CME: Beef Exports off to Slow Start, Concerns over PED

US - There is uncertainty in the cattle and swine markets, write Steven Meyer and Len Steiner - in the first case, over the rate of herd re-building and in the second, over the delay in reporting new cases of Porcine Epidemic Diarrhoea (PED).USDA recently announced that it will re-instate the July 1 cattle inventory update. There is a lot of uncertainty in the cattle market at this point as to the pace of herd rebuilding and resumption of this report is welcome news among industry and analysts as it should provide for more robust forecasting of cattle and calf supplies in 2015.

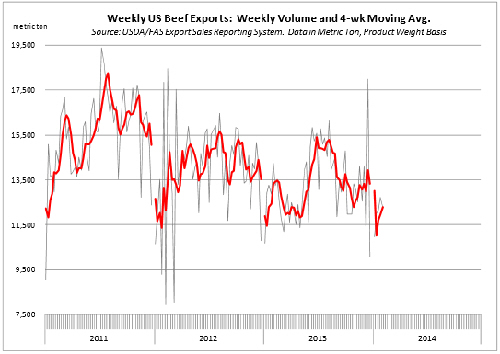

Weekly beef exports are off to a slow start this year, at least according to the USDA Export Sales Reporting system. For week ending February 6 exports of fresh/frozen beef were pegged at 11,890 metric tons (MT) and the four week average currently stands at 12,251MT, down nine per cent from the same period a year ago. A number of markets show pronounced weak ness. Shipments to Canada in the last four weeks average averaged 1,470MT, 37 per cent lower than a year ago. Shipments to Vietnam are now minimal compared to bout 1,688MT per week we were sending to this market in January 2013. Some of these lost sale s have been offset by gains in exports to Japan and Hong Kong.

Still, the trend in US beef exports has been drifting lower in recent months (see chart). We feel obliged to caution that weekly export data still presents significant discrepancies from the monthly official reports. For instance, the USDA monthly export data pegged US beef exports in December 17 per cent higher than the previous year. Implied monthly exports for December based on the weekly report were up only three per cent. Last year, USDA went back and revised some of their previously reported weekly numbers, which is fine in terms of maintaining a good data series. The major revisions, however, make it difficult to use the weekly report as a reliable tracker of US beef shipments.

As for pork sales, they continue to represent only a small fraction of overall US pork volumes almost a year after the system went into effect. We have no idea when the quality of the pork export data will improve.

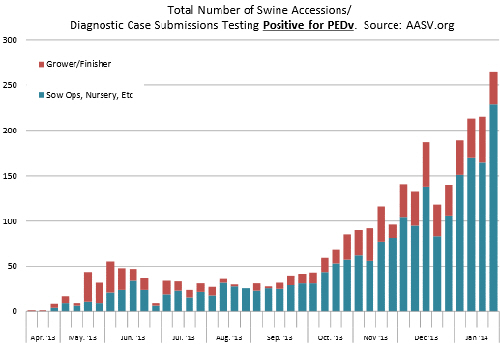

We were expecting an update from the National Animal Health Laboratory Network (NAHLN) about PED virus (PEDv) cases and an update may still come today. The delay highlights, in our view, something that has been missing with the outbreak of PEDv in the US.

Information regarding the spread of the disease has been slow in coming and not specific enough to allow market participants to have a good understanding of the potential scope of the economic impact. Almost a year after the first cases started showing up, we have yet to know exactly the true impact of the disease. The main issue is that PEDv is not a reportable disease.

We do not know all the legal ramifications of making a disease reportable but we would have thought that given the potential negative economic impact on producers, USDA and local governments would have figured out a way to implement a more aggressive system of monitoring the disease. Alberta is one place that has already declared PEDv a reportable disease. A number of countries have had to deal with PEDv in the past and their experience has shown that countries with the most success have been those that have taken early and aggressive steps in trying to eradicate it. The response of Korea versus China is a study in contrasts.

Experts suggests that the best way to control against PEDv is to implement proper biosecurity measures but the problem is that with no national standards, the issue becomes one of local understanding and implementation. A vaccine may possibly be on the way but, in the meantime, we continue to see the number of new cases expand.