CME: Cattle and Hog Futures Closed on a Positive Note

US - Cattle and hog futures closed on a positive note on Friday but there is plenty of uncertainty about price direction in the short to medium term, write Steve Meyer and Len Steiner.It appears to us that one can make a more convincing bullish case for cattle rather than hogs, at least in the very near term. Hog supplies remain much larger than anticipated and when combined with heavy carcass weights and limited exports, this has created a glut of pork that domestic markets are having a tough time absorbing. Extreme winter weather across heavily populated areas of the Northeast has negatively impacted demand, particularly foodservice, further pressuring prices lower.

Hog slaughter last week was 2.222 million head, 6.1 per cent higher than a year ago. USDA pegged hog carcass weights at 216 pounds per carcass, in line with the data from the mandatory price report, and 1.4 per cent higher than the same week a year ago.

Total pork production for the week was 7.5 per cent higher than last year. Last year pork exports in February were 420 million pounds or roughly 105 million pounds per week. If this year pork exports are running about 10 per cent below year ago levels (as some speculate) this would imply a weekly export pull of about 95 million pounds. Last week production was 479.1 million pounds - thus total pork available in the domestic market was around 384.6 million pounds compared to 340.9 million pounds a year ago. This represents a 12.8 per cent increase in pork supplies in US market.

Given this kind of interest in domestic product availability and the short term weather effects in heavily populated areas, it is not that surprising that the pork cutout currently is running about 22 per cent below year ago levels. Participants in the hog market will continue to focus on the outcome of negotiations between unions and management at US West Coast Ports, which has contributed to some of the export slowdown. But the strong US$ and ongoing troubles in Europe also are negatives for US pork exports in the short term. Normally with plentiful pork supplies and limited forward supply risk, hog markets tend to be steady to lower well into March. Warmer weather, the start of baseball season (hot dogs) and backyard grilling bring about a much needed bump in demand. For now, pork markets appear to be well supplied and this is showing up in both product and futures prices.

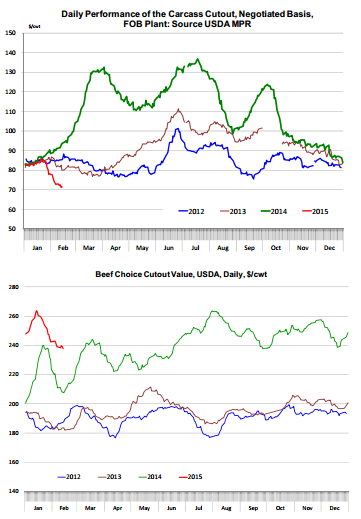

Beef prices have pulled back in the last three weeks but the decline has not been as sharp as it was last year. The choice beef cutout on Friday was quoted at $237.68, 12.7 per cent higher than a year ago. The select beef cutout at $233.95 was just 1.8 per cent higher than last year.

Cattle slaughter remains limited as feedlot supplies, which modestly higher than a year ago, remain quite low compared to earlier years. Feedlots placed some very expensive cattle on feed last fall and they are now holding out as long as they can to extract premiums for those cattle. We will review the upcoming cattle on feed report on Wednesday but our expectation is for on feed supplies as of February 1 to be at about the same level as a year ago. The cattle currently on feed appear to have spent more time in feedlots but keep in mind that last fall we saw a larger number of dairy calves placed and those calves require a longer time on feed to become market ready. So far packers have had little choice but to raise their bids in order to secure supplies.

This is a slow time of year in terms of sales and the slow pace of slaughter is evidence of that. The question remains what will happen with cattle prices once spring business starts to improve and packers will need to be out there once again chasing cattle. Exports are also an important consideration but not as critical as pork. Imports remain very strong, thanks in large part to a strong US dollar but also weak export markets for Australian and New Zealand beef. The current spread between US90CL boneless beef and imported 90CL boneless beef is as large as 60 cents a pound, an unheard of spread and indicative of both product availability in overseas markets and weak short term foodservice demand.