Return to Swill Feeding Could Cost the Pig Industry 3300 Million

UK - Why is the pig industry so set against an end to the ban on swill feeding of pigs as a solution to cut food waste? Two main reasons: firstly, poorly processed swill is the likely cause of the Foot and Mouth Disease (FMD) outbreak in the the UK in 2001 and second, a new analysis puts the cost of a serious disease outbreak at 3300 million overall or 30 to 40 pence per kilo on the pig price. Jackie Linden reports.Over the last few months, there has been a lot of talk in the pig industry about the risk of a notifiable disease outbreak, according to a new analysis from the British Pig Executive (BPEX) in Pig Market Trends.

*

"Perhaps the most significant impact would arise from the loss of export markets."

Earlier in the year, Exercise Walnut simulated an outbreak of Classical Swine Fever (CSF), providing some useful lessons for government and for the industry. More recently, the Pig Idea campaign has been promoting feeding of treated food waste to pigs. Most pig farmers are opposed to this development because of the risk that it could lead to a disease outbreak; swill feeding was thought to be responsible for the major Foot and Mouth Disease (FMD) outbreak in 2001.

The impact of a notifiable disease outbreak on the industry would be dramatic. Of course, there would be a massive personal impact on those directly affected. There would also be major challenges for those caught up in the incident through movement bans or other restrictions put in place to control the spread of the disease. However, even producers not affected in these ways would be hit by the impact of disease on the market.

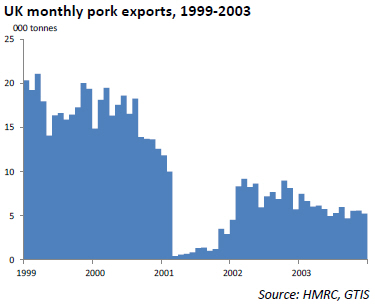

Perhaps the most significant impact would arise from the loss of export markets. In a major outbreak, this would likely be immediate and sustained. In 2001, pork exports fell virtually overnight from well over 10,000 tonnes per month to virtually nothing. They took almost a year to start to recover and much longer to reach anything like the levels recorded before the outbreak.

Last year, pig meat exports were worth about £310 million to the UK. This year, the figure is set to be closer to £350 million. This is equivalent to around a quarter of the total value of pigs slaughtered, which was a little over £1.2 billion last year.

In the event of a complete closure of export markets, some products would find alternative buyers in the UK, either in the consumer market or for other uses. In a few cases, this might replace imported products. However, most UK exports are cuts that have a limited market here, while imports comprise cuts for which demand exceeds supplies. Thus, the increase in products on the domestic market would add to the overall supply, bringing prices down for all pig meat. It is difficult to estimate the scale but a 10 per cent drop, which is at the lower end of the likely range, would mean a loss of £90 million from the market, on top of the value of lost exports.

The graph below shows the impact of the FMD outbreak in the UK in 2001 on pork exports, which slumped to almost zero and had nowhere near recovered more than three years later.

Those products for which no market could be found would have to be sent for rendering or disposed of in some other way. This would mean that they would achieve a fraction of the value that they would have been sold for on export markets. Estimates suggest that the loss of value from the products that could no longer be exported would be at least £200 million.

Lower prices might help to offset any consumer 'turn-off' from pig meat products. The extent of this would depend on the disease involved; it would likely be higher for a pig-specific disease than for a multi-species one like FMD, where consumers would have fewer alternatives meats. However, for an outbreak of a disease like CSF or African Swine Fever, lower consumer demand could add to losses.

Combining the losses above, suggests an impact on the industry of close to £300 million. If this was passed on to producers in full, it would be equivalent to a fall in the pig price of between 30p and 40p per kg. In reality, some of the loss would probably be absorbed elsewhere in the supply chain but pig prices would still fall sharply. The drop would probably be large enough to return most producers to a loss-making position and would certainly leave them particularly vulnerable to any increase in input costs.

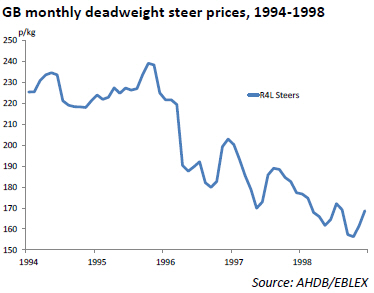

To illustrate the possible effect, the report adds that, during the BSE outbreak in 1996 (see graph below), when export markets were closed and consumer confidence hit, cattle prices immediately fell by 15 per cent and then continued to fall away in subsequent years. Prices did not reach pre-outbreak levels again until 2008.