The worst is behind us as “green shoots” appear in the pork industry

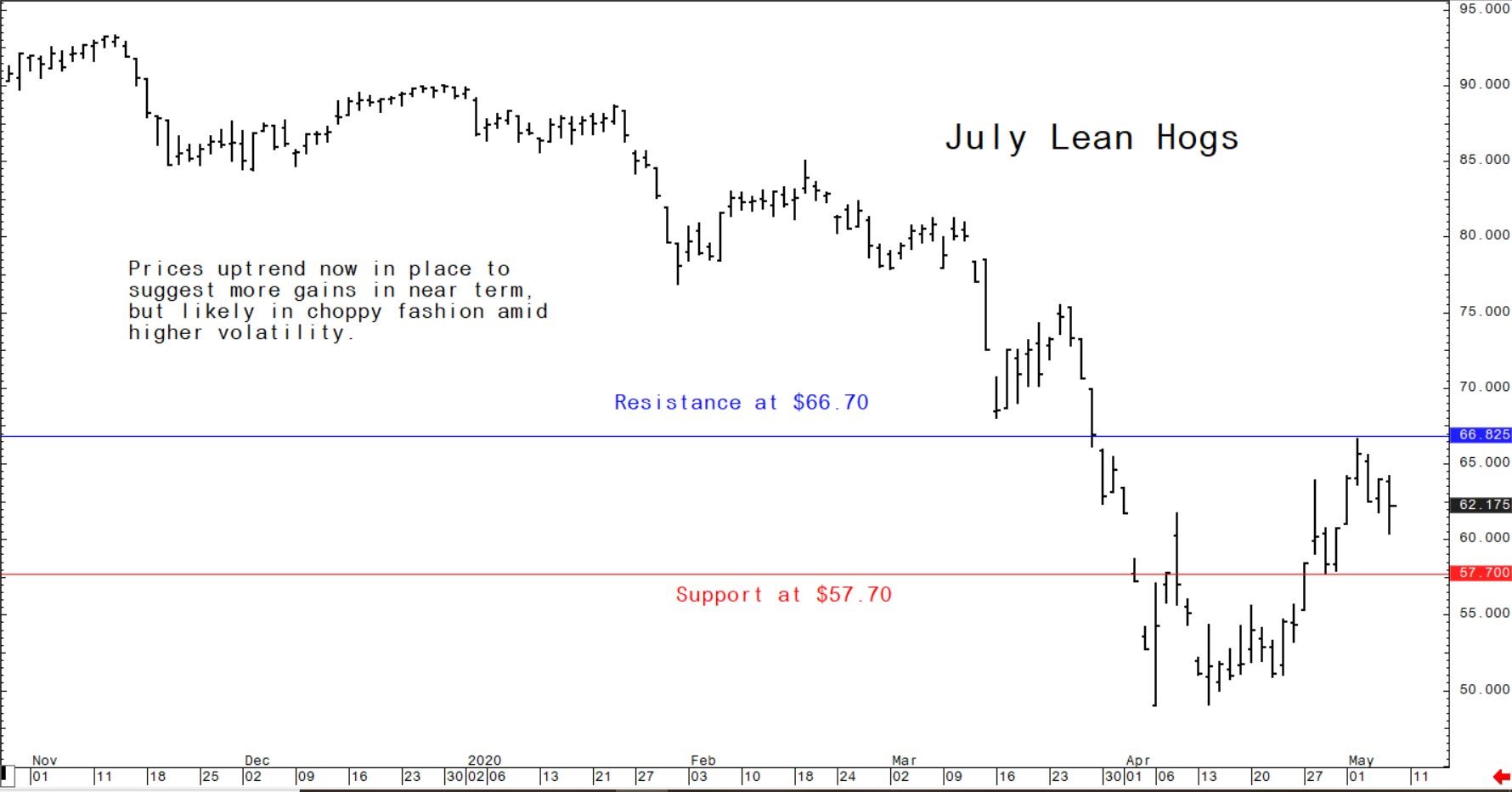

It's been a tough time for those in the pork industry but "green shoots" of hope are appearing with slaughter numbers picking up this week.It's been a brutal six weeks in the global pork industry, as the COVID-19 pandemic hit pork producers with one-two punches of sharply reduced demand and the closure of many major pork-processing facilities. However, the past week has seen some positive developments, including technically bullish hog futures charts.

Average hog weights in the key US mid-section states rose 5.3 lbs. the week ending 2 May, to 291.4 lbs. That’s also 5.6 lbs. higher than one year-ago. The numbers reflect pork producers’ struggles to market finished animals due to meat-processing-plant slowdowns or closures. However, US hog slaughter picked up to 312,000 head on Wednesday 6 May as more packing plants that were closed reopened. That’s a 46,000-head increase from last week, although Wednesday’s slaughter was still down 159,000 head from one year ago.

Hog futures traders are optimistic slaughter numbers will continue to improve.

In other upbeat news, China's meat imports in the first four months of 2020 rose 82 percent, year-on-year, to 3.03 million metric tonnes (MT), according to the General Administration of Customs, as that nation needs proteins including pork, and with amid the African swine fever reducing its pig herd. Finally, crude oil prices have risen sharply the past week and a half, due to US output cuts and the slow return of some economic activity in the US and Europe. Rising oil prices are important for the beleaguered raw commodity markets, including pork, as oil is the leader of the raw commodity sector. When oil prices rise significantly, many other raw commodity markets’ prices tend to follow.

The next week’s likely high-low price trading ranges

June lean hog futures: $60.00 to $70.00, and with an upside bias.

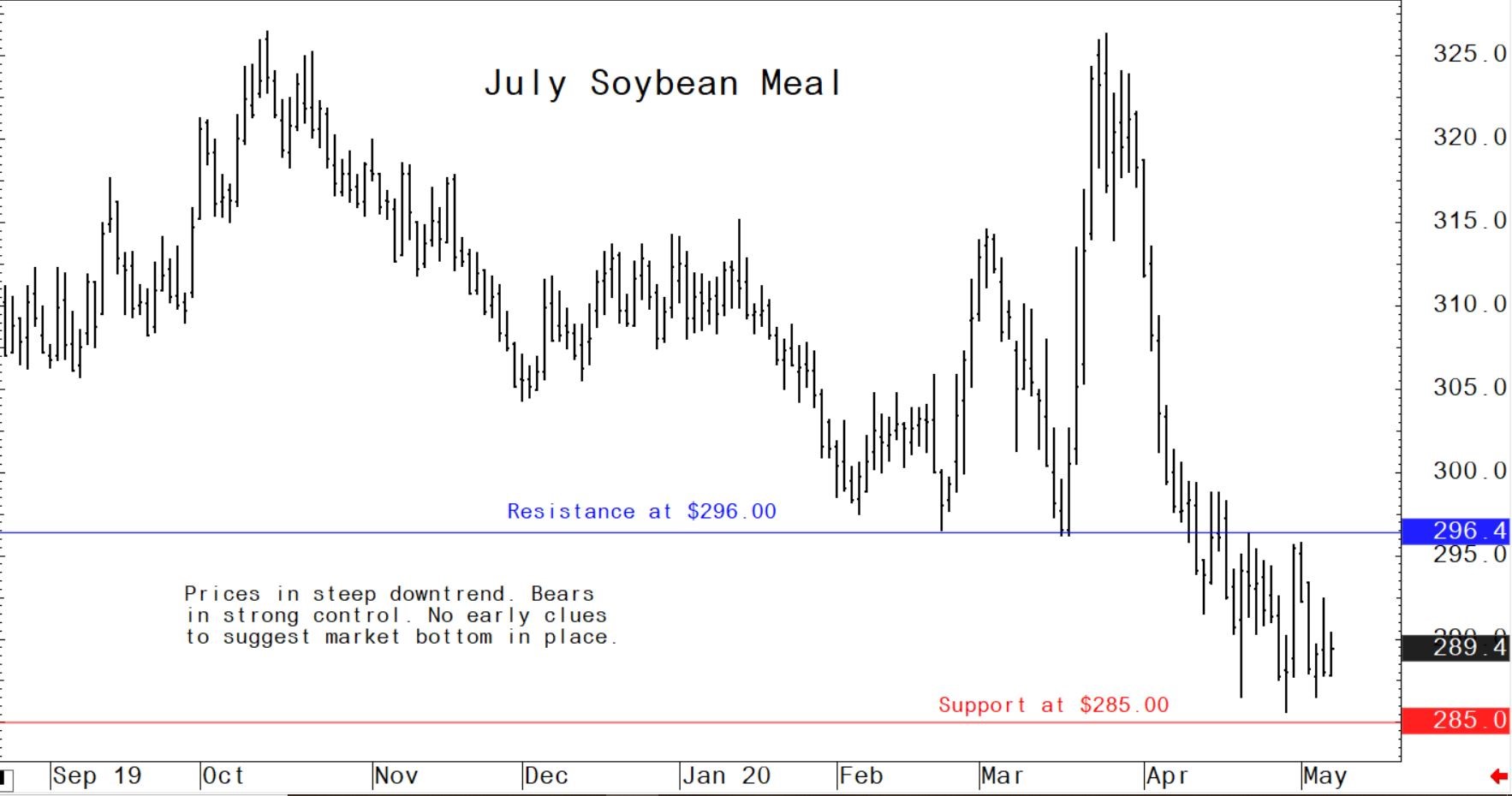

July soybean meal futures: $285.00 to $296.00, and with a sideways bias.

July corn futures: $3.09 to $3.30, and a sideways bias.

US pork export sales to China remain solid

The latest weekly USDA export sales report, issued Thursday, showed US pork net sales of 47,500 metric tonnes (MT) reported for 2020 were down 6 percent from the previous week and 1 percent from the prior four-week average. Increases primarily for China (40,200 MT), Mexico (5,100 MT), Japan (800 MT), South Korea (400 MT), and Canada (400 MT), were offset by reductions primarily for Costa Rica (100 MT) and Chile (100 MT). Exports of 39,300 MT were down 12 percent from the previous week and 2 percent from the prior four-week average. The destinations were primarily to China (17,500 MT), Mexico (7,600 MT), Japan (4,900 MT), South Korea (3,200 MT), and Canada (1,500 MT).

US soybean cake and meal net sales of 131,400 MT for 2019/2020 were down 20 percent from the previous week and 15 percent from the prior four-week average. Increases primarily for Colombia (21,100 MT, including decreases of 4,100 MT), Honduras (19,900 MT, including 6,000 MT switched from El Salvador), Ecuador (17,200 MT, including decreases of 5,500 MT), El Salvador (15,200 MT, including 8,400 MT switched from Guatemala ), and Peru (12,000 MT), were offset by reductions for Canada (10,400 MT). For 2020/2021, net sales of 39,800 MT were for unknown destinations (30,000 MT) and Panama (9,800 MT). Exports of 260,200 MT were up 27 percent from the previous week and 3 percent from the prior four-week average. The destinations were primarily to the Philippines (92,000 MT), Colombia (47,500 MT), Ecuador (31,700 MT), Canada (23,300 MT), and Guatemala (13,200 MT).

© Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff