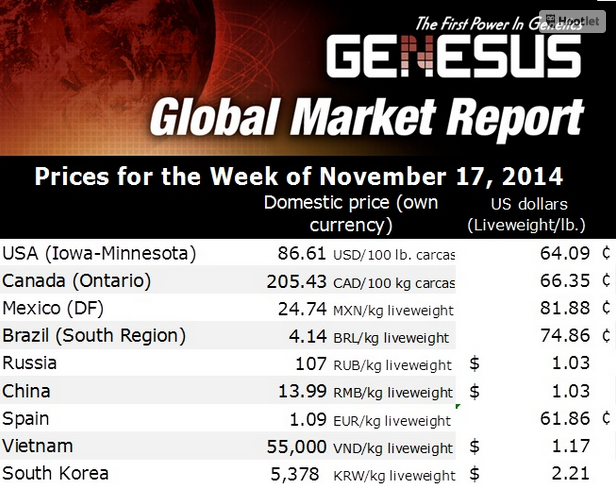

Mexico: Hog Markets

MEXICO - US pork meat imports still increasing and affecting the Mexican pork industry, write Carlos A. Peralta - President and R. Carlos Rodríguez Vice president of Genesus Mexico.November grain prices in Mexico as follows:

- Corn at $2,990 Mx/Ton ($215.11), 11 per cent below previous month.

- Sorghum $ 2,510 Mx/Ton ($180.58), 22.5 per cent below October

- Soybean meal $ 8,009 Mx/Ton ($576) same price than a month ago.

The liveweight price for Mexico City metropolitan area is $23.98 Mx/Kg ($1.73/Kg), 11.3 per cent below previous month. Mx-USD exchange rate was $13.90 Mx per $1.00.

Average production cost still between $ 18.00 Mx/Kg to $19.00 Mx/Kg, obtaining $ 5.48 Mx as profits per Kg or $630 Mx per 115 Kg slaughter pig ($45.32 /Kg) vs. $920 Mx per slaughter pig ($66.00) a month ago or $113.00 60 days ago (40 per cent profits compared with two months ago).

The slaughter price for Central, Northeastern and Central-Western Mexico is between $23.00 Mx/Kg to $25.33 Mx/Kg ($1.65 to $1.82); for the Northwest is $20.80 Mx/Kg ($1.50 Mx/Kg) and for the Yucatan Peninsula (Southeast), Puebla and Veracruz States is between $28.00 to $35.00 Mx/Kg ($2.01 to 2.52 /Kg).

The States of Jalisco (Central West), Sonora (Northwest) and Puebla (Central South) produce 19 per cent , 18 per cent and 11 per cent respectively (48 per cent ) of the total Mexican pork. The Mexican pork consumption is around 16.6 Kg per capita.

In October in México we had the Pig Producers Confederation (CPM) and the Country Pig Producers Organisation (OPORPA) Congresses.

Both of them were in beautiful tourism resorts, one in the Mayan Riviera and the other in Puerto Vallarta with excellent number of attendants who represented the total Mexican pig production industry.

Both organisations and the Federal Government keep promoting spots of information and motivation to increase the pig meat consumption in the country.

With this strategy could be an excellent opportunity to increase the national sow herd inventory and later on to promote the pork meat exports to different markets, focussing into the Asian market, due the volume and quality they are demanding.

The sow herd inventory is still growing in Mexico during 2014 and the market will start to feel the extra availability of pork meat during 2015. This situation has been a consequence of low costs of production (low prices of grain) and favourable market prices.

Mexico produces 1.3 million metric tonnes of pork meat per year. Due to growing on population and consumption the domestic pork production needs to be increased.

During 2013 the total pork meat imports represented almost 45 per cent of the Mexican pork meat consumption. Mexico imported 574,000 metric tonnes of pork meat. Throughout 2014, until now, hams represented almost 76 per cent of the total imports with 90 per cent coming from two countries, the USA (80 per cent ) and Canada (10 per cent ).

According with FAO and UN, a country to obtain the "Feed Security Reward" requires to produce at least 75 per cent of the total feed consumption. As we can see, the Mexican pig industry is far away to achieve this goal.

In an interview conducted by the Gazeta Porcícola of the Confederation of Mexican Pork Producers last September Claudio Freixes, Director General of Kekén mentions that without government stimulus, Mexican pork producers could be out of international competition.

The producers of pork in Mexico do not receive sufficient government support. He notes that in other countries, including USA, governments support this industry through incentives and subsidies in electricity prices, fuel and grain.

He also mentions that our northern neighbor, USA, annually sends 45 per cent of total Mexican pork consumption.

Mexican companies must be very large and very efficient to compete. If this changes, we will have in a few years only a small number of very large Mexican companies and a large volume being supplied by the United States.

He considers that much of the solution lies in promoting public policies that stimulate activity at preferential rates for commodities such electricity, fuel and support for the purchase of grain (including soybean).

As regards exports, he states that the task would be more efficiently executed starting from the countryside through support aggressive and effective promotion officials.

"What we have achieved as exporters of pork has been largely with our own resources". In addition to the above Mexico must be ready to compete with great exporting tradition countries like USA, Canada, Denmark, etc.