Canadian Swine Industry is Positioned for Success

Speaking at this year's London Swine Conference in March, Kevin Grier of the George Morris Centre in Guelph said that Canadian hog producers can look to the future with a sense of promise.

Abstract

Over the past several years, outside observers of the Canadian hog industry would likely have the impression that there was little reason for optimism or expansion in the industry. The evidence would have been the reports of serious financial losses resulting from grim market developments such as skyrocketing grain prices and the appreciating dollar.

These negative developments have resulted in a smaller industry as both producers and livestock have left the industry. In the latter half of 2013 and early 2014, however, the fortunes of the industry have turned for the better.

Grain and hog prices have combined to generate profits for hog producers.

The bottom line for the Canadian pork industry is that while there are sound reasons for short term optimism, there are also reasons to look forward positively to the future.

Whether from a global demand perspective or from a competitive supplier perspective

Canadian hog producers can look to the future with a sense of promise.

Introduction

During the past several years the Canadian hog industry has undergone an unprecedented period of financial hardships. The financial stress was caused by market developments, weather, animal health problems and political factors. Within that context, Canadian hog producers entered 2014 with a sense of cautious optimism. This optimism was based on relatively strong financial returns in the second half of 2013 as well as the prospects for profits through most of 2014.

The purpose of this paper is to argue that while there are sound explanations for short-term optimism, there are even more robust reasons for Canadian producers to look favourably on the industry’s long-term prospects in global markets.

Litany of Problems

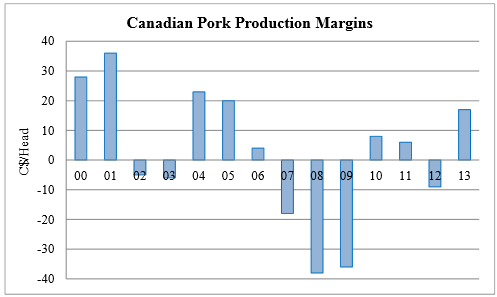

From approximately the second half of 2006 through the first half of 2013, the Canadian pork industry experienced a nearly uninterrupted string of quarterly financial losses from hog production. While there may have been net profits overall in 2010 and 2011 they were modest and not nearly enough to recover lost equity from 2006 through 2009.

Furthermore while 2012 began with promise, financial prospects quickly eroded during the summer when it became apparent that the US was undergoing a severe drought. That drought once again drove feed prices to new records and hog production returns to new lows. Those dismal returns continued through the first half of 2013.

By the summer of 2013, however, tighter pork supplies and ample grain production worked to drive hog prices higher and feed costs lower. As such, while the spectre of Porcine Epidemic Diarrhoea virus hangs over the industry, generally speaking producers enter 2014 on an optimistic note. The optimism, however is accompanied by caution given the past performance of challenge after challenge.

With regard to those challenges, details are not necessary but it is instructive to look back at the litany of obstacles and burdens that the industry endured over the past several years.

- The appreciation of the Canadian dollar resulted in an ongoing, continual erosion of the Canadian hog price relative to the United States.

- The explosion of grain prices due to the advance of the ethanol subsidies and artificial usage mandates in both Canada and the United States.

- The Country of Origin Labelling (COOL) law in the United States discriminated against Canadian livestock and resulted in reduced demand, markets and pricing for Canadian hogs.

- Animal health problems such as Porcine Reproductive & Respiratory Syndrome (PRRS) and H1N1 took out what little opportunity for profit existed.

- Pork packer rationalisation and inefficiencies resulted in lower price levels in Canada compared to the United States.

- Global economic weakness during and after the recession made demand prospects weaker than would otherwise have been the case.

Of these problems, the first two were the most relentless and lasting. While the dollar appreciation resulted in lower prices the ethanol mandates resulted in higher costs.

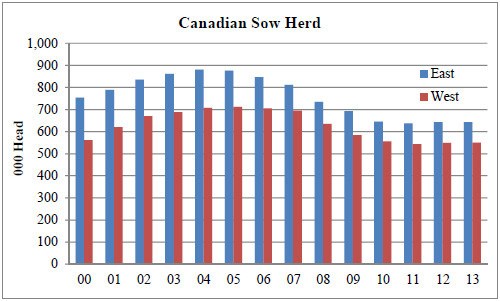

It is little wonder based on those two factors alone that the industry endured such financial stress. Needless to say, these challenges resulted in a significant rationalisation and consolidation of the Canadian pork industry. The sow numbers in Canada as of 2013 were 25 per cent down from their peak in 2004.

(Source: Statistics Canada)

Short Term Reasons for Optimism

In the short term, meaning approximately one year, hog producers in Canada have seen feed costs decline by 35 to 40 per cent while hog prices have risen by approximately 20 per cent. This has translated into robust profits during the past three quarters.

In addition, as producers look to the grain and hog market futures contracts, they can see the ability to lock in profits through most of 2014. The overall picture, in turn, has been significantly aided by a weaker Canadian dollar during the past six months.

Essentially, producers see that while for most of the past several years, factors have worked against them, currently those same factors are working in their favour.

Long Term Reason for Optimism

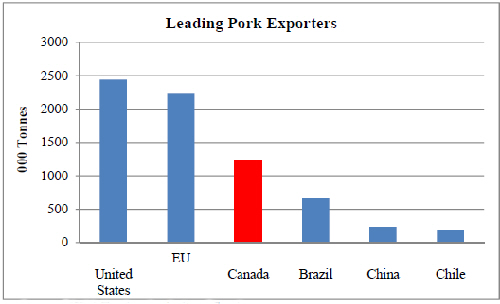

Canada is the seventh largest pork producer in the world and the third largest pork exporter in the world behind the United States and the European Union. Canada exports about 60 per cent of its pork production. Exports began to exceed domestic consumption in Canada about 10 years ago.

The main point is that Canada is a major player in global pork markets. Canada has pork trading expertise, is well respected as a supplier and is well positioned as a global pork trading power.

This positioning and logistical infrastructure is important because global demand for pork is going to continue to grow, likely rapidly in the coming years. The global population is growing by about 75 million people each year. That is two Canada(s) or 75 Saskatchewan(s) of population growth each year. Fundamentally that means more demand for food by that amount.

What is more interesting, however, is that we know that as incomes rise, the demand for food changes. The change in demand is a change towards proteins and meat. UN FAO estimates show that since 1980, while the population of the world has grown by over 40 per cent, meat consumption has grown by nearly double that rate.

Furthermore, most of the demand has come from developing countries. That is, those countries that are emerging as markets are seeing the biggest growth in meat consumption.

Simply put, this means obviously that the demand for pork is going to be an ongoing source of growth and demand for the Canadian hog and pork industry.

Source: USDA Foreign Agricultural Service

As noted above, Canada is well positioned to take advantage of growing demand given its robust production and export infrastructure. Beyond that, however, there are underlying reasons why Canada is positioned for success for the long term in the pork industry.

One main underlying reason that Canada is positioned for success is the fact that with Canada, Brazil and the US, Canada is one of the top competitive, efficient hog-producing regions in the world. While producers often bemoan the fact that Canadian prices are among the lowest in the world, that is because Canada is among the most competitive regions in the world with production far in excess of consumption.

Other reasons for Canadian optimism include the following advantages relative to competing regions:

- fresh water supply

- arable land

- absence of common major animal health problems

- livestock and human contact density

- ample feed grain supply, and

- technological adoption.

Conclusion

The bottom line for the Canadian pork industry is that while there are sound reasons for short-term optimism, there are also reasons to look forward positively to the future.

Whether from a global demand perspective or from a competitive supplier perspective, Canadian hog producers can look to the future with a sense of promise.

Reference

Grier K. 2014. Positioned for success. Proceedings of the London Swine Conference. London, Ontario, Canada. 26 to 27 March 2014.

Further Reading

You can view other papers presented at the 2014 London Swine conference by clicking here.

August 2014