German Pig Slaughterers on Consolidation Course

GERMANY - Over the past years, German pig slaughterers sought only to increase slaughter capacity. Now a phase of consolidation seems to have started.The four largest slaughter companies have had a mixed year.

Some had to sacrifice a lot and are now in the middle of consolidation; others were able to realise further growth.

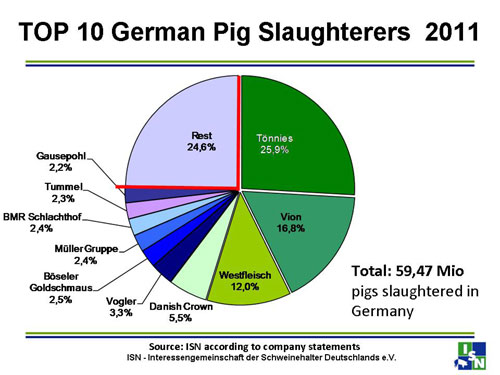

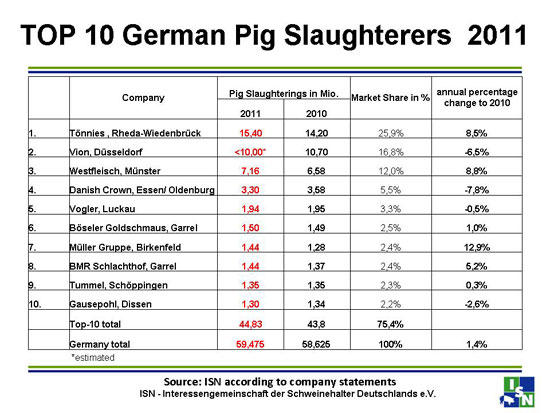

The slaughter pig market is still highly concentrated in Germany. The top 10 companies slaughter 75 per cent of the pigs in the country.

Out of the 10 largest pig slaughter companies, the top four alone have more than 60 per cent market share and 15 per cent of the market is covered by the next six companies.

A number of top 10 companies said they see future savings potential in optimising the production processes above all, as for instance, with regard to energy and water consumption.

Top four in detail:

Toennies: With an Eye on China as a Growth Market

Toennies continues to lead the pig slaughter companies, with about 15.4 million pigs slaughtered last year.

In 2011, the biggest German slaughter company was still expanding, increasing its number of slaughters by 1.2 million pigs.

Toennies has held a 50 per cent export share for a few years the company sees markets abroad of continuing importance. Traditionally, Russia has been a strong market for Toennies, but currently, Asian markets are now becoming the centre of focus. The company has announced plans for investments in China.

VION and Westfleisch Presenting their own Animal Welfare Labels

In 2011, the distance between Vion and the number one position grew again. Vion lost a big part of its market share. According to ISN estimates, Vion slaughtered less than 10 million pigs last year in Germany. Exact figures have not been released by the company. Vion has indicated that it intends to concentrate more on domestic markets in the future instead of growing via exports. Accordingly, Vion tried to exploit new market segments. Together with the German Humane Society (an animal welfare society) and others, an animal welfare label is being developed which is intended to guarantee the customer higher standards in animal husbandry.

Westfleisch was able to increase its number of slaughters. Growth of up to 7.16 million pigs was made possible in particular by increased export rates. Similar to the Toennies figures, Westfleisch’s export share is around 50 per cent. Growth proved to be particularly strong in Asian markets such as Hong Kong, China and South Korea.

Like Vion, Westfleisch exploited a new market segment in 2011 with the label “Aktion Tierwohl” (a campaign for animal welfare). The company said that 120 companies with a count of 410,000 pigs annually are taking part in this campaign. These labelled products are mostly produced for exports to foreign markets, according to ISN.

At the start of 2011, the D&S Fleisch slaughter company was taken over by Danish Crown. But after the change of ownership, slaughter numbers could not be maintained because, amongst others, the Cappeln site has been closed, at least temporarily, since August 2011. Over the past year, about 3.3 million pigs were slaughtered, down eight per cent from the previous year.

Medium-sized businesses show mixed results

There were mixed fortunes also in the lower part of the table.

While some of the companies were able to up their position, others went down in the ISN slaughterhouse ranking.

Vogler slaughtered 1.94 million pigs in total at their premises in Steine, Bremen and Laatzen. In this way, the previous year's value was achieved again. Vogler, too, is exporting more than half of its products to countries all over the world.

With 1.5 million head slaughtered in 2011, Boeseler Goldschmaus (Garrel) also remained on the same level as the previous year. Expanding capacity has not been scheduled for 2012.

The Mueller Group (South Germany) with their slaughterhouses at Ulm, Bayreuth and Birkenfeld and the BMR slaughter company at Garrel vie for the seventh position in the table. As a result of increased slaughter capacities at Ulm, the Mueller Group had 1.44 million pigs slaughtered in 2011, with slaughter up about 13 per cent compared to 2010.

An increase of about five per cent was reported by the BMR slaughter company, where 1.44 million pigs were slaughtered in 2011.

The fact that Tummel, based in Westphalian Schoeppingen, is still found in the official statistics must be attributed to the cartel office’s intervention. The cartel office blocked the take over of Tummel by Toennies at the end of 2011. At the Tummel premises, 1.35 million pigs was slaughtered last year.

Gausepohl (Dissen) was consolidating last year, and dropped down the ranking list a few notches. Gausepohl slaughtered 1.3 million pigs in 2011 (down 2.6 per cent). This slight decrease was, amongst other issues, attributed to the closing down of the Chemnitz premises, which was a result of high energy, disposal costs as well as veterinary fees.