CME: Export Demand Very Important for US Hog Industry

US - As pork supplies in North America expand in 2015 and 2016 (larger breeding herd, waning effect of PEDv), export demand will become a very important concern for the industry, write Steve Meyer and Len Steiner.US pork production has increased steadily in the last two decades and the US market simply cannot absorb all the pork that we currently produce. In 1995, US pork production was about 17.8 billion pounds and exports were around 770 million, 4.3 per cent of the total.

In 2015, USDA estimates pork production to reach 23.9 billion pounds and 5.2 billion pounds, about 22 per cent , is forecast to go to export. We think that part of the reason for the sharp drop in hog futures since mid-November is the growing concern that weak export demand will force more pork in the domestic market and lower prices will be required for the domestic market to absorb the additional supply.

So why all the concern about export demand? After all, the reason why pork exports declined in 2014 were largely a supply issue as PEDv decimated hog numbers and forced prices to all time record highs. There are a few issues to consider. We think the Russian ban on North American and, more importantly EU pork, has created a significant imbalance in the global pork trade.

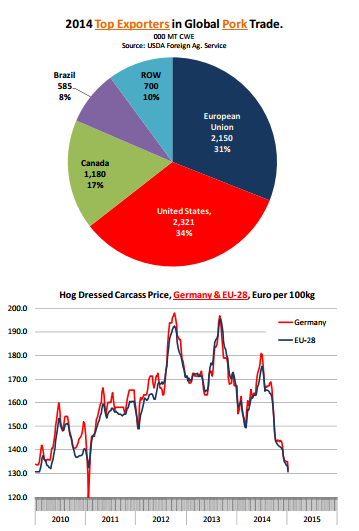

US, EU and Canada account for about 2/3 of world pork exports (based on USDA data). Russia, on the other hand, used to be the second largest pork importer after Japan, accounting for about 15 per cent of world imports. Following the ban, Russian pork consumption has declined sharply as Russian processors struggle to find adequate supplies. It is likely some pork is filtering through but Russian authorities have been much more forceful in preventing “gray trade” through neighboring Ukraine and Belarus.

The lack of Russian business has significantly impacted hog and pork prices in Europe, which currently are down about 16 per cent from a year ago and at the lowest point in the last five years (see chart). It does not help that the Euro markets are currently mired in a deflationary spiral and economic growth has stalled, further impacting consumer demand. And at a time when demand for EU pork has been relatively weak, producers have been ramping up production, largely as a response to the strong margins achieved in 2012 and 2013. Productivity gains have been the main contributor (more pigs per litter, heavier weights) but the breeding herd in key production areas also has been increasing. During the last three reported months (Aug-Oct), Germany production was up 5.3 per cent , Spain was up 5.1 per cent and Poland was up 16.9 per cent . Rising production at a time when your top export market has closed the door does not bode well for the pork producer in Europe.

The decline in EU hog and pork prices has come at a time when the value of the Euro has also declined. This has further added to the competitiveness of European pork in the global market. Consider this: In January 2013, the EU hog carcass price was about €170.0/100kg or US$102.8/ cwt. Today, the EU hog carcass price is about €130.6/100kg (-23 per cent from just two years ago). When converted in US$ terms, the price today is $69.5/cwt, down some 32 per cent from two years ago.

IA/MN price is $71/cwt. Given this context, it is welcome news that EU and Russian nego- tiators appear close to resuming pork trade. Per a press release of the European Livestock and Meat Trade Union, the meeting between EU Commission veterinary services and Russian counterparts was “very positive and should allow a resumption of the EU export of some products from the pork sector to Russia.“

This has always been a political issue and renewed fighting in Ukraine could derail such talks. For now, pork producers in Europe are struggling with weak prices and negative margins and pork producers in the US worry if we can still count on exports to take one out of four pounds of pork we produce.