European market: pork production down 8%

Production 8% down is a result of large financial losses leading to the liquidation of 1 million sowsIn the first 7 months of 2023 European Pork Production is down 8% compared to a year ago. This is a direct consequence of the major liquidation that happened in Europe when they suffered from large financial losses leading to liquidation of 1 million sows.

Despite lower production hog prices have declined 14 weeks consecutively in Spain. Declining from 2.025 Euro/kg (97¢ US lb. liveweight) to 1.658 Euro/kg (80¢ US lb. liveweight). Certainly, lower but still at highest level at this time of the year in data set. Lower is relative, current Spain price 1.658 Euros/kg (80¢ lb. liveweight) would be a welcome price for US producers being $70 a head higher.

Like much of the world the European Industry has many challenges, environmental regulations, animal welfare regulations, older facilities, generational challenge with family farms, feed costs, disease challenges (ASF – PRRS) etc. All factors in our observation that are keeping the declined pork production from expanding.

USA

The US pork industry is losing money. It doesn’t take an ag economist to state the obvious. US publicly owned pork companies indicate losses more than $30 per head year to date. Size doesn’t appear to be protection from the reality of hog market. The more you have the more you lose. The losses across the industry are leading to liquidation in the sow herd. Just as losses in Europe led to 8% fewer pigs. In a sense most know that financial losses in the US industry will lead to higher prices in the future. The big question is when? Our thought is major liquidation started in May, that indicates to us market hog supply will decline year over year beginning February – March.

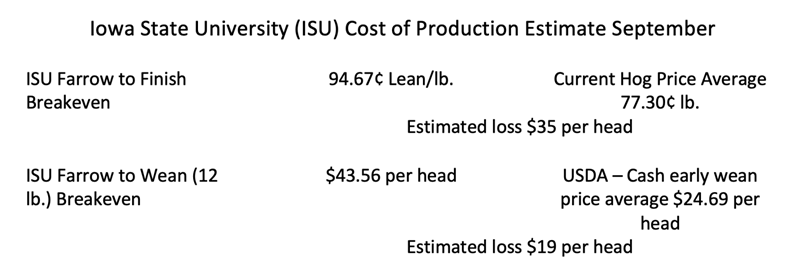

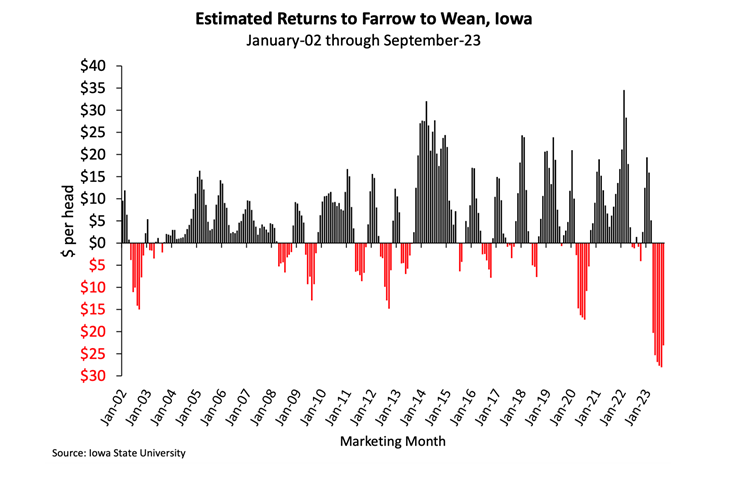

Using Iowa State University (ISU) costs current loss per head about $35 farrow to finish and early wean loss $19 per head. ISU data shows early wean losses from April until now (7 months) have averaged near $25 per head.

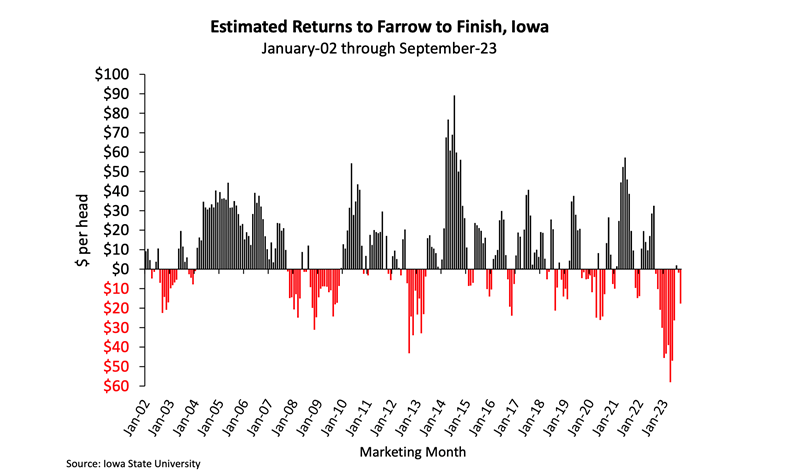

The two charts below from ISU indicate the history of farrow to finish and early wean returns. It appears to us losses have been longer and larger than in the last twenty years. We expect the historical cure to low prices is low prices will lead to excellent returns. History shows there is always a good rebound after multiple months of losses.

Better Beef

Currently Choice Beef Cut-outs are $3.02 lb. Select $2.72 lb. The price difference is over 10% and up to $250 per head premium. It is obvious the market will pay more for Choice as it's better tasting Beef. We have heard that the Pork market will not support higher prices for better Pork and too much better tasting Pork will lose the premium over time. Beef doesn’t indicate this we understand Prime – Choice % of total slaughter is 80%. The percentage at 80% is higher than it's ever been. Choice has become the main Beef market but still holds a real tangible premium. A 10% premium in the hog market would be $15 per head and we expect the better tasting product would increase Pork demand.