CME: Dramatic Decline in January 2015 Meat Shipments

US - Export data for January showed a dramatic decline in shipments of all main proteins and helps put some context behind the significant decline in prices for a number of products, especially pork and chicken dark meat, write Steve Meyer and Len Steiner.On page 3 we have included three charts that detail export performance of key markets. Below is a brief recap by species:

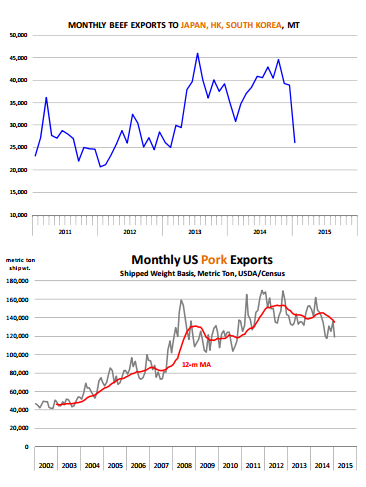

Beef: Exports of fresh/frozen and cooked beef and veal in January (on a shipped weight basis) were 54,298 MT, 13,530 MT (-20 per cent ) lower than the previous year. Beef shipments were lower across the board but weak Asia sales were the primary contributor.

Exports to Japan, Hong Kong and South Korea declined a combined 8,932 MT, accounting for about 2/3 of the lower January beef exports. It is not entirely unusual for beef exports to Asia to decline in January on lower seasonal demand. The most recent drop, however, is much larger than what we normally experience. We think in part the lower exports were due to the work disruptions in West Coast ports but also the effect of a strong US dollar and changes in product flows in some key markets, particularly Hong Kong.

Beef exports from Brazil and Australia to Hong Kong also appear to have slowed down. The effect of the strong US dollar can be seen in US beef exports to North American partners. January shipments to the second largest market for US beef were 10,278 MT, 10 per cent lower than a year ago.

Exports to Canada were 9,029 MT, down 23 per cent from already very low levels last year and 42 per cent lower than in January 2013.

Exports to the Mexican and Canadian markets were not affected by the West Coast situation, the lower shipments there reflect the double impact of record beef prices and a very strong US dollar.

And with less beef coming from the US, producers in Canada and Mexico have continued to liquidate their herds in an effort to supply the domestic market there. Imports of feeder and slaughter cattle also have increased.

So while the US beef cattle herd increased modestly last year, some of those increases have been offset by lower numbers in Mexico and Canada. The net effect is that North American beef supplies remain limited and this will continue to underpin beef prices for the next few years.

Pork: Lower shipments to Asia also impacted the pork market in January. Total exports of fresh/frozen/cooked pork were 119,458 MT, down 29,856 MT (-20 per cent ) compared to January 2014. Almost half of this decline was due to a sharp drop in exports to China/Hong Kong.

Exports to the China Mainland were a mere 1,546 MT, 90 per cent lower than a year ago while exports to Hong Kong at 3,204 MT were also down 31 per cent .

Mexico remains the top market for US pork and exports there in January were 46,187 MT, about the same as last year.

Japan, which for a long time was the top pork export market, bought 26,493 MT of pork, 25 per cent less than the same period last year. It is clear that the disruptions in West Coast ports negatively impacted US pork shipments in January. However, that was only one factor driving the decline.

The US strong US dollar as well as lower pork prices in competing markets also have been a significant factor. Market participants in places like Australia, which buy a fair amount of US pork, have indicated that they now find EU pork prices to be very competitive with US product. Pork imports in January were 40,131 MT, 33 per cent larger than a year ago, mostly due to an increase in imports of Canadian pork.

Net pork trade flows in January were –45,000 MT, supply that had to be absorbed in the domestic market. US pork exports have increased significantly in the last twenty years and now account for about 20 per cent of overall US pork production.

In the last three years, however, pork export have been trending lower due to the effect of high feed costs, the spread of PEDv and a stronger US$ .

US pork supplies are expected to expand in the next 12-18 months and we expect pork shipments to recover some of the ground lost in the last three years. But it is likely that lower prices will be required to offset the currency effect and restore competitiveness.