EU pig prices: hope in sight for troubled markets

ISN reports that imbalance in the market is causing further price collapses this week but meat plant closures in the US could open up export opportunities in Asia.The ISN reports that the closure of restaurants and commercial catering due to COVID-19 continues to hit pork industries across the borders - a loss that cannot be reversed by the increase in supermarket sales. The market is currently oversupplied with fresh meat and more meat is being stored in freezer reserved in anticipation of worsening market futures.

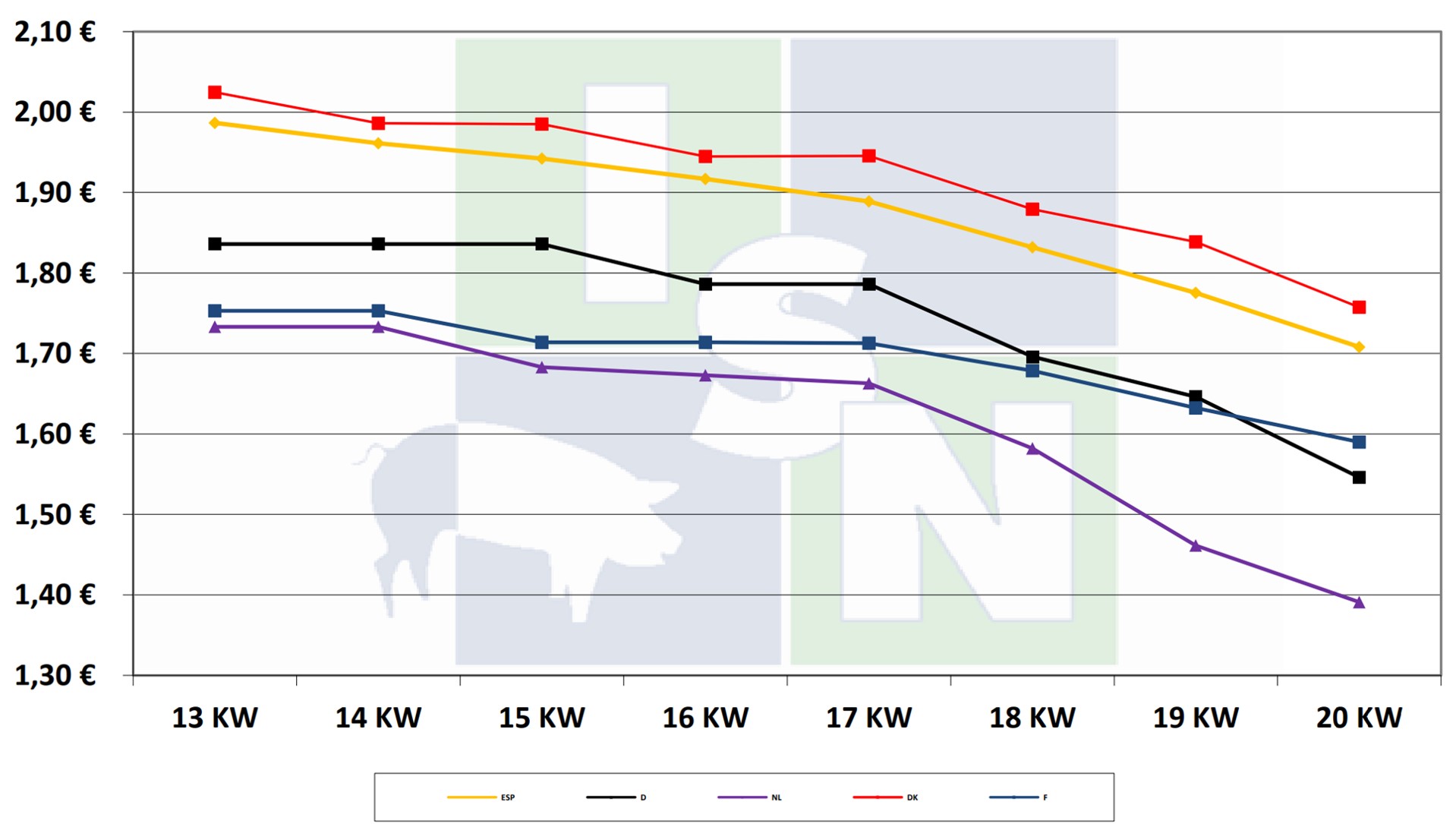

There is also a growing backlog supply of live animals in the EU which has brought pig prices down by 2.2 percent in the UK to a staggering 17 cents in Belgium. The closure of the Coesfield slaughter plant run by Westfleisch slaughter company is worrying and a number of employees have been confirmed to be infected with the coronavirus.

All this considered, EU market participants are increasingly hopeful that hope is near, particularly as meat plant closures in the US could create big gaps for export opportunities in Asia. Though demand in China is expected to remain high, sales of pork in restaurants has fallen and the re-opening of restaurants is needed to improve this situation.

1) corrected quotation: The official Quotations of the different countries are corrected, so that each quotation has the same base (conditions).

2) These quotations are based on the correction formulas applied since 01.08.2010. base: 57 percent lean-meat-percentage; farm-gate-price; 79 percent killing-out-percentage, without value-added-tax.

©

ISN