USDA GAIN Report: China pig production to exceed 2021 levels, prices remain low in 2022

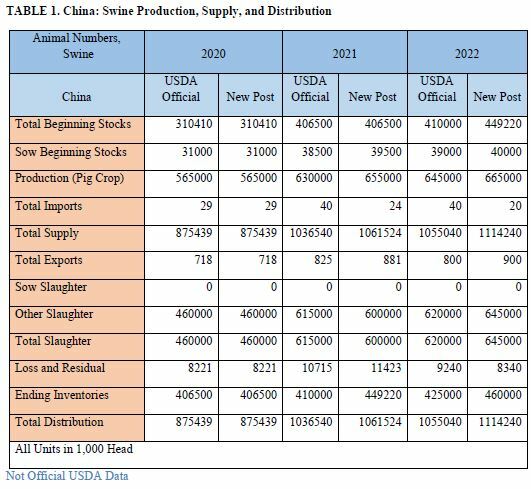

USDA releases its GAIN report on pig production in ChinaIn 2022, imports of breeding swine are estimated lower at 20,000 head and pork imports are estimated at 3.3 million metric tons (MMT). Domestic swine, breeding sows, and pork production are expected to exceed 2021 levels as producers increasingly compete for market share and morbidity associated with African Swine Fever (ASF) outbreaks, lowers. Consequently, and with weaker consumer demand in anticipation of a less robust economic outlook, domestic pork prices should remain low in 2022.

Summary

- Swine Production: The hog production estimate for 2022 is 665 million head, a 2 percent increase over 2021 driven by high beginning stocks and more efficient sows. Producers’ losses as well as government policies designed to stabilize the swine herd are expected to temper production and swine sector volatility in 2022.

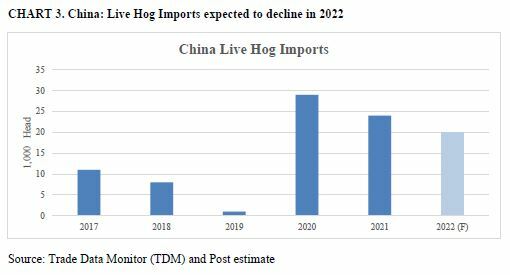

- Swine Imports: Imports of live breeding swine in 2022 are estimated lower at 20,000 head as producers clear through 2021 supply levels. Low hog and piglet prices that continued into 2022 are expected to lower demand for imported breeding swine.

- Pork Production: For 2022, pork production is estimated to reach 50 million metric tons (MMT), a 5 percent increase over 2021, due to higher hog production and higher slaughter levels. Large producers are continuing to expand their market share of pork production.

- Pork Imports: The 2022 pork import estimate is lowered to 3.3 MMT due to competition from low-priced domestic pork, a pork import tariff increase (from 8 to 12 percent), less optimistic economic outlook, and continued COVID-19 related restrictions and market disruptions.

Production

China’s sow beginning stocks in 2022 expected to exceed 2021 by 1 percent

Sow beginning stocks in 2022 are estimated at 40 million head. China’s Ministry of Agriculture and Rural Affairs (MARA) noted that 2021 sow inventory is oversupplied and exceeded prescribed levels. Animal disease had a smaller than expected effect in 2021 according to MARA information, and sow stocks continued growing despite hog and pork price declines. Publicly traded hog producers suffered significant losses in 2021 according to released financial statements and media reports. To stem financial losses and generate cash, reports indicate that large hog producers culled substantial numbers of inefficient sows.

China requires producers/provinces to maintain national sow inventory at 41 million

On September 23, 2021 MARA published the Interim Implementation Plan to Manage Swine Production Capacity (see GAIN Report CH2021-0121). This plan aims to stabilize the swine sector from dramatic fluctuations by providing production targets. The plan requires the national sow inventory to be maintained at 41 million and specifies a “normal” inventory target for each province/area that should not fluctuate more than 5 percent. The central government will use control measures if production is outside the targeted range. The plan also provides support for large-scale farms (defined as more than 500 head). Industry contacts indicate these measures could further accelerate concentration in the swine sector.

New ASF strain appears to be less fatal, more manageable

In 2022, hog losses from animal diseases are expected to fall but ASF is expected to remain endemic. In October 2021, the Harbin Veterinary Research Institute of the Chinese Academy of Agricultural Sciences (CAAS) identified a less virulent new strain of ASF. This strain appears to be less fatal to hog, sow, and piglet populations. Hog producers and provincial authorities have adapted production and slaughter practices to mitigate against large losses and disease spread (see footnote 1 below). 1 In 2021, China’s swine sector noted substantial production - increasing piglet, hog, and pork inventories. This exacerbated declines in prices through the end of 2021 (see CHART 1 below).

Significant swine sector losses - boost culling of inefficient sows

In 2021, media reports indicated that low hog and pork prices quickened the culling of inefficient sows as producers looked to increase cash liquidity. Reports indicated that one of the top five publicly traded hog producers in China announced that in 2021 (primarily, in the second half of the year) they had culled 2.2 million inefficient sows bringing their total year end sow inventory to just under 400,000 head. In December 2021, MARA announced that while the fertile sow population had been declining since July 2021 the overall supply exceeded the target population and that China would aim to keep the sow population to around 41 million head.

NOTE: China’s official National Bureau of Statistics (NBS) had the sow population at the end of 2021 at 43.29 million sows, higher than industry estimates suggest. Industry sources have noted that some producers are retaining and raising piglets in anticipation of an increase in piglet and breeding swine prices.

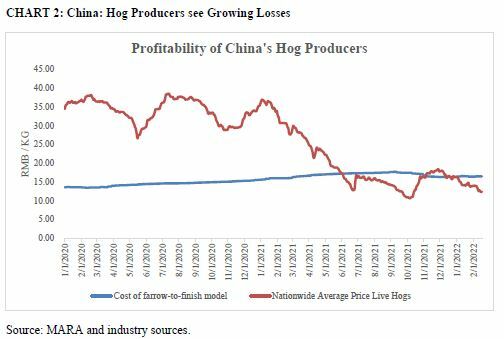

Concerns mount regarding China’s publicly traded hog companies

Reports indicate that China’s top twelve publicly traded companies registered losses totaling nearly $80 billion in 2021. Investors are increasingly concerned that public companies may not be able to ride out prolonged low prices without substantial financial assistance or subsidy from central, provincial, or local agencies (see CHART 2 below).

In September 2021, MARA announced the establishment of a “National Swine Production Adjustment Base” for swine farms with over 10,000 head, which emphasizes support for large hog producers. Provinces like Jiangxi and Henan, the homebase of two of China’s largest publicly traded hog companies, have provided a variety of subsidies to producers, including access to low-cost loans, to maintain production targets and avoid further stock shocks.

Hog production is estimated to exceed 2021 rates by 2 percent

In 2022, hog production is estimated to reach 665 million hogs, exceeding 2021. Higher beginning sow inventories, coupled with more efficient breeding sows, are expected to improve hog production by 2 percent. In 2022, further growth in hog production is expected to be stifled by government policies that are designed to stabilize the swine sector and limit production volatility (see above).

Consumer demand for pork has been weak and is expected to remain weak throughout 2022. Industry sources note that consumers diversified meat consumption during the “high” pork price period following outbreaks of ASF – and that these changes in preferences appear to have persisted even as pork prices declined in 2021. Reportedly, weak consumer demand, higher supplies and product availability dramatically lowered national pork prices in 2021 (see CHART 2 above). Finally, high feed costs are estimated to continue through 2022 - putting further pressure on profits, making substantial expansion less attractive.

Trade

2022 live swine imports expected to decline as sow herd stabilizes

In 2022, live swine imports are expected to decline to 20,000 head. Live swine imports have historically been relatively low and recent growth was spurred by the desire to improve herd genetics while pork prices were high (see CHART 3 below). However, costs for transporting, testing, and delivering imported hogs are reportedly unrealistic for China’s hog producers at current hog prices. Reports indicate that some large producers are establishing “nuclear” herds to centralize breeding within their facilities (those producers increasingly focused on vertical integration), while others have returned to relying on breeders to supply piglets.

In 2022, live hog imports will be dominated by long-term partners such as the United States, Demark, France, and the United Kingdom. In September 2021, Ireland signed an agreement with the General Administration of Customs of the People’s Republic of China (GACC) to ship breeding swine. Industry sources note that breeding swine from the United States are preferred because of hog size, higher survival rates, and higher meat production efficiency rates. Danish-origin breeding swine are popular due to higher rates of piglet production, on average, over the life span of the breeding sow.

Swine import and export estimates for 2021 are revised from USDA official data based on information from China Customs.

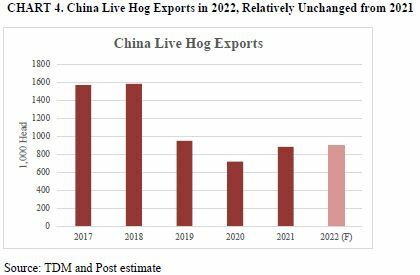

Exports estimated to rise to 900,000 head dominated by Hong Kong and Macao

In 2022, China’s live swine exports are estimated at 900,000 head, a similar level as 2021 (see CHART 4 below). China mainly exports live swine to Hong Kong and Macao. Consumer preferences in Hong Kong and Macao favor “hot” (fresh) pork meat which supports the export of live hogs for immediate slaughter.

Read more about China's pork production, supply and distribution