Pig outlook: very good week for the pork industry

Read Jim Wyckoff's latest weekly analysis of the global hog market.The pig traders’ perspective

December lean hog futures on Thursday 10 September jumped to a six-month high of $62.55 as of this writing Thursday morning. The technical chart posture for the hog futures market has turned solidly bullish as prices have been trending up on the daily chart for over five weeks. Fundamentally, average US hog weights in key markets are under year-ago levels, suggesting the pork industry has made major strides working through big supply backlogs.

US pork product prices are climbing and strong packer profit margins are giving processors room to raise cash hog bids. Seasonality studies point to continued strength heading into USDA’s 24 September Quarterly Hogs & Pigs Report. USDA export sales were delayed until Friday 11 September because of the US Labour Day holiday on 7 September.

© Jim Wyckoff

The next week’s likely high-low price trading ranges

December lean hog futures--$60.00 to $65.00, and with a sideways-higher bias

December soybean meal futures--$315.00 to $325.00, and with a sideways-higher bias

December corn futures--$3.50 to $3.70, and a sideways-higher bias

Latest USDA reports, and other news

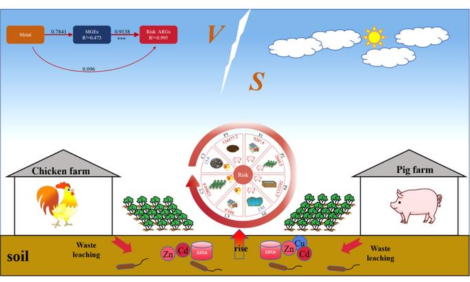

First German case of African swine fever reported

Germany has confirmed the detection of African swine fever (ASF) in a wild boar near its border with Poland, the country’s ag minister said at a press conference Wednesday 9 September. The country is stressing the “principle of regionality” in the case, emphasising that a farm animal was not involved.

The country is concerned that importers of pork could respond with blanket bans. The German ag ministry said it was in contact with China, as Germany does not have a formal agreement with China about the disease.

South Korea has already responded by banning German pork imports. Germany is a major EU pork exporter, shipping 158,000 metric tonnes of pork valued at around $501.6 million to China from January to April of this year. Poland has been dealing with ASF for some time. Germany has set up a quarantine zone in the area where the wild boar was detected, including a ban on corn harvest in the area.

USDA’s Ukraine livestock summary

Ukrainian cattle and swine inventories contracted in 2019 and are expected to contract further in 2020 and 2021. Red meat production remained relatively inefficient and decreased, following inventory contraction. A record number of slaughter cattle and significant volumes of beef were exported in 2019. Beef remains overly expensive for price-cautious Ukrainian consumers, therefore USDA estimates that exports will remain strong in 2020-21. African Swine Fever (ASF) remains a major obstacle for the Ukrainian swine industry. Pork importers fill market gaps left by domestic production. Consumers continue to substitute red meat with poultry in their diets.

The Ukrainian swine industry was slightly optimistic at the end of 2019. As of 1 January 2020, the number of sows was at its highest point in the last three years, reflecting those positive expectations. However, that optimism quickly evaporated after the arrival of COVID in spring, 2020.

Ukrainian production did not rebound in the first half of 2020. High production costs, lower pork prices, and an inflow of imports were the major factors suppressing production.

Domestic demand for pork declined in 2019 and is expected to contract further in 2020-21. Ukrainian consumers continued to substitute more expensive pork and beef with cheaper poultry.

Ukraine remained an importer of pork, although lower demand resulted in a drop in Ukrainian imports. The majority of imports consisted of offal that was consumed by Ukrainian processors. Although, Canada was successful in developing a limited market for bone in hams and shoulders, offering then at competitive prices. Canada became the number one supplier of pork to Ukraine in the shrinking import market in January- May 2020.

Read Jim Wyckoff's analysis of the global poultry market on The Poultry Site and updates on the global cattle industry on The Cattle Site.