Brazil: Hog Markets

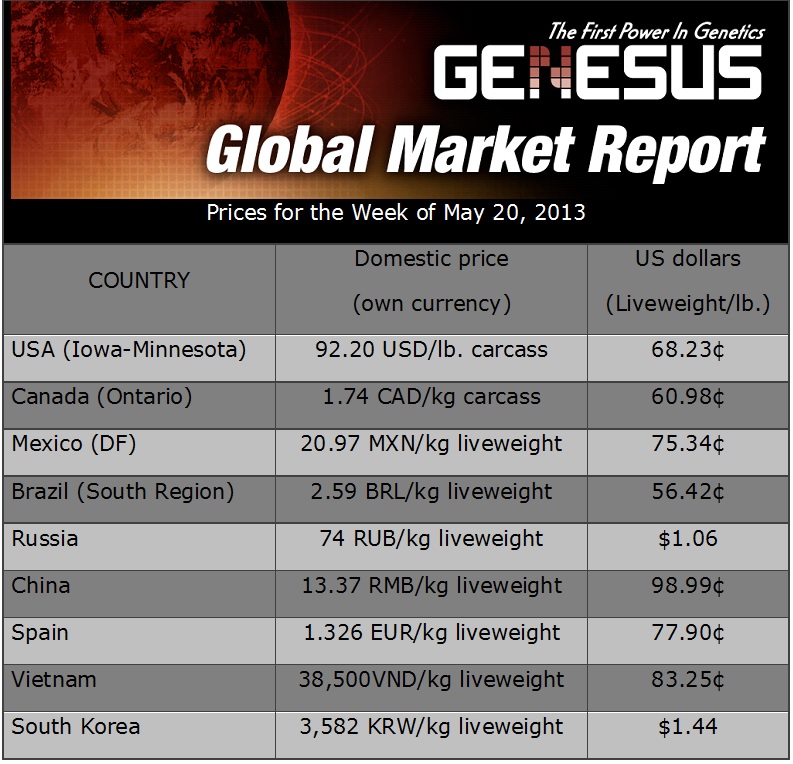

BRAZIL - The spot market price of hogs in Brazil has begun to increase. This movement began around the beginning of May and is nationwide. In the southern state of Rio Grande do Sul, the price has reached R$2.59 (US$1.25 per kg live weight), from R$2.29 exactly a month ago. This represents an increase of 13 per cent in one month.As always, it is hard to disentangle the relevant factors that have caused this increase. It certainly isn’t due to higher export volumes. According to ABIPECS, the association of pork exporting companies, exports in April were 25 per cent down year over year, with a gross volume of 35,618 metric tons, and this was accompanied by a fall of 20.86 per cent in value; ABIPECS comments that the average export price increased by 6.06 per cent in April.

In the first four months of 2013, Brazilian exports totaled 156,035 metric tons, a fall of nine per cent compared to 2012. Total exports for 2012 were 565,775 metric tons, the lowest volume since 2003. In 2005, Brazil exported 761,000 metric tons and has never again got close to this number.

Restrictions on exports to Ukraine are one of the reasons mentioned by ABIPECS for the poor performance in April. Brazilian producers are used to being told that a given market has closed, and in the next week it opens, a week later it closes again. The reasons given are varied, but generally boil down to protectionism.

Some producers are more skeptical. Brazil has been ruled by a Workers Party government ever since Lula was elected president in 2002, being reelected in 2006 and then managing to use his popularity to elect an unknown aide, Dilma Rousseff, as presidente in 2010. The massive support for the Workers Party has been bought with government handouts (that benefit about 40 per cent of the population) and votes bought from congressmen, a scandal that has led to more than 30 important political figures being condemned criminally by the Supreme Court.

Now the 2014 presidential elections are looming large, and the Workers Party is determined to stay in power, at any cost (forever, it seems). Cheap food on workers’ tables is a sure vote-catcher. And if exports are low, pork production is thrown on the domestic market, leading to low prices. These skeptical producers question how much effort Brazilian diplomats really make when negotiating trade restrictions on pork exports. It certainly suits the Workers Party long-term plans if these negotiations fail!

Corn and soy meal prices have increased slightly during the last month, but not as much as hog prices, so producers’ negative margins have fallen considerably. Some even claim that they are breaking even. In the world of pig production of recent years, this is indeed reason to rejoice.