Market rising

Jim Long's pork commentaryThe US hog market is showing rapid upside.

- An indication of declining supply and rising demand is the cash 40 lb. feeder pig price. Last week cash 40 lb. feeder pigs averaged $103.01, in January they were $47, a year ago now $72. If we were to work on premise no one pays more than they have too, there has obviously been a change in market dynamics.

- US market hog prices averaged 90¢ lb. lean end of last week. Cash hogs were in high 40¢ lb. range in January. We have gained $80 plus per head.

- The USDA is projecting 2.9% more pork to be produced in 2024 than 2023. The cold hard facts are that year-to-date pork production is up only 0.2%, a fraction. Year to date 2024, 8120.3 million lbs. and 2023, 8105.3 million lbs. We believe sow herd rapidly declined in 2023 and into 2024. There is no way we are gaining pork lbs. as the year progresses year over year. This industry lost on average $30 per head for 18 months, this has cut production. At market prices 88-90¢ lb. now, we are just at breakeven.

- Last week USDA estimated average slaughter hog weights 289 lbs. a year ago 292 lbs. Farmer Arithmetic 3 lbs. is equal to pulling hogs ahead a day (minimum) using a day slaughter average of 360,000 head. Year to date US slaughter 258,000 head higher than a year ago. In our opinion the weight difference year over year can easily erase the idea that there are more hogs. The lighter hog weights contribute to pork production only 0.2% higher year over year.

- The latest data on PigCHAMP data base indicates US sow mortality is at record 15.82% up from 10.73% in 2017 and 8.36% in 2013. MetaFarms group has estimated a total enterprise loss value of $1,000 per sow.

On a 1,000 sow unit at 8.36% sow mortality per year times $1,000 loss income = $83,000. On a 1,000 sow unit at 15.82% times $1,000 sow mortality per year $158,000.

Difference in loss income $75,000 if we use $40 value on a weaned pig = divide $75,000 by $40 = 1,875 pigs needed extra on a 1,000 sow unit to compensate for difference in sow loss or 1.875 pigs weaned per sow per year.

There is no doubt the weaker sows and the larger numbers of prolapses has led to higher mortality and challenges to profitability.

Genesus sow mortality is averaging 7% with same customers at 3% in pen gestation. If you like hauling out dead sows keep what you are doing. But there are choices.

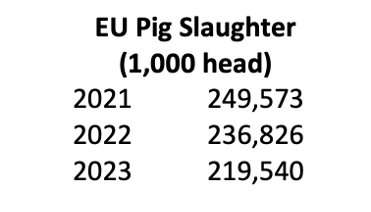

- Europe is the second largest hog production base in the world.

The hog slaughter declined 30 million head in two years (-12%). Why? Producers lost money, cut production. EU inventories at in December 2023 compared to 2022 down a further 3%. EU pork exports were 5,474 in 2022, 4,369 in 2023 (1,000 tonnes carcass weight) down 1,100. A huge amount. Conclusion cut your hog production 30 million head you have less pork to export. This trend will continue and it’s in our opinion why US pork exports are increasing and will continue too.

- US Pork Exports year to date are up 8%. Averaging about 32,000 metric tonnes per week year to date. Pork sales orders have significantly jumped the last three weeks averaging 43,000 a week. If this rising trend continues it will be very supportive to hog prices as we go into the next few months of lower hog numbers.

Last week on liveweight basis US dollars – US hogs were 65.39¢ lb. Spain 88¢ lb. (main exporting country). Not only EU has supply declining their hog price is over $40 per head more expensive. Why would foreign buyers not look to US for more pork?

Summary

Hog – Pork Market trend moving up, hog supply declining, export market up. Lean Hog Futures jumping around but trendline up. Don’t forget less Beef at triple Pork’s price. We won’t be surprised to see $1.20 lean hogs this summer as weekly slaughter numbers decline.