Canada: Hog Markets

CANADA - What else can one say when market hog price is near double from the same week a year ago ($260.45 vs $142.32), writes Bob Fraser, Sales & Service at Genesus Ontario.Canada – WOW!

Plus this has all happened in a seeming heartbeat, with margin after feeder pig and feed going from $68.30 to $126.82 in a mere five weeks. Producers have had little time to adjust to the fact that they’re making money (let alone a lot of money) after ten years wandering in the wilderness.

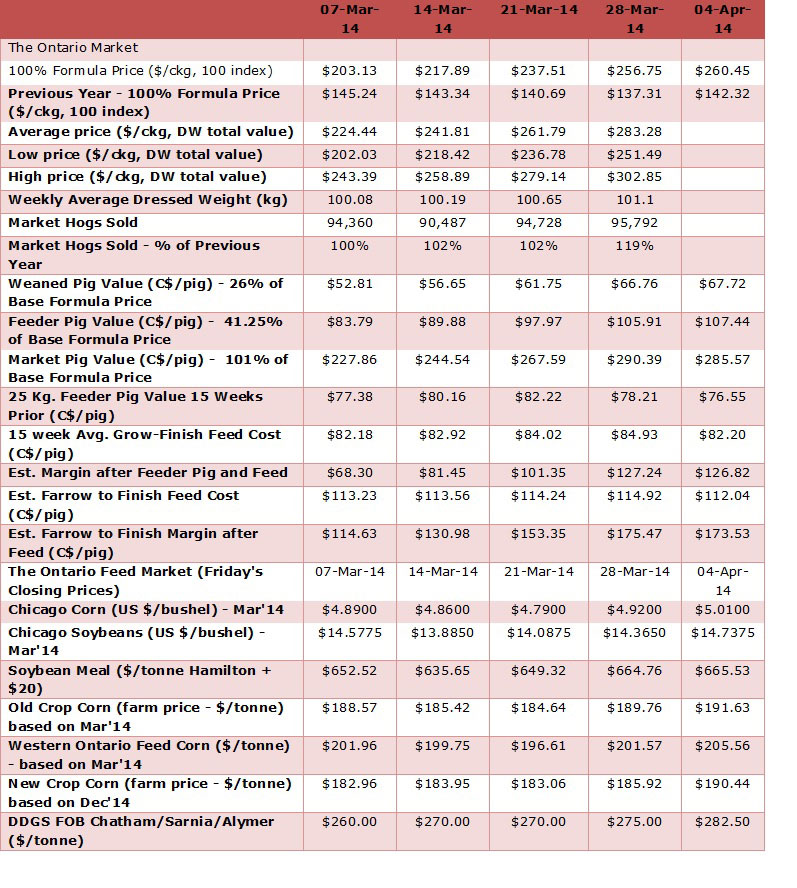

A look at the OMAFRA Weekly Hog Market Facts compiled by John Bancroft, Market Strategies Program Lead, Stratford OMAFRA [email protected]

Also Canadian producers can hardly be blamed for being nervous of their newfound fortunes. How many times has the proverbial “light at the end of the tunnel” proved to be a train! The list is long – ongoing COOL frustrations, swine flu, seven dollar plus corn, rapidly appreciating CDN dollar to name a few. So now the “perfect storm” of shortened supply (due to PEDv), smallest cattle herd in living memory, a vastly depreciated CDN dollar and the cheapest corn in North America can seem to be “all too good to be true”. So where may the storm clouds exist? For Ontario there are two.

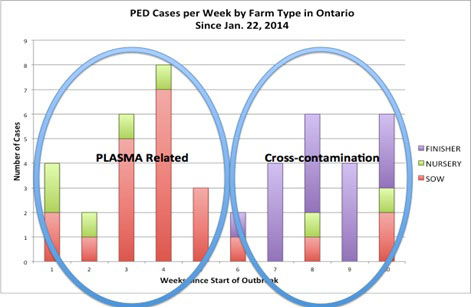

Ontario PED Update 5 April 2014

There are now 45 diagnosed cases of PED with an estimated 100 sites to be contaminated with planned pig movement. A listing of the diagnosed cases can be seen at www.ontario.ca/swine. There are 3 positive sites emptied, cleaned and have new pigs; testing to occur within a week but looking good so far.

As illustrated in the figure below, current information suggests that the first cluster of cases were primarily linked to contaminated plasma in sow and nursery barns but the second cluster of PED cases are primarily associated with finisher barns. The majority of these finisher barn cases are linked to market hog transport using dirty trucks. We encourage industry to focus on farm gate biosecurity and together we will work to limit the number of cases in the next few months and eliminate virus from positive sites during warmer weather.

Graph courtesy of Canadian Swine Health Intelligence Network

Quality Meat Packers

3 April 2014, ?To our customers: Quality Meat Packers Limited (“QMP”) and Toronto Abattoirs Limited (“TAL”) announce that in order to evaluate restructuring alternatives, they have sought creditor protection under the proposal provisions of the Bankruptcy and Insolvency Act ("BIA"). It is important to note that QMP and TAL are not bankrupt.

On Thursday, 3 April 2014, the Companies filed their respective notices of intention to make a proposal under the BIA which grant the Companies protection from their creditors for an initial period of 30 days. This will give the Companies the opportunity to evaluate and pursue restructuring alternatives. A. Farber & Partners Inc. has been appointed to act as proposal trustee through this process. They will fulfill roles such as monitoring our operations to ensure we are operating in compliance with the BIA and assisting us on identifying and evaluating the alternatives being considered for the business.

How these two will all play out is to early to tell. PEDV has come to Canada in four Provinces. However Manitoba, Quebec and P.E.I. have all reported only one case and none since. A larger issue in Ontario as outlined above. As to whether it’s contained is difficult to say although the disease’s spread seems to be slowing in the province.

As to the bombshell on Quality Meat Packers (representing about a third of Ontario’s kill) it is too hot of the press to predict its full implications. More next Canadian Commentary.

| Genesus Global Market Report Prices for the week of 31 March 2014 | ||

|---|---|---|

| Country | Domestic price (own currency) | US dollars (Liveweight a lb) |

| USA (Iowa-Minnesota) | 123.48 USD/lb carcass | 91.38¢ |

| Canada (Ontario) | 283.28 CAD/kg carcass | 94.06¢ |

| Mexico (DF) | 28.25 MXN/kg liveweight | 98.14¢ |

| Brazil (South Region) | 3.53 BRL/kg liveweight | 72.59¢ |

| Russia | 106 RUB/kg liveweight | $1.35 |

| China | 10.55 RMB/kg liveweight | 77.22¢ |

| Spain | 1.315 EUR/kg liveweight | 82.37¢ |

| Viet Nam | 50,000 VND/kg liveweight | $1.08 |

| South Korea | 4,511 KRW/kg liveweight | $1.98 |