CME: US Hog Slaughter Capacity to get Another Bump

US - US hog slaughter capacity will get another bump when a former cattle plant in North Carolina is converted to handle sows, writes Steve Meyer and Len Steiner.Government agencies in Cumberland and Sampson Counties in North Carolina announced last week that they had approved plans to connect the former Martin’s Abbattoir and Wholesale Meats plant to municipal sewer systems.

Kansas City Sausage Company will be the plant’s new operator and plans to process roughly 1000 sows per day in the facility when remodeling is complete. Kansas City Sausage is a major supplier of private label sausage products and operates the Pine Ridge Farms hog slaughter plant in Des Moines, IA. That plant, with a capacity of 3200 head per day, is a major processor of both cull sows and boars as well as some butcher hogs. Pine Ridge has also provided toll packing services for a number of value-added pork production systems such as Neiman Ranch.

The company formed a 50-50 joint venture with Smithfield Foods in 2013 that marked Smithfield’s entry into breakfast and dinner sausage spaces in which it had not historically competed. Smithfield obviously planned to utilize the sow slaughter and sausage processing expertise of Pine Ridge and KC Sausage to accomplish that goal. But Smithfield also has a large hog production base in North Carolina and one of the outputs of those farms is cull sows.

The closest large sow slaughter facility to those North Carolina farms was the Jimmy Dean/Hillshire/Tyson plant in Newburn, TN.

There are a number of smaller sow processors in Virginia, Tennessee and Kentucky. Selling cull sows to other processors has always ran counter to Smithfield’s historic vertical integration approach to the hog and pork business. But the company had little expertise in that business and the sow slaughter sector had excess capacity. The Smithfield-KC Sausage merger solved the first of those issues but the second one remains.

US sow slaughter plants could process over 100,000 head per week if they all worked 5-day weeks. Total US sow slaughter has not exceeded 80,000 head in any week since 1995 and last week above 70,000 was in 2008. But this is about location, location, location! The plant in North Carolina will be well positioned to utilize Smithfield’s cull sows and buy cull sows from the other large operations on the East Coast. Add KC Sausage’s expertise and Smithfield’s brand name and it is easy to see why this move is being made.

The primary attention to tomorrow’s World Agricultural Supply and Demand Estimates (WASDE) report from USDA will be focused on world production and ending stocks figures

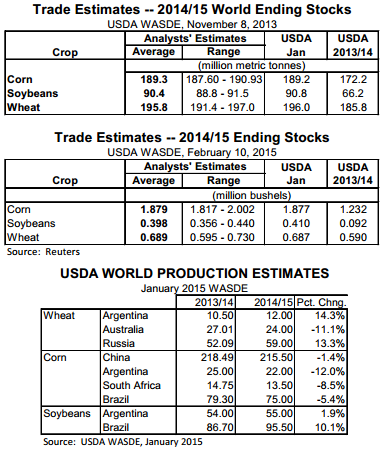

According to Reuters’ pre-report survey of analysts, the market will be expecting only small changes in the ending stocks figures.

Analysts expect slight downward revisions for world soybean and wheat stocks and a small upward adjustment for corn. Expectations for al three items remain significantly higher than the final 2013/14 USDA estimates. That is especially true for soybeans whose year-end stocks are expected to be 37 per cent larger this year.

Estimates for US ending stocks are expected to be changed only slightly as well. The 2014 crop estimates are, of course, final at this point and the only changes the we will see from here forward for the 2014/15 crop year will be on the usage side.

Analysts do expect soybean carry-out stocks to be revised downward by 12 million bushels or about three per cent. Though the survey did not pinpoint where that change would come from, we suspect that it would be due to an increase in exports.

Perhaps the key numbers in tomorrow’s report, however will be those for production of the three primary crops in other exporting countries. The Reuters survey did not ask for analysts’ predictions on these numbers but we provide them here so you will have a ready reference to put tomorrow’s figures in context.

In its January WASDE, USDA expected healthy increases in the wheat crops in Argentina and, more importantly, Russia and a significant increase in Brazilian soybean output to a record 95.5 million metric tons. There have been several published estimates that would put that crop down slightly from that figure but still record large.

USDA was much less optimistic about corn output in the countries that, along with the US, have historically — albeit periodically in the case of China — been corn exporters. Significant deviations between tomorrow’s report and the numbers in the middle column of the table below would be noteworthy indeed.