Spain: Hog Markets

SPAIN - The EU pig meat market has been destabilised as the result of Russia's ban on pig exports from all 27 countries in the region, writes Fernando Ortiz, Genesus Ibero-America Business Development.The ban affects 24 per cent of the total exports of the EU, that is, about four per cent of total production, and the industry is on the edge of the abyss, riding a rollercoaster that has lost control.

Negotiations between Russia and the EU have not progressed and time has not dissipated doubts: increasing frozen stock in the EU while Russia’s stores are emptying. Depending on the degree of dependence on the Russian market and the resilience of each internal market hog prices in the EU are down or trying to stabilize on this particular roller coaster.

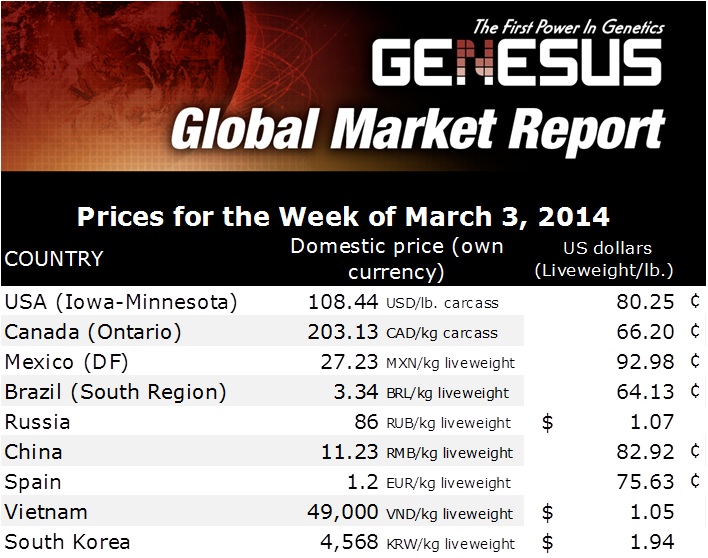

Market hogs: 1,200€ (+0,002)

Last week in Spain, the price recovered the 0,002€ that it was down seven days ago. It seems like nothing significant, you may think, but this up and down is indicative of the tensions running through the Spanish market. Firstly, the negative atypical European pork and beef situation, both immediately and in the short term and on the other hand, a balance between supply and demand that occurs typically in February, so the hog supply tends to be below than demand each week. The killing has gone down every week since the beginning of the Russian ban, around -2%, while the volume of supply has gone inconsistently up and down, probably depending on what the price was and the desire to maintain weight profitable. But even reducing the slaughter, the average weekly weight is also lower: carcass 425 grams and liveweight 825 grams.

So it is the demand that has to accommodate the available supply. It's what always happens in February, once the post- Christmas excesses are corrected; this is transferred to the price that increases at the same rate that production drops. That is why everybody in the Spanish hog industry is not happy now about any price: to the packing plant, because in view of how European meat and pork prices are with their European competitors , believes that declines should be deeper, at least as much as those reached by the German slaughterhouses, its main competitors in the meat market. But also to the pork producer, because of the non-stop market hog demand, they see that is selling more than planned based on their piglets acquisition; this market action pushes them to reduce weight with no beneficial on their final price. But also, everyone is aware that the distaste for the current price is a lesser evil compared with what may be ahead: Spanish slaughterhouses and producers are now getting slightly over their breakeven.

With bigger amounts of frozen pork being stored, the Europeans are thinking seriously about their future profitability of their business: if Russia opens, albeit only part of the EU or some specific slaughterhouses, pork will leave the EU. If Russia lifts the U.S. and Brazil’s ban in March (as already Russia has confirmed), both countries will leave gaps behind to cover a Russian demand that, at least initially, envisaged bulk by the vacuum of a month without imports EU (which is its main pork supplier).

The export availability of both countries is limited: in the American case because of PED. In the Brazilian case, because its growing domestic consumption is taking a lot of pork to get it exported; further this year with the World Soccer Cup. But what matters is that meat moves. This is a rollercoaster of global dimension.

Over all there is optimism for a great year in Spain in terms of prices.