CME: Bearish Hogs and Pigs Report Analysis

US - So about that “bearish“ Hogs and Pigs report from last Thursday —- it certainly hasn’t played out that way yet. Prior to Tuesday’s overnight session, CME Lean Hogs contracts had pretty much gained value across the board since the release of inventory estimates that were generally higher that expected. Why the positive reaction to the negative report? write Steve Meyer and Len Steiner.We think it is probably a matter of the hog and pork market crying a collective “Enough!” after a couple of months of decidedly bad results. June Lean Hogs futures began 2013 at $99 and touched $87 on March 20. Cash hogs (national negotiated net price) began the year at $83, touched $91 in early February and have now retreated into the low $70s. The cutout value has fared even worse, beginning 2013 at $81, reaching a high of only $86.81 on February 1 and falling to a yearto-date low of $77.21 on March 28, the day of the latest USDA report. It is not unusual for hog and pork prices to move sideways through March but this kind of decline is a bit of a surprise, especially relative to expectations of higher prices after last summer’s cost run-up.

There are a number of reasons for the struggles and virtually any of them would not have been a big problem had they occurred in isolation. Put them all together and you have a set of hurdles that the market has yet been able to clear with any degree of sustained success.

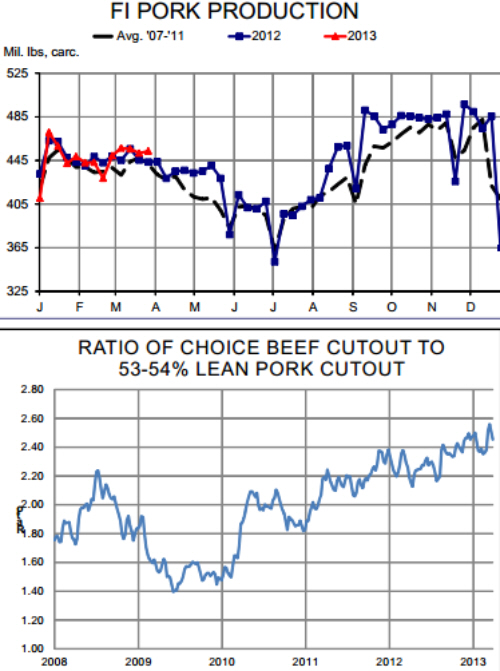

FI pork production has been higher, year-on-year, in 8 of 13 weeks so far in 2013 and was 1.5% higher for the four weeks that ended last Friday (basically the month of March) on slaughter that was 2.1% larger. Year-to-date production based on daily data is slightly lower than last year but the recent surge of hogs has put cash pork and hog markets on their heels.

Demand has, by most measures, been soft and there are several reasons for it.

- The self-employment tax increase of January 1 basically clipped 2% off everyone’s incomes so far in 2013 and the reports or reduced consumer traffic and buying have been widespread, even hitting “always low prices” Wal-Mart who has long been considered the retailer that wins when times get tough.

- Unemployment remains well above 7% even with some steady gains in total employment.

- Per capita disposable income plunged in January to a level lower than one year ago after very respectable showing in November and December — results we believe were due to bonuses paid before year-end so as not to be subject to the 2% FICA tax increase.

But there are signs of opportunity. Chief among them, in our opinion, is the current under-priced status of pork, especially relative to beef. As can be seen in the chart at right, the ratio of the Choice beef cutout to the 53-54% lean pork cutout reached a new record high of 2.558 the week of March 16. It has since dropped to 2.454 but that multiple is still larger than any seen prior to last December. Beef is very expensive compared to pork. We think that means pork will gain feature space as the weather warms and grilling season begins, providing some lift to pork values. That lift could become very strong indeed if Choice beef prices ever crack the $200/cwt. barrier and we still believe that is likely as steer/heifer slaughter totals tighten to reflect the smaller feedlot placements of this past winter.

And chicken could provide some help as well. In spite of broiler production that is, year-to-date, 3% higher than one year ago, chicken prices are near or at record levels. The national composite broiler price has been over $105, a level never before reached, for the past 4 weeks. Boneless skinless breasts are back above $1.50/lb. and leg quarters are approaching year-ago levels, likely due to increased interest from Russia in the absence of U.S. pork and beef imports. Our calculated broiler cutout value moved above $1/lb. last week for the first

time since August.