USMEF reports record-breaking pork exports in March

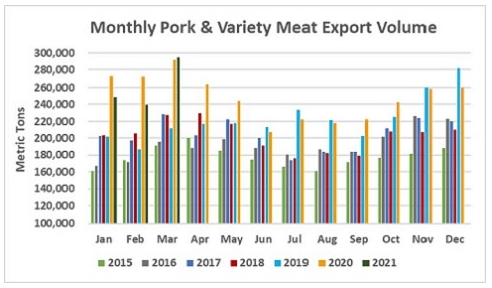

US red meat exports posted record highs in March 2021, according to data released by the USDA and analysis from the US Meat Export Federation (USMEF).USMEF analysis shows that March beef and pork exports each posted the highest monthly value on record. Pork exports and shipments of beef muscle cuts also set new volume records in March.

March pork exports were record-large at 294,724 metric tonnes (mt), up 1% from last year’s strong total, and set a new value record at $794.9 million (up 4%). Pork muscle cuts also set new monthly records for both volume (247,660 mt, up 2% from a year ago) and value $689.2 million (up 4%). For the first quarter, pork exports were 7% below last year’s pace in both volume (782,620 mt) and value ($2.07 billion). Pork muscle cuts followed a similar trend at 659,420 mt (down 7%), valued at $1.79 billion (down 8%).

“It’s very gratifying to see such an outstanding breakout month for US beef and pork exports,” said USMEF President and CEO Dan Halstrom. “Exports were off to a respectable start in 2021, considering the logistical and labor challenges the industry is facing and ongoing restrictions on the foodservice sector in many key markets. While these obstacles are not totally behind us, the March results show the situation is improving and the export totals better reflect the strong level of global demand for US red meat.”

While muscle cuts certainly drove March export growth, Halstrom was also encouraged by a rebound in shipments of beef and pork variety meat.

“The tight labor situation at the plant level has been especially hard on variety meat volumes,” Halstrom said. “But March variety meat exports matched last year’s performance for pork and were the largest of 2021 on the beef side. It’s important that the capture rate for variety meat continues to improve, as this is a critical component of the export product mix.”

Japan, Mexico, Central America and the Philippines fuel record month for pork exports

Pork export value equated to $67.71 per head slaughtered in March, up 6% from a year ago, while the first quarter average was down 4% to $64.66 per head. March exports accounted for 32.2% of total pork production and 29.1% for muscle cuts, up from 31.6% and 28.4%, respectively, last year. In the first quarter, exports accounted for 29.9% of total pork production and 27.1% for muscle cuts, each down about 1.5 percentage points from the very high ratios reached in the first quarter of 2020.

March pork exports to Japan totaled 40,746 mt, up 11% from a year ago, while export value increased 13% to $169.5 million. This pushed first quarter exports slightly ahead of last year’s pace at 104,828 mt (up 1%) valued at $436.2 million (up 2%).

Pork exports to Mexico increased 5% from a year ago in March to 66,174 mt, with value climbing 21% to $130.2 million. While first quarter exports remained 4% below last year’s pace at 187,012 mt, value was down just 1% to $345 million.

After a record performance in 2020, pork exports to Central America gained even more momentum in the first quarter, jumping 47% from a year ago to 35,926 mt, valued at $89.7 million (up 43%). March shipments were record-large to Honduras, Guatemala, Costa Rica, El Salvador and Nicaragua, and exports were also higher to Panama.

First quarter pork exports to the Philippines nearly tripled from a year ago to 25,377 mt, up 190% year-over-year and 86% above the strong fourth quarter pace. Export value more than tripled in the first quarter to $62.4 million, up 201%. This was achieved before the Philippine government ordered a temporary decrease in tariff rates for imported pork muscle cuts in an effort to bolster supplies and stabilize prices, which took effect 7 April. Pork muscle cut exports to the Philippines soared to a record 11,736 mt in March, up nearly 500% from a year ago and more than double the February volume.

Other first quarter results for US pork exports include

- China/Hong Kong remains the largest destination for US pork in 2021, despite first quarter exports falling 20% from a year ago to 236,498 mt, valued at $532.3 million (down 27%). March export value to the region was $202.5 million, down 14% from a year ago but the highest in 10 months as exports of bone-in ham and shoulder cuts to China set a new monthly record.

- Following a difficult year in 2020, first quarter pork exports to Colombia rebounded to 25,696 mt, up 26% from a year ago, while value increased 22% to $57.6 million. March exports to Colombia were the highest since October 2019 and the sixth largest on record.

- First quarter exports to the Dominican Republic soared 49% from a year ago to 17,472 mt, with value up 51% to $40.6 million as U.S. exports set consecutive records in February and March.

- While slightly below last year, March pork exports to Korea were the largest in 12 months at 17,079 mt, valued at $50.6 million. This pushed first quarter exports to 46,595 mt, down 9% from a year ago, valued at $135.8 million (down 11%). Korea achieved record-large pork production in 2020, reducing its reliance on imported pork, with a challenging foodservice situation also negatively impacting demand. Korea is importing more belly cuts from the U.S. and other suppliers this year, but imports in other categories remain below year-ago levels.