Hogs & Pigs Report: a Bearish Surprise

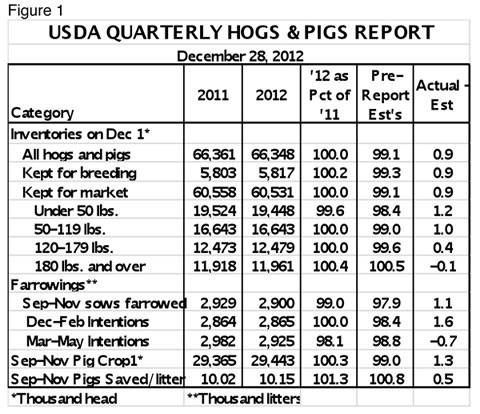

US - "Happy New Year! Please accept our wishes that this year will be a great one for you – both professionally and personally!" writes Steve Meyer in his weekly "Market Preview" as published in National Hog Farmer magazine.USDA's December Hogs and Pigs report was a bit of a bearish surprise as virtually every number was larger than what was expected, on average, by analysts surveyed before the report’s release. See Figure 1 for the key data from Friday’s report.

USDA estimated that the 1 December breeding herd numbered 5.817 million head, 14,000 or 0.2 per cent larger than one year ago and 29,000 head larger than on 1 September. Most – including me – expected some reduction of the breeding herd based on the extreme feed costs that began last summer. But as I have pointed out on many occasions this fall, the data simply have not supported those expectations with sow slaughter lagging year-ago levels in many weeks and gilt slaughter as a percentage of total barrow/gilt slaughter falling well below year-ago levels. There was never in my opinion a strong chance of the massive liquidation of which some had warned, but I did not expect there to be no reduction – and even some growth.

Why could this be? First, USDA may have the numbers wrong. There is always that possibility. They sometimes make some big revisions just as they did in this report when they added 636,000 head to the March-May pig crop to account for the higher Sept-Nov slaughter. Those added pigs were the result of 63,000 added litters during the March-May quarter. The point is that the number could be wrong. But I doubt that it is off by much.

Second, it could be irrational behavior by producers, but my experience is that hog producers do not often behave irrationally. On the contrary, hanging on to one’s sow herd and trying to ride out a short-crop-driven cost surge is completely rational. Whether it is ultimately the right decision depends on whether it rains this spring and summer. If normal weather returns, corn supplies will be ample, costs will return to more reasonable levels and current futures prices, even after Monday’s sell-off, will be profitable.

Third, the numbers confirm that there was indeed more financial staying power among hog producers than we had anticipated. That staying power was the result of lower-than-believed losses in 2008 and 2009 and, quite possibly, higher-than-believed profits in 2010 and 2011. Producers are much better at managing margins now and this lack of reaction is, I believe, the result of these new abilities.

One analyst friend remarked that “These guys are fearless.“ I took issue with that because I believe there is plenty of fear out there. I do, though, believe pork producers are courageous, making decisions to “do what they do“ based on their best information. The stakes of this courageous stand are very high indeed.

So what do the numbers in Figure 1 mean for the coming year?

They do mean that hog supplies will be larger than what the futures market was pricing going into the report. Part of that optimism was removed from the market on Monday with Lean Hogs contracts from April through year end losing $1.40 to $1.875/cwt. I wouldn’t be surprised to see a bit more bearish sentiment but nothing severe from this point.

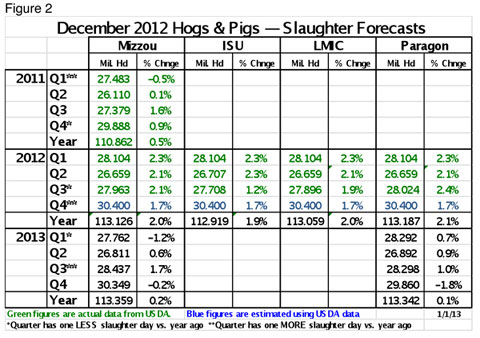

They do not mean that supplies will be burdensome and, in fact, imply that hog slaughter will be close to 2012 levels. Figure 2 shows quarterly and annual slaughter levels projected by the University of Missouri and me. Estimates based on Friday’s report from Iowa State and the Livestock Marketing Information Center are not yet available. I will include an updated table in next week’s edition.

These slaughter levels plus lower weights, very likely higher exports and a growing US population imply that per capita US pork availability/disappearance/consumption will be down perhaps 2 per cent from the record-low of 2012. That alone would push prices higher but lower beef and very likely chicken supplies should be supportive as well.

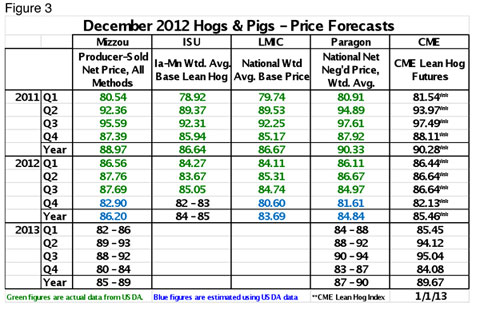

Figure 3 shows my price forecasts for 2013 as well as those of the University of Missouri. The Q1 prices will not be high enough to be profitable given current feed cost expectations. Q2 will be close to breakeven while Q3 will yield some profits. Q4 depends on the size of the 2013 US corn and soybean crops.

Current futures prices are above the top of ,my forecast range for Q2 and Q3. That means I would advise some coverage at these price levels but this is usually not the time to book summer hogs. Spring cash strength usually pulls the complex higher and provides better opportunities. That's as long as there is, in fact, a spring rally. Anyone remember H1N1 influenza? The point is that these price levels are good relative to where I and other analysts think cash hogs will be. How much risk can you stand? How are you sleeping at night knowing that most of your financial reserves are gone? What can you do with the time you would spend watching markets, worrying, throwing things, etc.? Only you can answer those questions.