 1 percent - down to 5.4 percent. In the US, the virus is forecast to shave 0.6 percent from first-quarter gross domestic product and 0.2 percent off of full-year GDP, leaving GDP at 1.3 percent in the first quarter and 1.7 percent for the year. That's if the virus is contained.

"A pandemic will result in global and US recessions during the first half of this year." That’s a dour outlook that will keep global commodity markets tamped down in the coming weeks, or longer.

The next week’s likely high-low price trading ranges

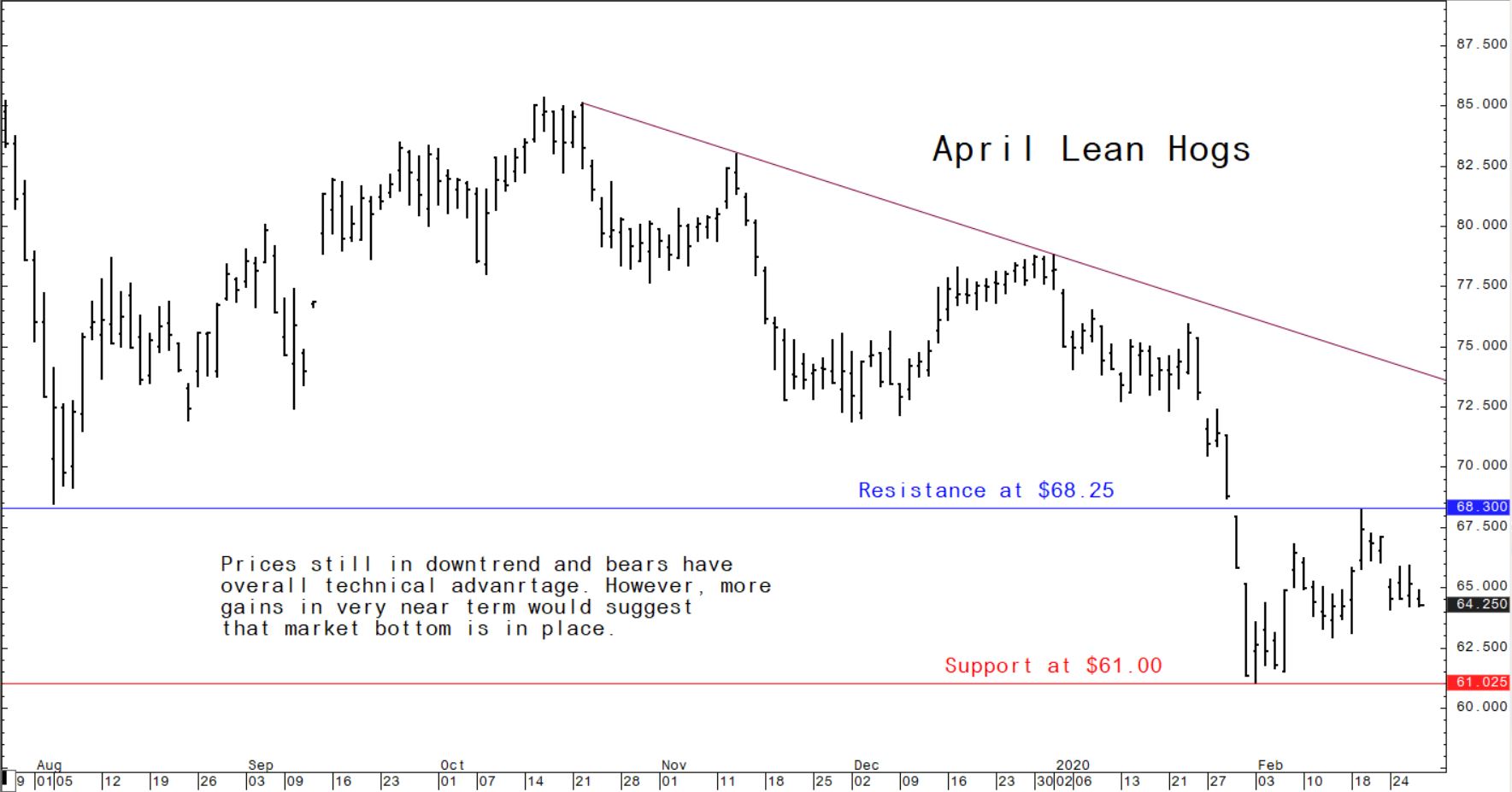

April lean hog futures: $61.00 to $68.25, and with a sideways, choppy bias.

May soybean meal futures: $290.70 to $305.00, and with a slight upside bias.

May soybean futures: $8.75 to $9.10 and with a sideways, choppy bias.

May corn futures: $3.65 to $3.77 1/2, and a downside bias.

Latest USDA weekly export sales show solid US pork sales but grain sales disappointing

This weekly USDA U.S. export sales summary is based on reports from exporters for the period February 14-20.

Pork

Net sales of 38,900 MT reported for 2020 were up 64 percent from the previous week and 34 percent from the prior 4-week average. Increases were primarily for Mexico (11,800 MT), South Korea (8,800 MT), China (7,200 MT), Japan (3,300 MT), and Canada (1,600 MT). Exports of 42,500 MT were up 1 percent from the previous week, but down 1 percent from the prior 4-week average. The destinations were primarily to China (15,700 MT), Mexico (10,900 MT), Japan (5,800 MT), South Korea (3,300 MT), and Canada (2,500 MT).

Corn

Net sales of 864,600 MT for 2019/2020 were down 31 percent from the previous week and 26 percent from the prior 4-week average. Increases primarily for Japan (316,700 MT, including 95,200 MT switched from unknown destinations), Mexico (162,300 MT, including 66,000 MT switched from unknown destinations and decreases of 75,900 MT), Costa Rica (146,600 MT), Colombia (104,500 MT, including 37,000 MT switched from unknown destinations), and South Korea (67,100 MT), were offset by reductions for unknown destinations (111,500 MT). For 2020/2021, net sales of 113,600 MT were for Mexico (97,600 MT), unknown destinations (13,000 MT), and Japan (3,000 MT). Exports of 844,700 MT--a marketing-year high--were up 11 percent from the previous week and 20 percent from the prior 4-week average. The destinations were primarily to Mexico (278,700 MT), Colombia (224,700 MT), Japan (155,500 MT), Guatemala (62,200 MT), and Honduras (59,600 MT). Optional Origin Sales: For 2019/2020, new optional origin sales of 65,000 MT were reported for South Korea. The current outstanding balance of 649,900 MT is for South Korea (531,000 MT), Israel (60,000 MT), and Egypt (58,900 MT).

Barley

For 2019/2020, total net sales of 300 MT were for Japan. For 2020/2021, total net sales of 500 MT were for Japan. Exports of 300 MT were down 19 percent from the previous week and 66 percent from the prior 4-week average. The destination was Japan.

Sorghum

Net sales of 444,500 MT for 2019/2020 - a marketing-year high - were up noticeably from the previous week and from the prior 4-week average. Increases were primarily for unknown destinations (324,200 MT), China (119,000 MT), and Mexico (1,100 MT, including decreases of 200 MT). Exports of 2,300 MT were down 97 percent from the previous week and from the prior four-week average. The destination was Mexico.

Soybeans

Net sales of 339,300 MT for 2019/2020 were down 31 percent from the previous week and 38 percent from the prior four-week average. Increases primarily for Japan (108,200 MT, including 54,900 MT switched from unknown destinations and decreases of 2,000 MT), China (71,700 MT, including 66,000 MT switched from unknown destinations), Costa Rica (69,500 MT), Germany (66,000 MT), and South Korea (58,400 MT, including 55,000 MT switched from unknown destinations), were offset by reductions for unknown destinations (176,400 MT). For 2020/2021, net sales of 22,100 MT were for Mexico (21,000 MT) and Japan (1,100 MT). Exports of 597,900 MT were down 38 percent from the previous week and 42 percent from the prior four-week average. The destinations were primarily to Mexico (102,900 MT), Egypt (94,000 MT), China (68,700 MT), Germany (66,000 MT), and South Korea (60,300 MT).

© Jim Wyckoff

© Jim Wyckoff