Jim Long Pork Commentary: Finally US weekly harvest surpasses a year ago

After several weeks of hog harvests significantly below a year ago, this past week the US got to 2,452,000, up 42,000 from the same week a year ago. Certainly a positive sign that US plants are getting closer to the new normal in the coronavirus situation and packers certainly have the incentive to push harvest numbers, the latest DTN Gross Packer Margin calculation is $70.

Harvest numbers have recovered faster than many predicted, obviously phenomenal profit margin motivated packers to get things going. What’s the saying “Follow the money!”

There are information services that charge for their astute knowledge of the Meat Industry. One of them last week wrote the following “We estimate there are 4-7 million hogs which have been backed up and ready to go to slaughter.”

Let’s consider this 4-7 million number of backed-up hogs. Some Farmer Arithmetic.

- 4 million hogs divided by 2.5 million hogs harvest a week is about 11 days of hog production;

- 7 million hogs divided by 2.5 million hogs harvest a week is about 17 days of hog production.

Let’s assume an indicator of hogs being backed up would be slaughter weights.

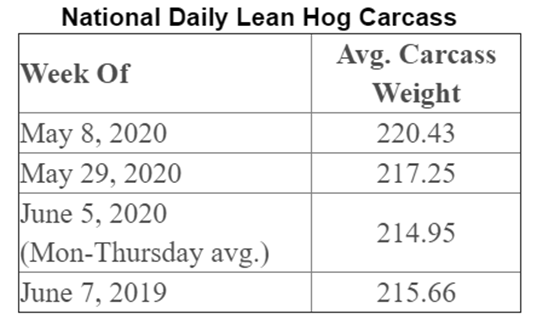

Hogs were 220.43 lb. carcass the first week of May indicating hogs were backed up for sure. Since then we have dropped at least 5 lbs. and now weights are in line with a year ago. It’s hard for us to fathom that any feed adjustments can back up 4-7 million market hogs (11-17 days) while weights have dropped continually the last four weeks.

We don’t believe numbers of 4-7 million hogs backed-up. Why?

- Weights same or lower than a year ago;

- The idea that there are 4-7 million more spaces for hogs is beyond comprehension of barn infrastructure.

We believe there are backed up hogs but they are mostly in the Southwest Minnesota-South Dakota-Northwest Iowa-Nebraska region. The closure in that area of Smithfield Sioux Falls, JBS Worthington, and Tyson plants for the length of time they were, backed up hogs there.

In other areas producers going to other plants are current with some more than current. Due to the coronavirus issues producers continually jammed as many hogs as possible in case their plant shut. Some producers are under 210 lb. carcass weight.

Probably hogs are not backed up as much as some speculate is because alternate harvesting happened with small plants and on-farm sales ramping up. Hogs moved all over the country as low hog prices and high pork prices created opportunities for some. Also, there has been euthanasia of market hogs and other weights. How much euthanasia is purely speculative, but we believe it has been significant enough to cut hog numbers.

Last week we wrote, watch the weights for the next two weeks. Last week we dropped couple lbs. If we continue this trend this week it will indicate to us that we are closer to current hog inventory.

Ramifications - we believe Lean Hog Future experts have bought into the 4-7 million hog back-up. Lean Hog Futures are terrible. If we suddenly discover that there are fewer hogs than the experts predict, there could be a sudden surge in hog prices as the market finds a big surprise. We will know soon enough; slaughter and their weight numbers don’t lie.

China

The below table shows the changes of market hogs produced by leading Chinese Public Companies for the four-month period January-April 2019 and 2020. As you can see, there was a significant drop overall in market hogs produced. It appears to us the reality of China’s lower hog production due to ASF is far from over. This in itself should continue to support Global Hog Prices.

We expect China will be back in US market stronger now that Pork Cut-outs have declined from being over $1.20 lb.