US meat-packing industry recovering, but US-China relations deteriorating

The beleaguered pork industry is working to recover from the severe damage inflicted by the COVID-19 pandemic that not only sapped global demand but also put major constraints on processing market-ready pigs.There are reports late this week saying all US meat-packing plants should be back in action by the end of this week. Processing is still running well behind pre-COVID-19 levels, but the drop versus year-ago is easing. Through Wednesday, this week’s US slaughter was up 206,000 head from week-ago, but still 279,000 head (20.4 percent) behind year-ago. Meanwhile, US pork prices continued to climb on the wholesale level but lean hog futures prices slumped amid a backlog of supplies waiting to be processed. Another negative for the pork industry intensified this week as US-China relations have deteriorated. US President Trump Thursday said he was very disappointed in China over its failure to contain the novel coronavirus, saying the worldwide pandemic has cast a pall over his US-China trade deal.

"They should have never let this happen,” said Trump. “So, I make a great trade deal and now I say this doesn't feel the same to me. The ink was barely dry, and the plague came over. And it doesn't feel the same to me," Trump said. A Chinese state-run newspaper has reported that some government advisers in Beijing were urging fresh talks and possibly invalidating the agreement. China is a major importer of US pork.

The next week’s likely high-low price trading ranges

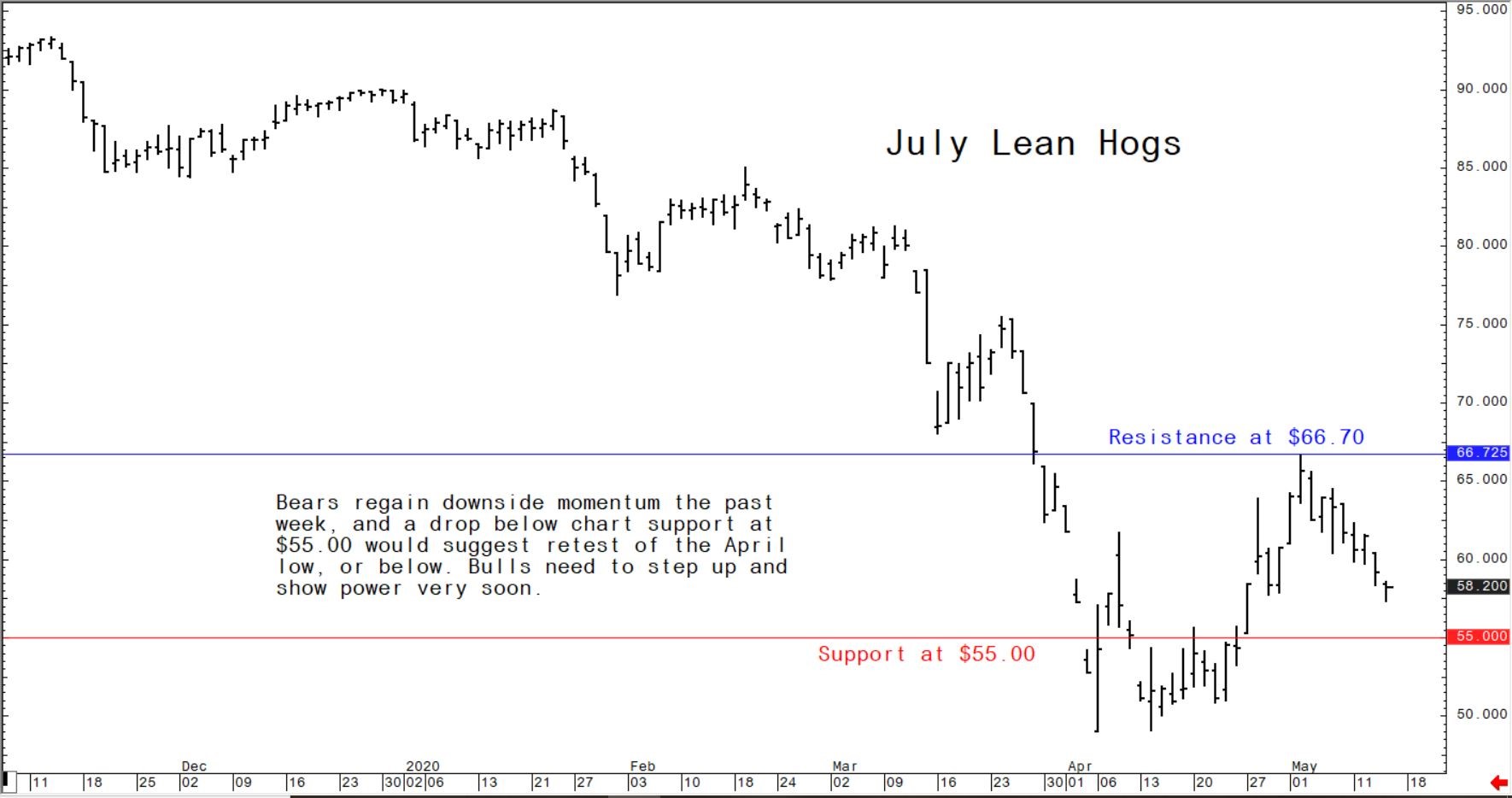

June lean hog futures: $55.00 to $62.00, and with a downside bias.

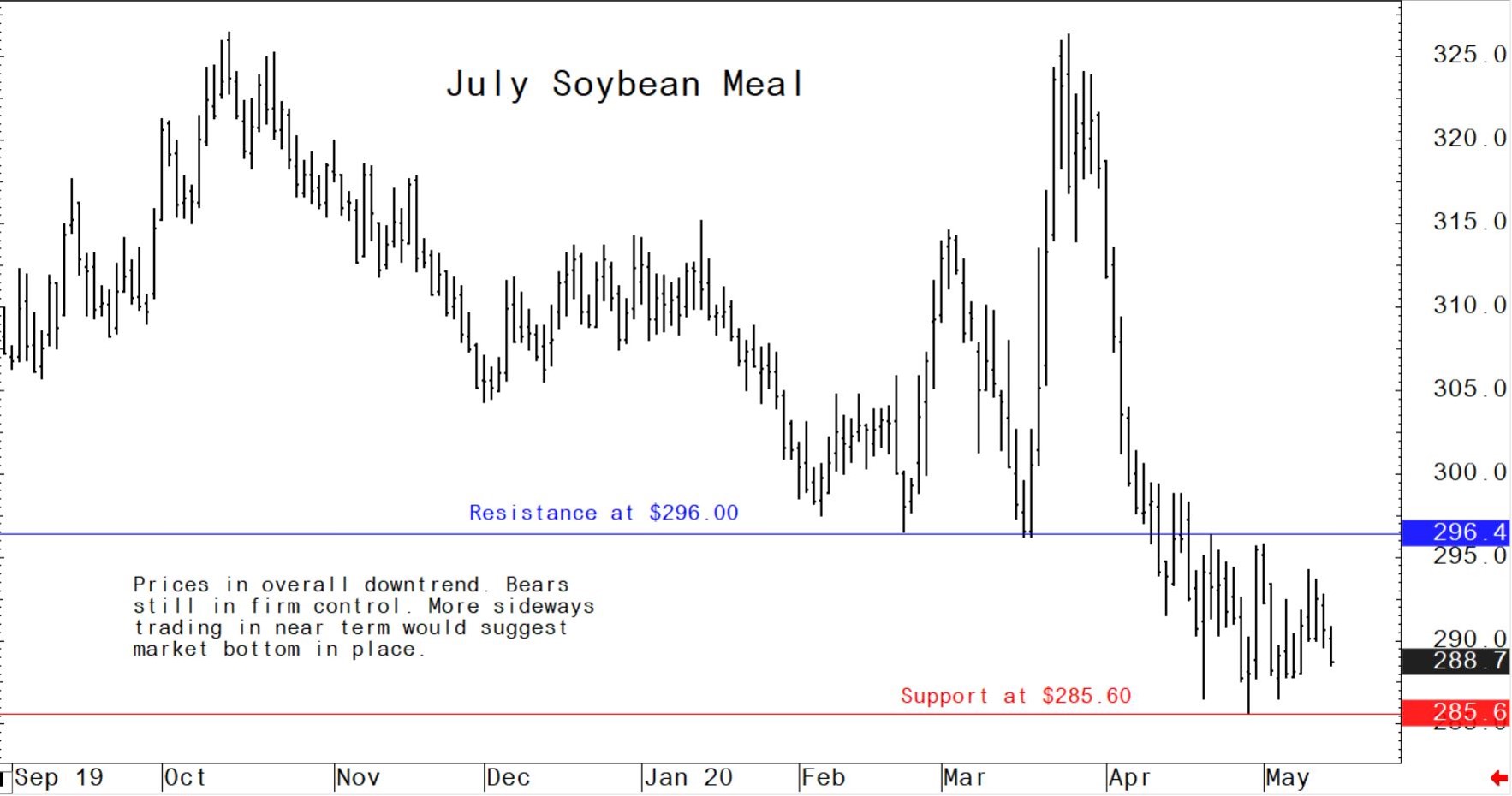

July soybean meal futures: $285.00 to $296.00, and with a sideways bias.

July corn futures: $3.09 to $3.30, and a sideways bias.

US pork export sales dip in latest week

Weekly US pork net sales of 10,800 metric tons (MT) reported for 2020 were down 77 percent from the previous week and 76 percent from the prior four-week average. Increases primarily for China (6,100 MT, including decreases of 18,500 MT), Japan (2,100 MT, including decreases of 400 MT), Mexico (1,400 MT, including decreases of 400 MT), Canada (1,100 MT, including decreases of 100 MT), and Vietnam (300 MT), were offset by reductions primarily for South Korea (200 MT), the Philippines (200 MT), Colombia (200 MT), and Chile (100 MT). Exports of 21,800 MT were down 45 percent from the previous week and 46 percent from the prior four-week average. The destinations were primarily to China (12,700 MT), South Korea (2,100 MT), Japan (1,800 MT), Mexico (1,700 MT), and Canada (800 MT).

UK preparing a “big concession package” on US agricultural products

The United Kingdom is planning to lower tariffs on imports of US agricultural products to help move forward on a free trade agreement (FTA), the Financial Times of London reported today. The UK and the US started negotiations on a FTA last week, pledging to work quickly toward a deal that could help ease the strain of the COVID-19 pandemic for both sides. The UK is the US’s seventh-largest trading partner, according to the US Census Bureau.

Wall Street Journal reports on global food crisis

Transport disruptions, processing breakdowns and a number of government restrictions have dislocated the global food supply, putting the world's most vulnerable regions at risk of famine, reports the Wall Street Journal. Prices for staple foods such as rice and wheat have increased in many cities, due in part to panic buying set off by export restrictions imposed by countries wanting to ensure sufficient supplies at home. Trade disruptions and lockdowns are causing logistical problems, making it harder to transport produce from farms to markets, processing plants and ports. That’s leading to food shortages and new worries about political unrest if solutions aren’t found soon, said the report.

Bulls need to step up and show power very soon. © Jim Wyckoff

© Jim Wyckoff

© Jim Wyckoff