CME: Canadian Pork Industry Finds Some Stability

CANADA and US - Statistics Canada has published the results of its semiannual surveys of the Canadian hog and cattle industry and the data showed a couple of diverging trends, write Steve Meyer and Len Steiner.Below is a brief summary of the highlights and implications for North American beef and pork output in the next couple of years:

1. Beef/Cattle: The cattle inventory in Canada as of January 1 was estimated at 11.915 million head, 2.5 per cent lower than the previous year. This is the smallest cattle inventory in Canada since 1993.

The decline in inventory was larger than some expected but not entirely a surprise. Sharply higher beef prices in North America coupled with a very strong US dollar have significantly distorted relative prices in the US and Canada.

High beef prices in the US have limited US beef exports to Canada and as a result Canadian consumers have had to rely more on domestic production to fill needs. It appears, however, that this was accomplished at the expense of future production.

High US beef prices and a strong US dollar also pulled more Canadian cattle into US feedlots, limiting the number of heifers that were retained for beef cow herd rebuilding.

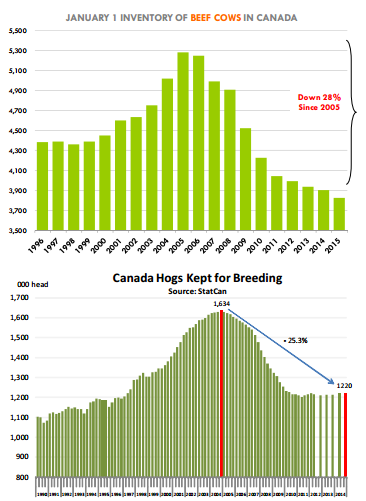

Beef cow inventories, the capital base for the beef industry, declined 2.1 per cent from the previous year and they are now 27 per cent lower than the peak established in 2005.

Heifers held back for beef cow herd rebuilding were 531,100 head, 1.5 per cent lower than a year ago. The ratio of replacement beef heifers had been increasing modestly in past years and it is still larger than a few years ago.

However, at this point the depletion rate of the beef cow herd has outpaced replacements, leading to a net reduction in beef cow numbers. As a result, we should expect further reductions in the Canadian calf crop for 2015 and 2016.

Ultimately, this means that beef production in North America will remain limited and, over- time, a further erosion in the beef production capacity of the continent relative to other areas, particularly South America.

The 2014 calf crop was reported at 4.598 million head, 1.8 per cent larger than a year ago. The calf crop looks suspiciously large considering the steady decline in beef and dairy cow inventories. The ratio of the calf crop to the cow inventory has averaged a little under 92 per cent during 2010-2013 period.

Last year, however, the ratio jumped to almost 95 per cent . Very strong feeder cattle prices certainly provided strong incentives to better manage the herd and increase the calving ratio. Improved feed conditions also may have supported a much higher than normal calving ratio. However, the recent declines in the beef cow inventories imply that even with above average calving ratios, the calf crop will likely decline in 2015.

2. Pork/Hogs: Different from the cattle industry, which continues to shrink, it appears that the Canadian pork industry has found some stability, even as overall production capacity is much smaller than it once was.

The total inventory of hogs and pigs as of January 1 was 13.165 million head, 1.7 per cent larger than a year ago. The breeding herd has been slowly increasing, gaining another 0.5 per cent this year compared to the year before. Still, breeding stock inventories remain about 25 per cent smaller than what they once were.

Higher inventories in the US and Canada imply a notable improvement in North American pork supplies in the short to medium term and a significant correction in pork prices in 2015 and 2016.

The Canadian data does show that the industry there was also hit by the PEDv virus last year but appears to have recovered and it is now back to where it was prior to the outbreak of the disease.

The number of pigs saved per litter during the first half of 2014 dropped to 9.86, a 4.2 per cent drop the prior year. However, the number of pigs saved per litter in the second half of 2014 was 10.31, just 0.5 per cent lower than a year ago and slightly below the 10 year trend.

A larger breeding stock and trend pigs per litter numbers imply a quick recovery in the Canadian pig crop and larger feeder pig exports to the US market in 2015.