Pig Meat Sector in Australia

Australian pig meat production increased for a fifth consecutive year in 2013-14, rising by one per cent and a similar growth rate is forecast for the coming year, according to Robert Leith in the ABARES Agricultural Commodities report for the September 2014 quarter.

Summary

Pig prices are forecast to fall by one per cent in 2014-15, reflecting expected higher domestic production.

Exports are forecast to increase in 2014-15 but will continue to represent only a small share of total industry output.

Pig meat imports fell by 11 per cent in 2013-14, as the weaker Australian dollar made imported pig meat more expensive.

Pig meat exports to New Zealand, Papua New Guinea and Hong Kong each increased by between five and eight per cent in 2013-14.

In 2013-14, the total value of Australian pig meat exports increased by five per cent to $85 million.

Pig Meat Prices

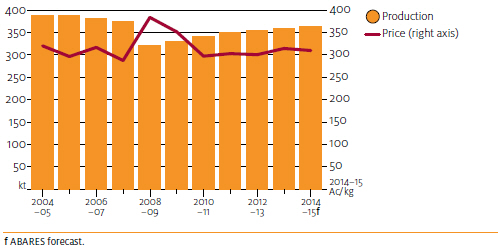

The weighted average over-the-hooks price of pigs is forecast to decrease by one per cent in 2014-15 to 304 cents a kilogram. Domestic production is forecast to increase, supported by lower feed grain prices. Imports are also expected to rise because lower forecast corn and soybean prices are expected to encourage increased pig meat production in the Northern Hemisphere. This is likely to help North American producers overcome the effects of a virus outbreak in 2013–14 that resulted in high piglet mortality.

In 2013-14, the Australian pig price increased by seven per cent to 306 cents a kilogram, reflecting a reduction in total pig meat supply. Domestic processor demand for locally produced pig meat increased as imports declined, putting upward pressure on domestic prices.

Production to Increase

Australian pig meat production increased for a fifth consecutive year in 2013-14, rising by one per cent to around 360,000 tonnes.

In 2014-15, pig meat production is forecast to increase by a further one per cent to 364,000 tonnes.

The forecast reduction in feed barley and wheat prices is expected to result in lower input costs, encouraging producers to increase production.

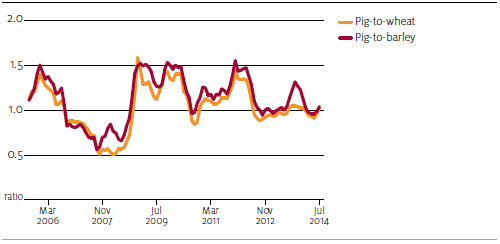

Pig-to-feed price ratios are indicators of Australian pig producer input cost margins. In 2013-14, the pig-to-barley ratio increased by 10 per cent and the pig-to-wheat ratio by six per cent. Both ratios are expected to increase again in 2014-15.

Imports to Increase

Australia allows imports of deboned pig meat from selected countries. It must be heat-treated before it is sold, so it can only be sold as manufactured product. Therefore, only domestically produced pig meat can be sold as fresh pork in Australia.

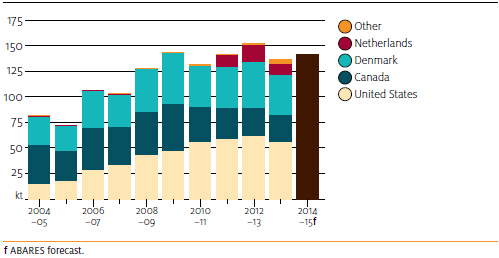

Pig meat imports fell by 11 per cent in 2013-14; the depreciation in the Australian dollar against the currencies of pig meat-exporting countries made imports more expensive. In 2014-15, imports are forecast to increase by four per cent to 142,000 tonnes. Lower corn and soybean prices are expected to result in increased competition from exporting countries in the Australian pig meat market.

Australia sources most pig meat imports from North America. Over the five years to 2013-14, Canada and the United States accounted for around 60 per cent of Australia’s pig meat imports. Access to cheaper feed grains, notably corn, allows these countries to be highly price-competitive pig meat producers. Corn prices fell significantly in 2013-14 and, in August 2014, were the lowest in around four years.

In the first half of 2014, a porcine epidemic diarrhoea virus (PEDV) outbreak in North America resulted in many piglet deaths (particularly in the United States). This caused pig meat supply to fall and prices to increase. Reflecting this, US pig prices increased by around 60 per cent between January and July 2014. Instances of PEDV pig deaths are expected to drop considerably in 2014-15.

Exports to Increase

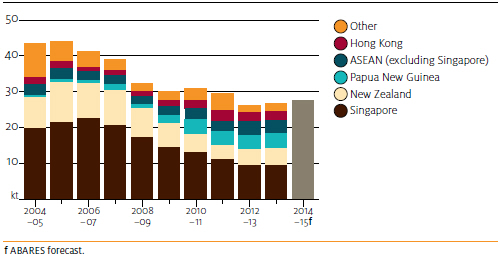

In 2013-14, Australian pig meat exports increased by two per cent to 27,000 tonnes, as the depreciation of the Australian dollar made Australian pig meat more price competitive relative to Northern Hemisphere pig meat.

Shipments to Singapore were relatively unchanged at 9,000 tonnes but exports to New Zealand, Papua New Guinea and Hong Kong all increased by between five and eight per cent.

The total value of Australian pig meat exports increased by four per cent to $85 million.

Australian exports of pig meat are forecast to increase by four per cent in 2014-15 to around 28,000 tonnes. The value of exports is forecast to increase by two per cent to $87 million.

| Pig meat outlook in Australia | |||||

| unit | 2012-13 | 2013-14 s | 2014-15 f | % change 2014-15 vs 2013-14 | |

|---|---|---|---|---|---|

| Over the hook price a | A¢/kg | 285 | 306 | 304 | -0.7 |

| Slaughterings | '000 | 4,745 | 4,778 | 4,800 | 0.5 |

| Production | 000 tonnes | 356 | 360 | 364 | 1.1 |

| Import volume b | '000 tonnes | 152 | 136 | 142 | 4.4 |

| Export volume bc | '000 tonnes | 26 | 27 | 28 | 3.7 |

| Export value | A$ million | 81 | 85 | 87 | 2.4 |

| a = dressed weight b = shipped weight c = excludes preserved pig meat f = ABARES forecast s = ABARES estimate Sources: ABARES; Australian Bureau of Statistics |

|||||

September 2014