Short Term Outlook for EU Pig Meat Market 2014-2015

There are the first signs of a production increase after two years of reduced pig meat supply, according to the 'Short Term Outlook for EU arable crops, dairy and meat markets in 2014 and 2015' from the European Commission.

After two years of reduced pig meat supply, a further 0.5 per cent contraction of the pig meat production is expected for 2014. But the decline in production took place in the first half of the year and there are now signs of a recovery in production; in May-June the number of breeding sows was higher compared to last year, notably in Germany, the Netherlands, Spain, Denmark and Hungary.

In 2012 and 2013, the implementation of new welfare standards in the EU led to a declining production because of a decrease in the number of breeding sows and consequently of piglets. Production was expected to recover slightly already in 2014, but the outbreak of African swine fever (ASF)1 in February 2014, which led to a full ban of EU exports to Russia (even before the August ban was imposed by Russia) delayed the recovery in EU production by bringing uncertainty in the market.

The situation varies among Member States. In the first seven months of the year, slaughterings went down compared to last year in three of the main producing country: -2 per cent in Germany, -1 per cent in Denmark and around -5 per cent in Italy. Slaughterings were relatively stable in France, while noticeably higher in Poland (+7 per cent) and the Netherlands (+3 per cent).

The lower feed prices should allow the sector to cope with declining pig prices and to achieve a projected 0.8 per cent production recovery in 2015.

The 2014 EU pig meat exports are expected to decline by just 8 per cent compared to 2013, despite the loss of the Russian market since February 2014, which accounted for a quarter of total extra-EU pig meat exports2. Part of the volumes initially destined to Russia is expected to be absorbed by some growing Asian markets like Philippines, South Korea or Japan.

As the sector is affected by two bans (including the one for alleged sanitary reasons which the EU is contesting in WTO), EU exports are expected to remain stable in 2015, provided that strong demand from our Asian partners and price competitiveness will continue next year. In addition, new outlets could appear, for example, Viet Nam, which recently opened the market for fresh and frozen pork, but this would depend on the time needed for logistics and certifications.

Moreover, trade diversion of Brazilian meat towards Russia could leave room for EU exports to the usual export destinations of Brazil. In order to secure the supply of pig meat, Russia has authorised several Brazilian companies in an attempt to find substitutes for the pig meat imports from the EU, and has been searching other suppliers (as Chile, Argentina, Ecuador and China) for additional quantities of beef, pig and poultry meat.

Source: DG Agriculture and Rural Development

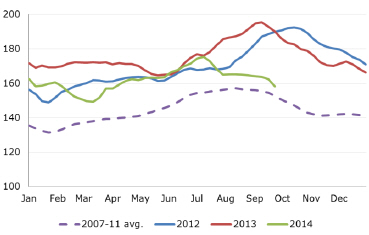

Despite the Russian ban, pig meat prices remained firm so far because the supply in the EU was limited. After a drop in March 2014, the EU pig meat price has gradually increased and reached €170 per 100kg in July. The EU price kept relatively stable through August but, from the beginning of September, it went down to €158 per 100 kg; nevertheless, a decrease in pig meat prices is a normal feature in autumn when slow demand meets higher supply.

In 2014, pig meat consumption is expected to be stable at the 2013 low levels (31kg per capita in retail weight). Consumption is expected to resume growth in 2015 together with higher availability on the EU market and better prospects of economic growth.

Focus on Russia

Russia was the first destination for EU pig meat. The EU exported around 3.2 million tonnes of pig meat3 (product weight) outside the EU with main destination Russia (24 per cent or 800,000 tonnes of pig meat products). Main exporters in volume are Germany, Denmark, Spain, France, the Netherlands and Poland (altogether 80 per cent of EU pig meat exports to Russia). Most exported pig products to Russia are frozen meat (43 per cent), lard (32 per cent) and offal (15 per cent).

1 In January a few cases of ASF in dead wild boar were discovered in Poland and, Lithuania close to the border with Belarus. During the year further cases came up also in Latvia and Estonia and also in domestic holdings.

2 Including live animals, fresh/frozen, salted, processed, offal and fats (in carcass weight equivalent); 2013 data.

3 This figure includes all pig meat products (fresh, frozen, salted meat, offal, fats and preparations). For calculation and comparison reasons, offal are not included in the balance sheet (the meat and meat products are converted into carcass weight equivalent and offal are not part of the carcass).

Further Reading

You can read the full 'Short Term Outlook' report by clicking here.

Read the highlights of the report by clicking here.

October 2014