Genesus Global Market Report: Processing challenges in Canada/Ontario. Part Two: When it all hits the fan

In my last commentary eight weeks ago, I reviewed some of the challenges to the Canadian pork processing industry, particularly in Ontario. Unfortunately, those challenges seemingly have now gone from bad to worse.

In the last two weeks Olymel has served notice that come February 2022 they will cease taking approximately 8.5K hogs per week contracted from Ontario Pork Marketing. At the same time, they have informed the Quebec Pork Board that they will cease taking 15K contracted from them.

A fight can be expected from the Quebec board, but Olymel’s likely argument is that proportionally they have pushed back harder on Ontario. Apparently, a host of reasons for this move. Starting with Olymel being badly beat up in the commodity market that they wish to do more value added. However, in the present labour market that’s easier said than done. The Princeville plant that has been kill and cut will be moved to just further processing and supplied from the Valle´e-Jonction plant. Further challenge though is that plant since the end of its strike is only running 21K per week, down from 38K per week.

The real culprit though appears to be Covid/labour creating a 150K plus backup of hogs to Olymel with prospects that number could rise to 220K come January with the two shortened holiday weeks. Definition to ten pounds in a five-pound bag! Hard to imagine that this is but the tip of the iceberg in resolving as I’ve suggested in previous commentaries what has been a long-time industry challenge.

Although Ontario hogs have shipped into Western Canada and the US throughout this time with the inherent freight costs difficult to see this as more than a band-aid.

Would seem that Eastern Canada pork industry either evolves greater pork processing or shrinks down to the capacity it has… The present equation doesn’t seem to add up.

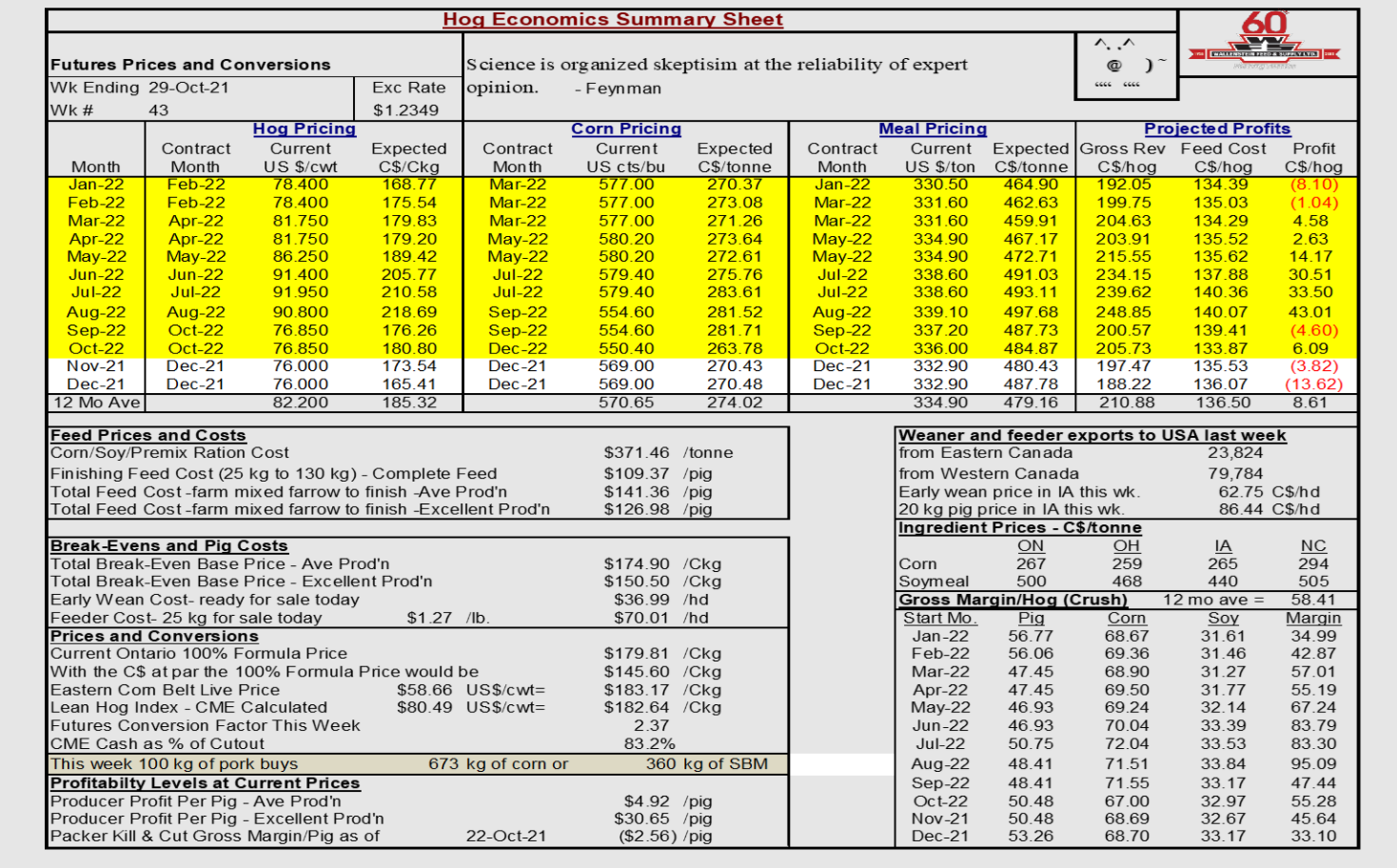

Last commentary eight weeks ago Bob Hunsberger, Wallenstein Feeds, Hog Economics Summary Sheet showed profitability per pig with average production at $44.41. Now it has dropped a further thirty dollars to $4.92. The next twelve-month projection has dropped from a profit of $31.20 to $8.61. Still an acceptable margin but off the heights we had seen. Reviewing this year’s commentaries:

- January 25, 2021 - profitability per pig with average production at (-$39.27)

- March 22, 2021 - profitability per pig with average production at $26.34

- May 17, 2021 - profitability per pig with average production at $51.03

- July 12, 2021 - profitability per pig with average production at $67.41

- September 6, 2021 - profitability per pig with average production at $44.41

- November 1, 2021 - profitability per pig with average production at $4.92

A very good year by any measure. However, appears to be headed to some tough sledding. Although to be on the positive side during the 4th quarter is an accomplishment.