CME: Hog Futures Rallied on Friday

US - Hog futures rallied yesterday despite ongoing weakness in cash markets. The IA/MN lean hog carcass price (base price before discounts and premiums) was quoted last night at $57.66/cwt, down 75 cents compared to the previous day and down 24 per cent since the start of the year, write Steve Meyer and Len Steiner.There is plenty of uncertainty and speculation as to what is driving the sharp decline in hog markets and, depending on how you answer that question, there are a number of different views as what to expect in the next three to four months.

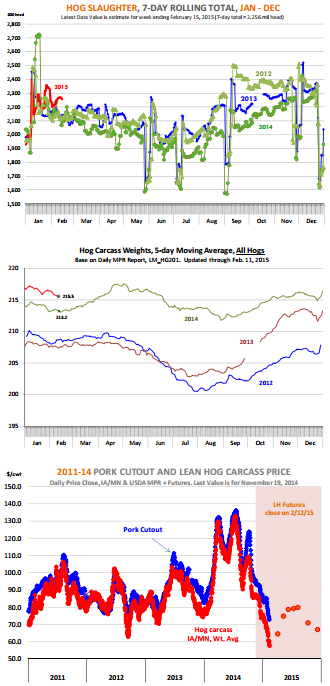

It is possible that producers have become more aggressive in marketing hogs in an effort to become more current, especially with spring demand six to eight weeks away. Hog carcass weights have been drifting lower but the rate of decline has for the most part been in line with the seasonal tendency this time of year. Producer hog weights have declined faster while packer owned weights remain near all time record highs.

Our five day moving average of hog carcass weights (based on MPR data) shows the dressed weight of producer owned hogs was on average 214.2 pounds, still about 0.7 per cent higher than a year ago but down about 2.2 pounds (-1 per cent ) compared to earlier in the year. Weights of packer owned hogs, however, are hovering around 219.5 pounds per carcass, 1.5 per cent higher than a year ago. Carcass weights for all hogs are still 215.5 pounds, 1.1 per cent higher than a year ago.

The higher carcass weights and sharp increase in hog slaughter certainly has created a short term glut in the pork market, especially given the slow pace of exports.

Daily hog slaughter so far this week has averaged 425 hogs per day compared to 392 hogs per day a year ago. For the week we estimate slaughter at around 2.25 million head, 7.5 per cent higher than last year.

Hog slaughter has been over 2.2 million head for each of the last five weeks and in the last four weeks it has averaged 5.5 per cent higher than the same period last year. With 5.5 per cent more hogs coming to market and hog carcasses about 1.5 per cent higher as well, we have seen a weekly increase in production that exceeds seven per cent.

For the latest week the production increase could be nine per cent over last year. This is a substantial increase in output for a time of year when demand tends to be somewhat soft. Add to this the effect of cold weather across heavily populated areas and one starts to grasp the short term supply impact.

At this point futures have built a modest premium for summer contracts but prices are expected to remain substantially below both year ago and 2013 levels. The recent break in hog prices resembles a bit the sharp decline we saw in the fall of 2012, when producers fell behind in marketings and accelerated sales ahead of the seasonal down in Q4. What is unusual for the current market is that hog prices are down at a time when normally prices tend to move higher.

Those that hold a more bearish view of the market have speculated that the USDA Hogs and Pigs survey likely missed the true size of the pig crop in previous quarters. Since December 1, hog slaughter has been up 0.9 per cent from a year ago so we are not terribly far from the USDA numbers. Wholesale pork prices continue to trade very weak, largely due to lower belly and ham prices. But, keep in mind those spring bacon features and the fact that we will have Easter again this year.