Will Tulip Bloom in This Crisis?

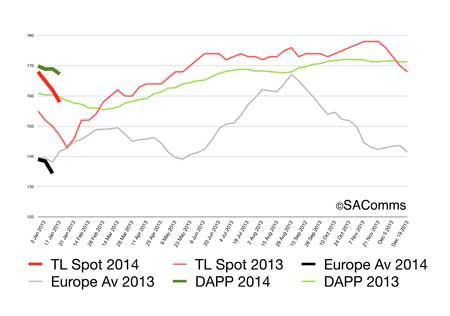

UK - The gap between the DAPP at 167.29p and spot base of 158p gets wider but late January is usually a difficult time for sellers, writes Peter Crichton in his "Traffic Lights" commentary for 23 January.

Cranswick told BPEX this week that it was pulling out of DAPP reporting.

This was disappointing because the BPEX board went the extra mile last week to keep the processors happy, including a promise to investigate bringing in Northern Ireland prices, which would have reduced the overall average.

Cranswick has pretended in conversations with various people that price reporting is anti-competitive, but its real motivation is simply to keep shareholders happy by paying less for its pigs.

It has pulled out of DAPP-reporting in the knowledge that others might well follow its lead, destroying the DAPP and allowing processors to invoke force majeure on DAPP-based contracts.

Producers will not easily forgive or forget this action at a time when they need to claw back three years of losses and to reinvest in the industry's tired infrastructure.

A lot depends on Tulip now. It pulled out of the DAPP before but then rejoined—not because it wanted to, but for the good of the industry.

If Tulip continues to report into the DAPP, most of the other processors will continue reporting also. This will give BPEX time to consider the future shape of the DAPP in an orderly manner.

Tulip ... we know you've got it in you.