U.S. lean hog prices continue strong

Jim Long Pork CommentaryThis past week U.S. Cash Lean Hogs stayed strong with Iowa – S. Minnesota averaging $106.15 a lb. We expect lean hog prices to continue to rise as supply declines. Lean Hog Futures for June closed at $118.17 last Friday. We expect lean hog prices will surpass that price and will not be surprised if lean hogs reach $1.30.

The Three Pillars of World Pork Production

We have been writing for several months that we believed that the three major world areas of Global Pork Production: North America, Europe, and China (over 75% of production) would have a major decline in production in 2022.

We already see the consequences in North America with lower production and higher prices. This is a fact.

We have been writing for months about the ongoing financial losses in Europe. EU sow prices for 18 consecutive weeks the lowest in history. Losses of $30-40 per head for months. Feeder pig prices at $25 for months. Our premise, producers lose money, you always end up with less pigs.

Germany – second largest producer in Europe

From August 18, 2021 – February 9, 2022 (6 months) Germany’s slaughter price (carcass) ranged from 1.20 to 1.30 Euro/kg. On February 9th it was 1.20. Since then Germany’s hog price has jumped to 1.75 Euro/kg (March 9). So, in one month an increase of .55 Euro/kg or about $65 U.S. per head. A huge jump.

Reason is less hogs – reports of German slaughter levels declining 15-20%. The sow liquidation that started a year ago then accelerated is coming to roost. The dog has hit the end of the chain.

Spain – Europe’s largest producer

Spain’s hog price is set weekly by the Mercolleida. It is a meeting of Packers, Processors, Producers who asses supply and demand and set the bench price for Spain’s industry. Spain also had prices below breakeven since the first part of September 2021. On January 20, 2022, the price was 1.02 Euro/kg liveweight (breakeven currently 1.30-1.35 – 66¢ U.S. lb.). Last Thursday the Mercolleida benchmark price 1.29 Euro/kg. An increase since January 20 of .27 Euro/kg or about $40 per head.

Other Countries

Belgium – February 10 .75 Euro/kg liveweight – March 10 1.22 Euro/kg an increase of .52 Euro/kg.

Netherlands – February 11 .89 Euro/kg liveweight – March 4 1.15 Euro/kg.

Poland – February 18 5.372 PLN/kg – March 4 6.65 PLN/kg

It is obvious that Europe’s hog supply has declined. We wrote last week in our commentary that the 404,000 sows that Eurostat reported to have declined December to December in Europe was underestimated. We believe the huge jump in hog prices verify that premise. Producers will cut or leave production when they lose money. Always have and always will. We expect to see further decline in Europe's pork production with feed price accelerating.

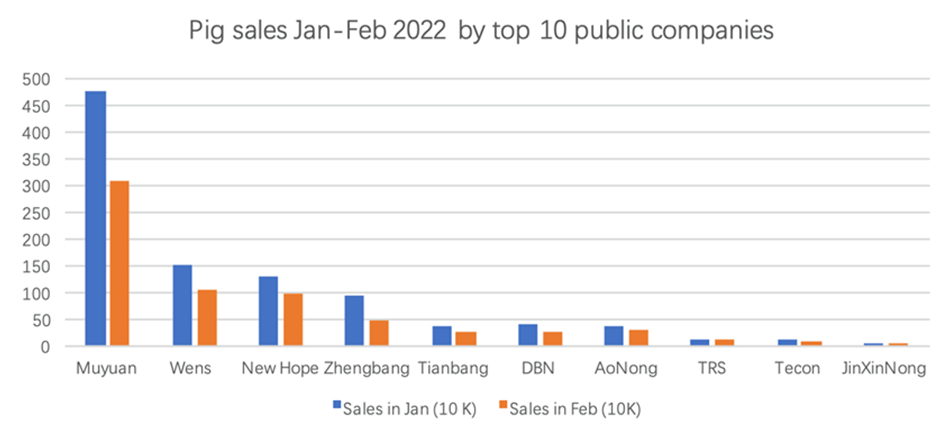

China

Below is a chart indicating swine sales reported by 10 publicly owned companies in China, January compared to February. Our Farmer Arithmetic of all companies on list January 9.75 million head – February 6.75 million head. January has more days than February. Chinese New Year was in February. Even so a huge difference. Are we at cusp of China’s hog slaughter having the serious decline as we have been expecting? You can’t lose billions of dollars and not have liquidation. China’s hog price will take off when the realization of less hogs is in the market. Just as USA. Just as Europe.

Three Pillars

U.S. supply is down – Europe supply is down – China maybe supply is down. The three pillars of world pork production have less pork. Prices will be good to excellent for a sustained time.

Kalmbach Feeds Agribusiness Conference

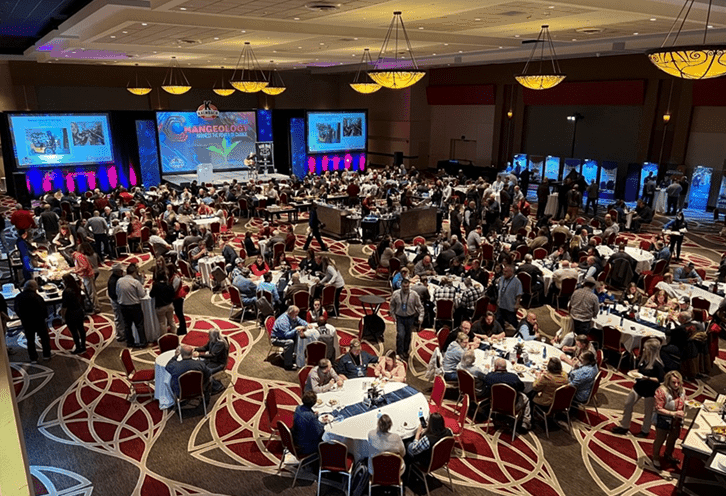

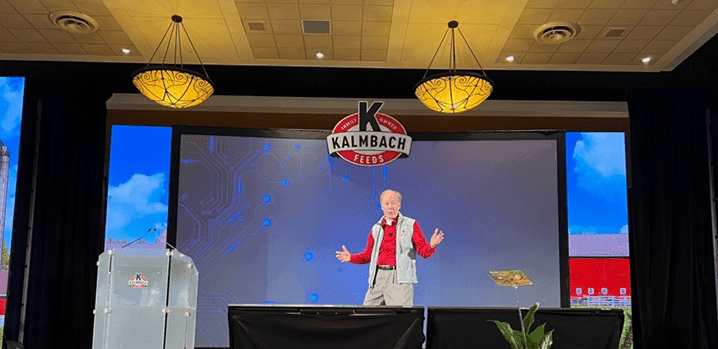

Last week we attended the Kalmbach Feeds Agribusiness Conference held at the Hyatt Regency in Columbus, Ohio. It is an annual conference with over 800+ attendees present. The theme of this year’s conference was Changeology. We have attended conferences around the world. The Kalmbach Feeds Conference was the best we ever attended. All speakers were excellent. There were none that you wished you were somewhere else when they spoke. The conference speakers were bookended by Paul and Paul Jr. Kalmbach. They both gave positive motivating addresses that set the tone and attitude of the entire conference.

The excellent lineup of speakers from Best Selling Authors, Fox TV host Shannon Bream, Emmy award-winning TV hosts, Commodity Experts, Foreign Trade Analysts. We were honored to give a breakout presentation on World Markets and opportunities for Independent Producers to compete.

Kalmbach Feeds was founded in 1963. The family business has grown to close to 1,000 employees. With major presence in Feed production (livestock, poultry, companion). Kalmbach Feeds is listed as a Pork Powerhouse at 27,500 sows with other interests in poultry production. Kalmbach Feeds also has a major presence in the ownership of Routh Packing (Swine) in Sandusky, Ohio.

If you ever get an opportunity to attend the Kalmbach Feeds Agribusiness Conference, make the time. The attendees that were there enjoyed the hospitality, knowledge, positivity and fellowship that permitted the event from beginning to end.

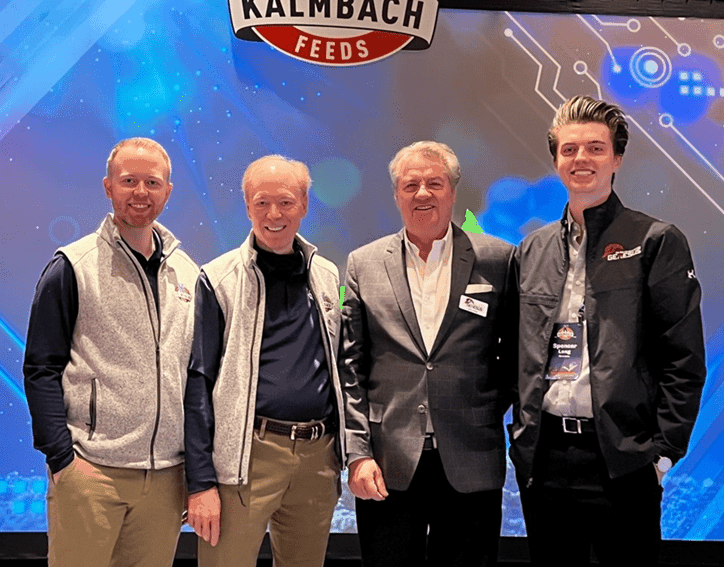

Paul Kalmbach Jr., Paul Kalmbach, Jim Long, and Spencer Long at the conference

Main ballroom at the conference

Paul Kalmbach gives the opening keynote presentation of the conference