Jim Long Pork Commentary: “Anyone can raise hogs. But it takes a near genius to make money doing it.”

“Anyone can raise hogs. But it takes a near Genius to make money doing it.” - The quote attributed to John Swisher, founder of United Feeds, sums up where we are in the US-Canada hog industry.More and more hogs continue to push the supply level beyond profitable hog prices. Over the last few weeks, we have attended five different US industry events. At them we heard the same sentiments and/or questions: “When is this going to turn’, “I am tired of not making money.”

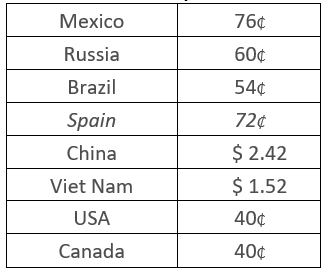

Most producers are aware that in just about every country in the world producers are making money (actually we are not aware of any that are not). Only USA-Canada are not.

You don’t need to be a computer and/or ag-economist to figure that US-Canada is sucking air relative to the rest of the world when it comes to hog price.

There is no doubt that USA-Canada have both suffered from the trade issues both countries have had with China.

Just when things appeared to get somewhat settled, the Phase 1 agreement finalised and Canada was back in China market, the Coronavirus (COVID-19) has hit and disrupted the market. It would be anyone’s guess how Coronavirus (COVID-19) will get sorted, but all indications are the Chinese government is putting a priority on ensuring food movement. That is not to say containers carrying pork are not being slowed by issues at ports and trucking in China.

Despite these issues, US pork exports to China continue near record levels. We would have expected US pork export sales to China to have increased further, if not for Coronavirus (COVID-19).

The Phase 1 commitment of China to purchase more US ag products ($40 billion total) should lead to US pork exports surpassing 25,000 tonnes a week (currently 15,000), or about another 100,000 more hogs a week equivalency. By comparison- Europe shipped about 40,000 tonnes a week to China in 2019.

When we hear that logistics will limit US exports to China, we don’t believe the US logistic capacity can’t match European logistics.

Other Observations

US Sow slaughter is up.

- January 2019 – 265,300,

- January 2020 - 283,100. (Up 18,000 - same number of slaughter days)

We don’t believe there will be many new sow barns constructed in 2020 from discussions we had over the last few weeks.

- Market pricing and packer capacity is braking expansion

- Has there ever been expansion when producers are losing money?

Purchase of J.H. Routh Packing Co. in Ohio by HK Property Holdings- a joint venture between Holden Farms and Kalmbach Feeds, is another indication of large producers seeing packer margins and wanting to be part of the pork supply chain.

- We expect the new ownership will increase daily slaughter numbers towards the plant's capacity (about 4500 a day).

- As time goes on we expect further push for producers to want to integrate into packer equation.

Not sure who all reads this commentary, but from the reaction last week it appears Genetic competitors do. The appointment of the new CEO of Topigs-Norsvin Coop got a lot of laughs in our industry. His previous experience as CEO of a division of deadstock- rendering company- Darling International was found to be funny.

Months and months of search to replace former CEO who went to a Grass Seed company, then to decide a Senior deadstock person is the background you need for the future to drive a Coop Swine Genetic company is interesting. Maybe the search committee motto was:

“It’s easier to give birth then bring the dead back to life.”