December Repeats Broken Record for Pork Expenditures

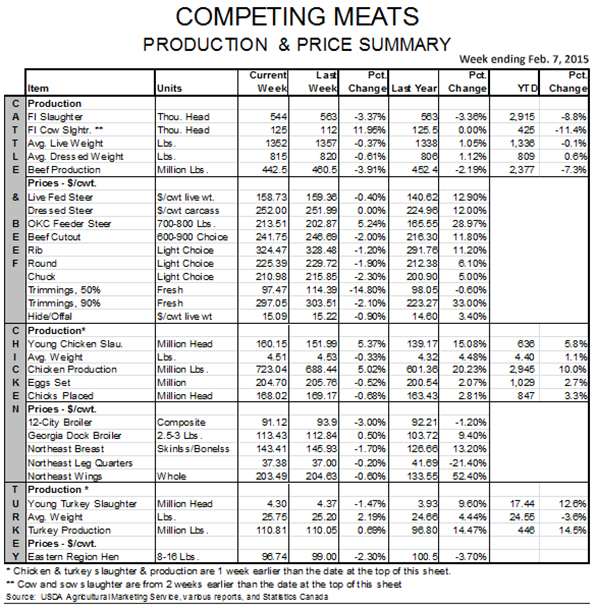

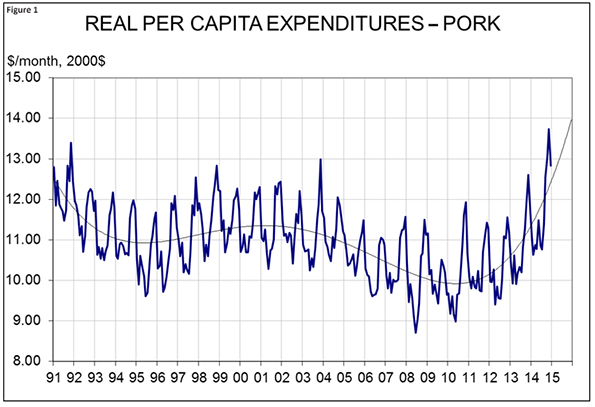

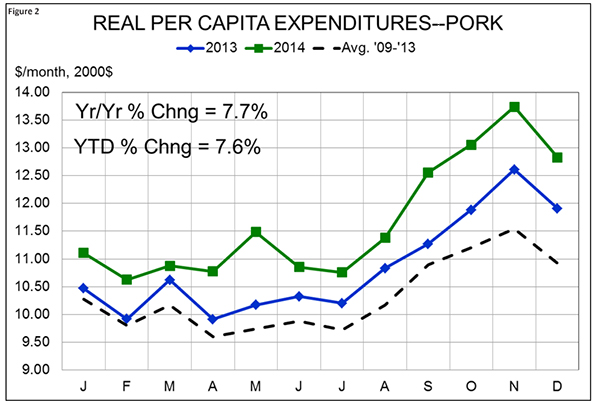

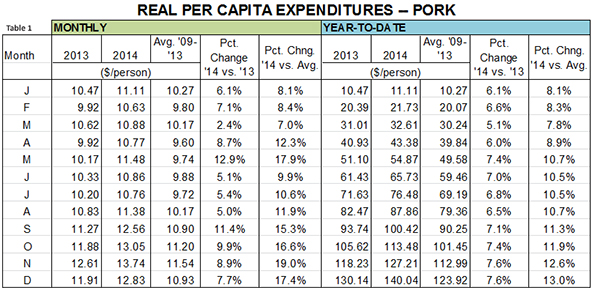

US - It has become a broken record (does anyone know what that means anymore?), but December was yet another great month for real per-capita expenditures for pork, writes Steve Meyer for the National Hog Farmer.The month’s $12.83 (year-2000 dollars) was the highest December figure since 1990 when pork RPCE tied the $14.08 record high set just one month earlier. That is the highest level ever in our data set that goes back to 1988. See Figures 1 through 3 and Table 1. It is possible that pork RPCE was higher than that figure at some point in the past, but we have no data with which to make any estimates of RPCEs prior to 1988.

The December figure was, as expected, lower than that of November ($11.54) but was 7.7 per cent higher than one year ago and 17.4 per cent higher than the average for December from 2009 through 2013. As always, these figures include purchases at retail and foodservice establishments, with all pounds priced at the deflated average retail price published by the U.S. Department of Agriculture.

Some highlights of the November data and RPCE are:

- November is usually the seasonal high for RPCE so the decrease for December was not a surprise. The average November-to-December decline over the past five years has been $0.61 or 5.3 per cent . This year’s decline of $0.70 was a bit more than that average but not near large enough to raise any red flags.

- December’s RPCE brings the year-to-date total to $140.04 in year-2000 dollars, 7.6 per cent higher than last year’s $130.14 and 13 per cent higher than the five-year average of $123.92.

- Again in December, per capita pork consumption per day contributed significantly to the growth in RPCE, gaining 2.3 per cent from last December due to lower exports and higher production. The impact of porcine epidemic diarrhea virus on slaughter levels continued to decline in December. More increases in domestic availability and consumption are expected in 2015, so keeping retail prices up enough to maintain or grow RPCE will be a challenge.

- Retail price was still the largest factor in the higher RPCE level. The average retail price declined once again in December, but $3.991 per pound was still 6.1 per cent higher than last year. After allowing for inflation, the real retail price was 5.3 per cent higher than in 2013. US consumers’ willingness to pay more for pork remains outstanding.

- Real per-capita disposable incomes of US consumers rose three per cent , year-over-year, in December. That is the largest year-on-year growth rate in a normal month (i.e. one not impacted by changes in social security tax rates) since February 2011 and the second largest such increase since before the Great Recession. December’s growth brings the year-to-date change in real per capita disposable income to 1.7 per cent , a far cry better than 2013’s -1 per cent . Add in the sharp decline in gasoline prices and US consumers’ “discretionary income” is growing – a factor that should be positive for pork demand in 2015.

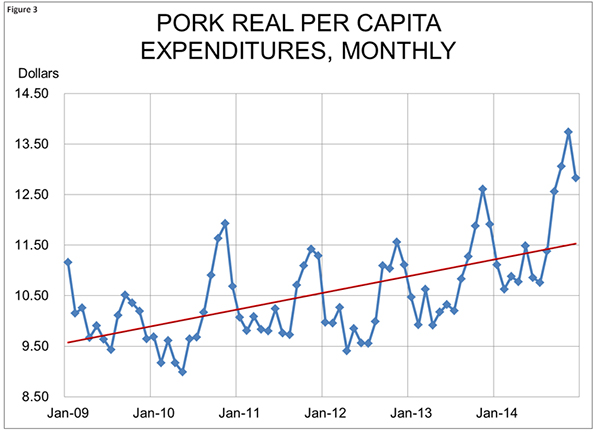

Beef demand had another strong month in December even though the year-on-year gain was slightly below that of November. Beef RPCE of $22.87 exceeded last year’s level by 12.8 per cent, the fifth straight month of double-digit year-on-year gains. December’s performance brings the 2014 total for beef to $270.17 (year-2000 dollars), 7 per cent higher than one year ago and 11.1 per cent higher than the average from 2009 through 2013.

The change driver for beef remained retail price which set yet another record. The deflated (real) average price of Choice beef in December was 16.8 per cent higher than one year ago, marking eight straight months in which the average real price of beef has grown by 9.5 per cent or more from the previous year.

Per capita beef consumption was 3.5 per cent lower versus December 2013. The decline was driven by continued reductions in slaughter – a situation that we think will persist for most of 2015. December placements of cattle into feedlots were eight per cent lower one year ago. That was lower than was expected, but continued slow marketing still left feedlot inventories higher (1.4 per cent ) than last year for the second straight month. The number of cattle that have been on feed 120 days or more is still high, so we expect some increases in slaughter and production yet this winter before seasonal declines this summer.

Chicken RPCE exceeded its year-ago level for the second straight month and only the second time since April. December’s $11.06 is 3.2 per cent higher than last year and 11.8 per cent higher than the five-year average. The December number brought the year-to-date total to $126.57, $0.02 higher than in 2013. Unlike the “red” meats, price remains the challenge for chicken with December’s deflated retail price being just 0.6 per cent higher than last year. Per-capita consumption was up 2.6 per cent for the month as chicken production continued to grow relative to one year ago.

Driven by the strength of pork and beef demand, the RPCE for the four major species continues to gain handsomely on year-ago levels. December’s total of $49.98 (year-2000 dollars) was down $3.27 from November’s level but up 8.2 per cent from one year ago. That total is also 14.7 per cent higher than the average over the past five years. The 2014 RPCE for the four major species finished at $555.68, (year-2000 dollars), 4.9 per cent higher than one year ago and 9.1 per cent higher than the 2009-13 average.

.jpg)