What would a UK-Canada trade deal mean for pork producers?

As the UK's trade deals with Australia and New Zealand take shape, analysts from AHDB consider the potential implications of a trade deal between the UK and Canada.The UK already has a trade agreement with Canada, as a roll-over of the previous agreement the EU has with Canada (Known as CETA).

However, as part of that agreement both sides agreed to revisit the text and negotiate "upgraded" deals that better suit the two individual countries. With that in mind, in this article we take a look at some figures behind Canada’s domestic production and trading partners.

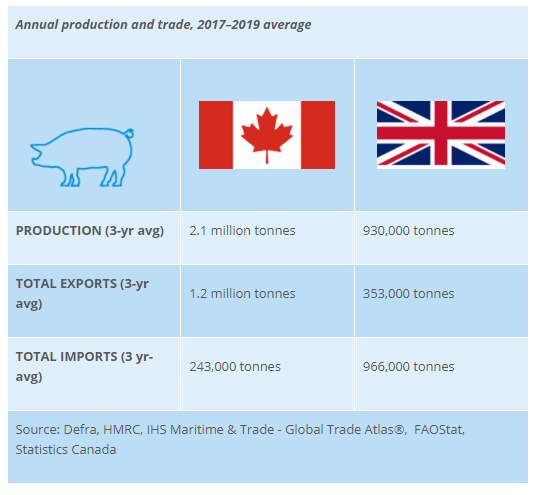

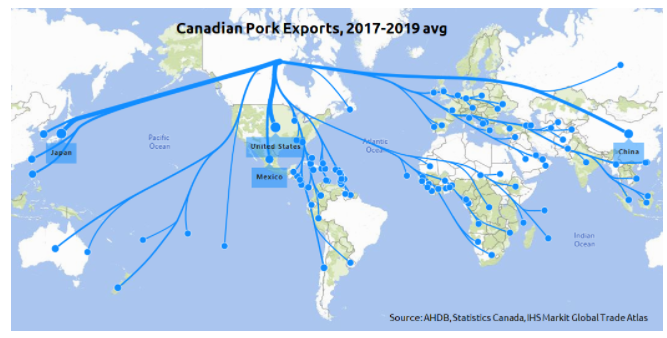

The pork industry in Canada is one of the largest of the agricultural commodity sectors operating in the country. With over 7,000 pigs farms currently operating, producing around 2.1 million tonnes of pork each year. Domestic consumption is reasonable, however over 50% of production is exported each year to a variety of markets. The top destination for Canadian exports is the United States, however this is followed closely behind by Japan, who import around 235,000 tonnes of Canadian pork each year.

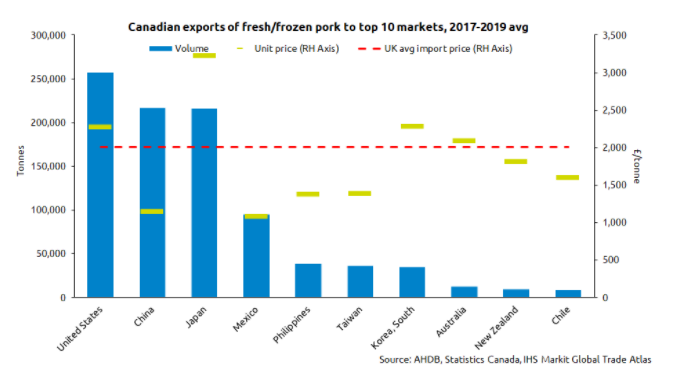

The vast majority of exports consist of fresh/frozen pork, as opposed to hams, bacon or sausages for example. In terms of fresh/frozen pork, average export prices from Canada were around £2,000/t between 2017-2019; similar to the average import price of pork products imported into the UK. However, there is a more variation in the Canadian export price, depending on the market, and to certain markets Canada are extremely competitive. Currently there is a negligible amount of pork exported from Canada to the UK, or even to the wider European Union market place, despite a free trade agreement between the two being signed, highlighting the fact that often a trade deal doesn’t necessarily lead to an increase in trade of particular products.

Although Canada is a fairly large producer and exporter of pork, around 243,000 tonnes of pork is imported each year (2017-2019 avg.). The vast majority of this comes from the United States, which is most likely in part due to circular trade between the two countries with product passing back and forth for processing sides either side of the border. There is also significant live trade in pigs between the two countries. Aside from the United States, Canada imports 23,000t on average (2017-19) from the EU, the vast majority of this is fresh/frozen pork.