China Hog Markets

CHINA - China: it is the pork powerhouse of the world with over 51 per cent of the world’s population of pigs raised within China, writes Ron Lane, Senior Consultant for Genesus China.Looking at the size of the breakdown of the inventory for August, 2014, the information from the Ministry of Agriculture (MOA) is indicating 432.04 million on farm inventory and a 45.03 million sow herd. The 432.04 million on farm inventory is up 0.6 per cent from last month and down 5.9 per cent from August, 2014.

The sow herd is down 0.80 per cent from last month and is down 10.0 per cent from one year ago. Again in August, another 360,000 sows were sold, culled and/or eliminated from the total national herd.

Along with the 550,000 sows in July, the 464,000 sows in June plus another 470,000 sows in May and with the 1.05 million sows from April, the past 5 months has seen more than 2.89 million sows eliminated.

The current sow inventory is the lowest level in 4 years. It is expected that there will be more sows lost in September. The 10.0 per cent loss in sow numbers is about 4.5 million sows-more than 75 per cent (three-quarters) of the total number of sows in the USA-number 2 in the world for sow numbers. Hog production capacity has significantly been adjusted with the main cause being the loss of farm households.

Despite the recent recovery of the market price for live pigs, several farm households are still in financial difficulty. MOA states that since the peak high of November 2013, the on farm inventory has dropped 5.8 per cent or about 26.7 million pigs … almost Canada’s total production for one year (Canada is around 8th/9th in the world for production).

Factors such as disease, cold weather and/or home consumption (mainly backyard farms) for Holidays, have all affected the total on farm inventory. Recently, the low prices have been sending sows to market as small farmers are lowering the sow herd size or are totally quitting the business.

The Consumer Price Index (CPI) continues to be quite interesting for the national government.

Previously, when the pork prices were gaining, this rapid increase in pork, gained the attention of the national government as it greatly affects the CPI. The CPI is made up of about 31.8 per cent food found in the consumers’ basket. Pork is estimated to be about one-third of the food portion of the basket or in other words, about 10 per cent of CPI as a whole. CPI increased to 102.00 Index points for August down from July by 0.3 per cent (July was 102.30 Index points). The price of pork for China fell 3.1 per cent, contributing to a decline in the August CPI. Currently, the pork prices are keeping the CPI lower, but a substantial increase, likely towards the end of this year, will cause national government concern.

As a measure, when pig prices increase, CPI should increase. National inflation target for 2014 is 3.5 per cent.

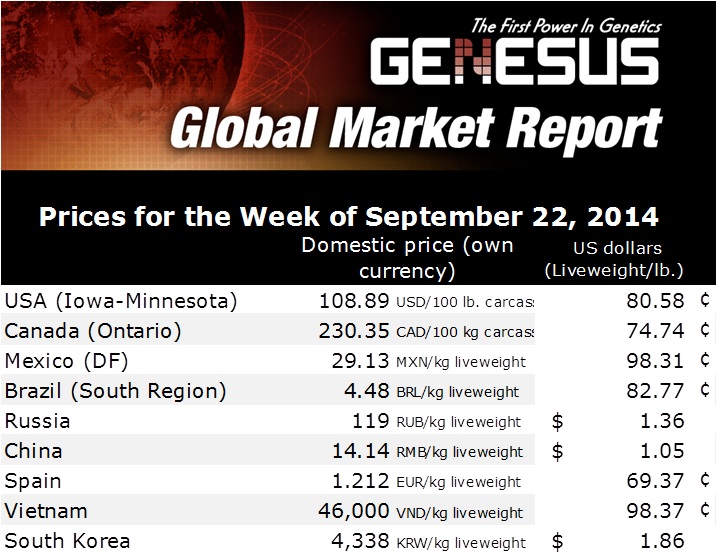

- At the end of the first week of September, the national average pig price was 14.51RMB/kg (US$2.36/kg; $1.07/lb.), which is a decrease of 0.68 per cent from the previous week. Since the beginning of July, the national market pig prices had continued to improve, up more than 16 per cent for the 7 week duration. According to the Ministry of Commerce, the wholesale price of fresh pork also rose from 19.32RMB/kg ($3.14/kg; $1.43/lb.) on July 4th to 21.01RMB/kg ($3.42/kg; $1.55/lb.) on September 5th, 2014.

- Ranking for pork production by country: China (50 per cent); USA (10 per cent); Germany (5.3 per cent); Spain (3.4 per cent); Brazil (3.1 per cent), Russia (2.0 per cent); Viet Nam (2.0 per cent) and Canada (1.7 per cent).

- A new benchmark for cost of production in China is about 1,300RMB/pig ($211.52/pig).

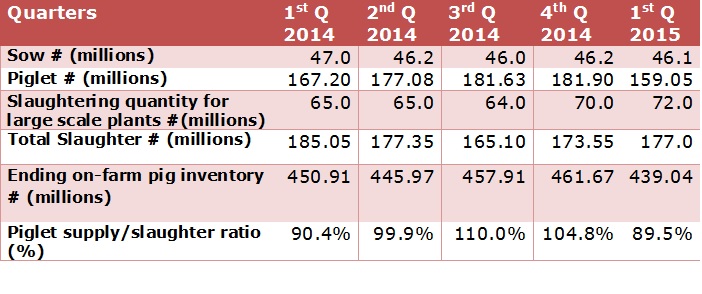

- The current decline in market pig production suggests that for a long period of time in the future, the country will be in a tight state of supply of market pigs, thus pork price must have an upward movement or that imports from other countries may increase. The annual average sow number for 2014 is estimated to be 46.35 million sows.

Swine Production and Marketing Projections for China

- The Mid-Autumn Festival failed to increase the demand for pork (usually pork demand around a national holiday improves). After pig and pork prices have risen for 7 weeks just prior to the holiday, the prices flattened again. The next holiday will start on October 1st-Golden Week. Many producers held onto the pigs hoping for an increase in prices, but instead more slaughter pigs came to market which caused the slaughter numbers to go up and the market price to drop this week.

- For 12 consecutive months, the sow numbers declined to the August level of 45.03 million head (a historical low). With the decline in the number of sows, then the supply of piglets will be a tight balance for the second half of 2014 (416.25 million piglets-a 7 per cent decrease compared to 2nd half of 2013. The full year expected piglet supply is 825.91 million head-down 3.5 per cent compared to the full year in 2013. The first half of 2015 is expected to continue to have a decline in piglet numbers.

- Projected slaughter numbers and weights for 2014; include a total of 720 million head of market pigs will be slaughtered giving a total of 55.39 million tonnes of pork with an average carcass weight of 76.9 kgs of carcass—this weight is up 0.3 per cent from last year. Of this pork: 68 per cent is consumed as hot, fresh meat: 17 per cent is consumed as chilled meat and 15 per cent is consumed as further processed products.

Projections for the first half year of 2015:

- Total sow inventory will gradually increase

- Total hog and pork output will decrease about 1 per cent during this time frame

- Total pig production costs will increase

- Pork supply shortage will be largest in the second quarter of 2015

- The pig marketing price will be positive during this time with about 10 per cent profit over expenses.

- The piglet supply will be lower during this time

- The pig marketing price will increase and so will the cost of production.

- There will be insufficient breeding gilt numbers to assist with the increasing and regular replacement of culled/dead sows. State funds are very difficult for swine farmers to obtain