Genesus Global Market Report: Canada, April 2020

Challenges in the time of COVID-19

Then to add insult to injury this...

March 29

Laterre.ca says that Olymel is closing its pig slaughter and cutting plant in Yamachiche, for the next two weeks, due to the growing number of COVID-19 cases among employees, which now stands at nine. "Olymel will communicate with producers, particularly the pig farmers who feed this plant in order to make arrangements with them," said communications manager, Richard Vigneault, however, not wishing to specify the nature of these arrangements for now.

Something in the order of 25,000 hogs are (or were) contracted per week from Ontario to Olymel in Quebec. Olymel is Canada’s largest pork packer (and Canada’s largest pork producer). A week into this shutdown Olymel claimed force majeure and canceled contracts. Anyone who even vaguely understands pork production knows this heads towards a train wreck quite rapidly.

The plant reopened April 13 and apparently killed something like 8,000 hogs for the week of a 27,000 per week capacity. Going forward, suggestion is it will only be able to get to 60 percent perhaps 70 percent of its capacity due to social distancing and other public health safety measures. In addition, other of their plants such as St. Espirit have had to throttle back to similar percentages.

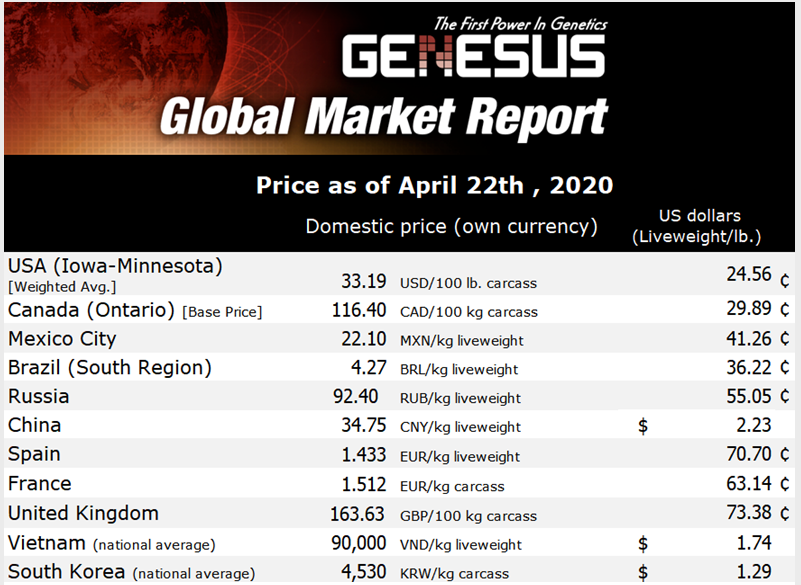

As there is really no pause button on pork production this has resulted in a significant back up of hogs in Ontario (perhaps 37,000) into a collapsing price. March 26 Ontario Pork 100 percent formula price $169.70 ckg DW. April 16 Ontario Pork 100 percent formula price $115.40 ckg DW. $54.30 ckg drop in three weeks.

If we do some “cowboy arithmetic” we have perhaps two million finishing spaces in Ontario. That would place the 37,000 at less than 2 percent of that capacity. One would think there would be shock absorber for that percentage, but how much more. As the system backs up you have the compounding effect of more weight (15 lbs. per week) along with more hogs. How much can we stretch the capacity?

Seasonally we should be only two or three weeks for supply beginning to contract. This coupled with a return of slaughter capacity hopefully allows things to not get any worse. Although the bulge will be a considerable time working through the python. However, another plant goes down as we’ve seen with beef plants in Alberta all bets are off.

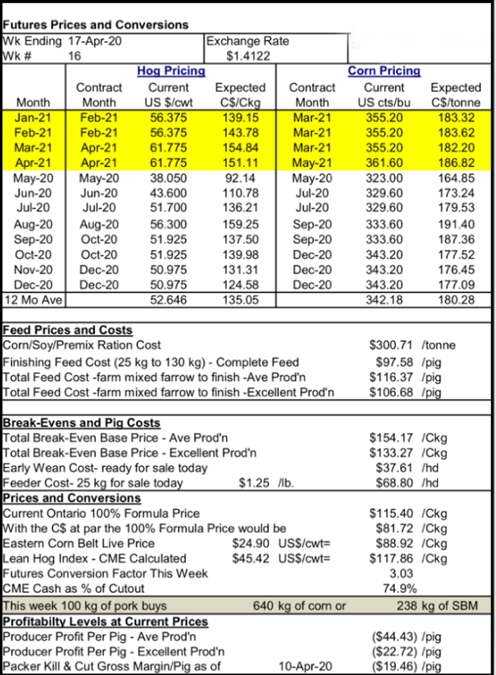

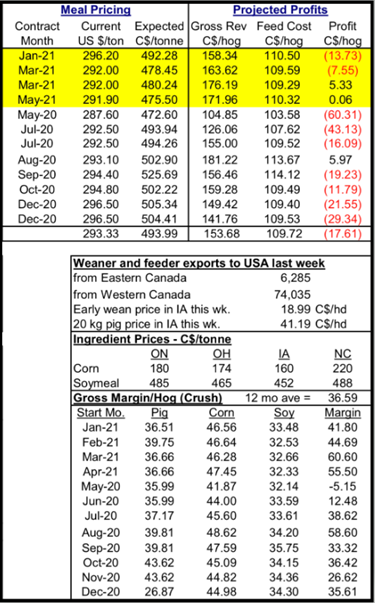

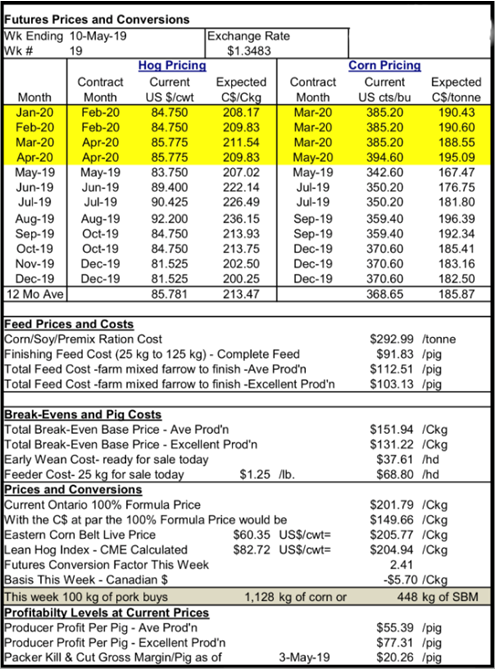

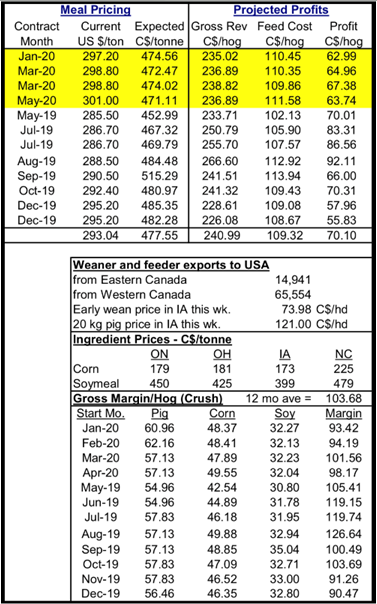

© Bob Hunsberger, Wallenstein Feeds

Bob Hunsberger, Wallenstein Feeds, Hog Economics Summary Sheet shows the reversal of fortunes in just the three weeks, profitability for average production going from profit of $11.29 to loss of (-$44.43) per pig with average production. A $55.72 per pig decrease in revenues in just three weeks! Then with the next twelve-month projection moving from (-$3.13) to (-$17.61). Certainly not providing anything in the way on encouragement.

Bob Hunsberger, Wallenstein Feeds, Hog Economics Summary Sheet shows from eight weeks ago, a tremendous and unprecedented reversal of fortunes with profitability going from per pig with average production loss of (-$34.07) to profit of $55.39 per pig with average production. An unbelievable $89.46 per pig increase in record time! Then with the next twelve-month projection moving from $20.98 to $70.10.

I’ve mentioned before in this business you have to enjoy rollercoasters. As my Father used to say, “it’s a long road that has no turn”. Let’s hope the producers turn is next.