China: Hog Markets

CHINA - China is the pork powerhouse of the world with over 51 per cent of the world’s population of pigs raised within China, writes Ron Lane, Business Director Asia Pacific for Genesus.Looking at the size of the breakdown of the inventory for December, 2014, the information from MOA is indicating 421.78 million on-farm pigs and a 42.91 million sow herd (November, 2014, there was 431.71 million on farm inventory and a 43.70 million sow herd). The 421.78 million on farm inventory is down 2.3 per cent from last month (a drop of almost 10 million on-farm pigs) and down 7.8 per cent from December, 2013.

The sow herd is down 1.80 per cent from last month and is down 13.2 per cent from one year ago (some analysts put it even higher). Again in December, another 787,000 sows were culled and/or eliminated from the total national herd. Along with the 531,000 for November, 583,000 for October, 225,000 sows in September, 360,000 sows in August, the 550,000 sows in July, the 464,000 sows in June plus another 470,000 sows in May and with the 1.05 million sows from April, the past 9 months has seen more than 5.02 million sows eliminated.

The current sow inventory is the lowest level in more than 4 years. It is expected that there will be more sows lost in the next few months as more signs of Foot and Mouth Disease in Henan, Hubei, Guangxi and other provinces along with poor market prices may make farmers sell off inventory. The 13.2 per cent loss in sow numbers is more than the total number of sows in the USA, which is number 2 in the world for sow numbers. Several farm households are deep in financial difficulty and rumours of bankruptcy of large farms are being touted by the industry. Factors such as disease, cold weather and/or home consumption (mainly backyard farms) for Holidays, have all affected the total on farm inventory.

- A total of seven provinces that cover a vast market pig area in China have reported some cases of Foot and Mouth Disease (FMD). Henan, Anhui, Jiangxi, Hubei, Hunan, Tianjin and Liaoning have had recent cases. FMD risk increases especially under winter weather conditions. Also, it is projected that several farms, in trying to reduce their vet costs, have been neglecting to vaccinate for FMD. Poor sanitation and/or poor bio-security conditions on the farm can increase the risk for FMD. At this time of the season - just prior to Spring Festival - these outbreaks should be causing the wholesale pork prices to increase but so far, the opposite has been happening — pork prices have been dropping. Does this mean there is an oversupply of market pigs and thus pork?

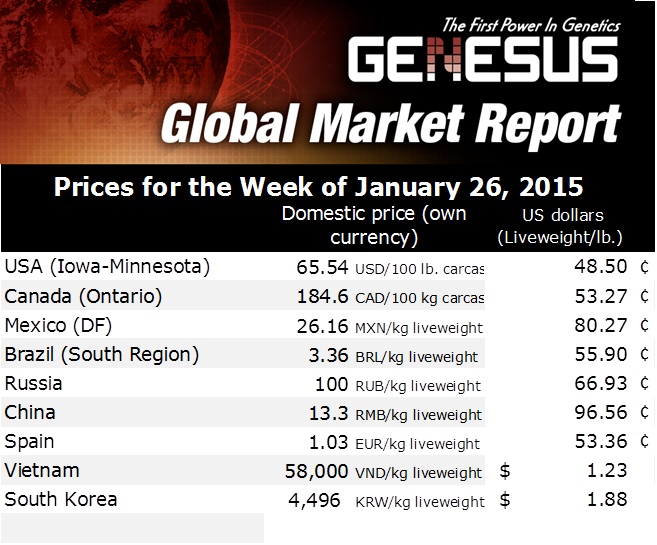

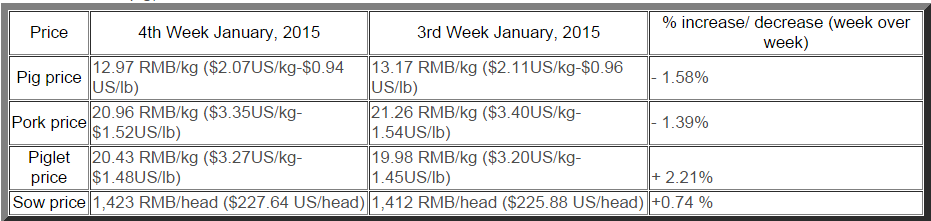

- Market pig prices and pork prices for the 4th week of January 2015 were down from the week before, whereas piglet prices and the sow prices were up from the week before. The current market prices for pigs and pork continued in a market downturn. Ministry of Agriculture (MOA) monitoring data shows that during the 3rd week and for large scale-pig slaughterhouses, the carcass price fell to RMB18.55 per kg (US$2.97 per kg; US$1.35 per lb), a continuous decline for 19 weeks since last September. The Commerce Department that monitors the national wholesale lean carcass price, again the price fell this week to RMB19.53per kg (US$3.12 per kg; US$1.42 per lb). Currently the major slaughterhouses are accelerating delivery which could continue to lower the price of pork and market pig prices. It is projected that better market prices will be expected beginning April, 2015. *In China, the declining sow herd will only be partly compensated by increasing sow productivity (assuming that most of the sows that have been culled and/or eliminated would have poor reproduction of up to 14 pigs per sow per year - from Rabobank).

- Market pig prices in December have been weak with falling instead of rising prices as should be the trend as the New Year approaches. According to the China Feed Industry Information Network Monitoring report, for December 2014, the nationwide market pig price was RMB13.86 per kg (US$2.22 per kg; US$1.01 per lb). The price fell 2.26 per cent from November and was down 12.94 per cent from last December.

- Piglet prices have been increasing lately. The chief cause is that farmers are optimistic that the slaughter pig prices in May-when these piglets start to go to slaughter-will be higher. Farmers sense that the second half of 2015 will show improved market prices.

- Pig to grain ratio last week was 5.53:1 (down from the week before by 0.03).This is still below the traditional break-even point of 6.00:1. Corn price is RMB2.34 per kg (US$0.374 per kg; US$0.170 per lb) - a slight drop from last week. Farrow to finish market pig prices showed a negative profit of RMB96 per market pig (US$15.36 per pig) — this is down by RMB15 (US$2.40) per market pig from the week before.

- With the sanctions against Russia, provinces such as Heilongjiang see that during 2015, it can look at increasing exports to that region. Heilongjiang has many inland ports of entry into Russia. Last year, Heilongjiang exported about 4,324 tons of pork into Russia (equivalent to 86,000 market pigs). This year, the province wants to look at exporting the equivalent of 1.5 million slaughtered market pigs.

- China imported more than 95 million metric tonnes of cereals including: soybeans, rice, corn, cassava and wheat for the 2014 year. This is an increase of 22 per cent from the same period as last year. As a major importer, China has a huge influence on global prices. However, this year, the main factor in buying offshore relates to the cheaper international prices versus the domestic market prices. Ren Zhengxiao, the Director of the State Administration for Grain (SAG) stated that the average prices for the three staple grains - corn, rice and wheat - remained RMB600 (US$96.77) per tonne higher than the prices available from various foreign sources. Due to general farming conditions and high input costs, China purchased about 70 million tonnes of soybeans and about 25 million tonnes of grains last year. The minimum domestic grain purchase price by the government has been above world grain prices for the past three years. This has prompted more imports of these products. Another concern reported by Ding Lixin, a researcher at China Academy of Agricultural Sciences in Beijing is that about one-fifth of China’s grain reserves either rots or is wasted because of poor grain storage at the national grain reserves. About 17 million tonnes per year is wasted. SAG spent RMB22.15 billion (US$3.57 billion) last year on grain storage and other related food security. This year, they plan to build 50 million metric tonnes of storage facilities.

- China’s grain production rose by 0.9 per cent (year on year) to 607.1 million tonnes for 2014. This is the 11th annual increase in a row.

- Burger King in China has introduced the new “double pork burger” (two grilled pork patties) Burger King has recently introduced this “king value” item at the Beijing outlets. Currently, beef is high and pork is low for market price. Since the general Chinese population source two-thirds of its entire meat from pork, this product may catch on there. Price is beneficial for fast food consumers with an all-beef burger costing about RMB22.5 (about US$3.60) whereas, the pork burger will cost about RMB10 (about US$1.57).