CME: Hog Supply Up in 2015 Post-PEDv

US - Markets are concerned about oversupply of hogs, a marked contrast with last year when outbreaks of PEDv caused concern over product shortages and price rises, write Steve Meyer and Len Steiner.Last year, futures rallied sharply into the spring on concerns (which turned out to be correct) that the spread of PEDv in the USDA hog breeding herd would lead to significant product shortages and dramatic price increases over the summer and early autumn.

Today, the primary concern of the market is an oversupply of hogs at a time when export markets are hamstrung by a strong dollar.

There is also mounting worry that if supply growth exceeds current estimates, we could run into slaughter capacity issues for a few weeks this autumn.

The upcoming USDA Hogs and Pigs report should help provide some indication as to the hog supply on the ground. It will also provide market participants with a chance to update some of their estimates for production levels in the fall and winter months.

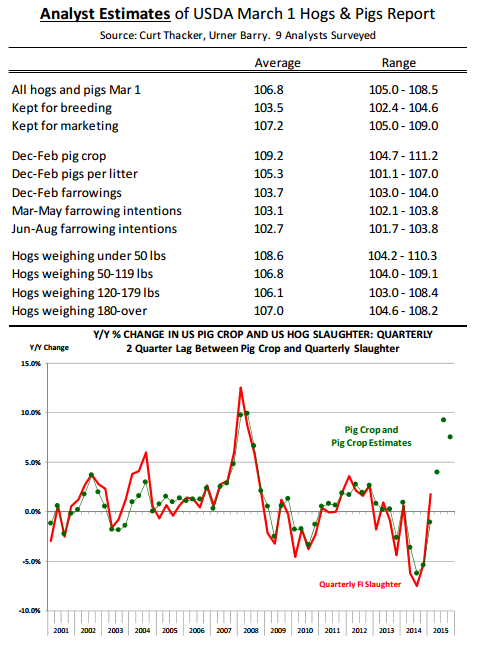

The table provides a summary of analyst estimates prior to the USDA report on Friday, March 27.

On average analysts expect the total inventory of hogs and pigs as of 1 March to be 6.8 per cent higher than a year ago. Hog slaughter has been running at an average 7.3 per cent per week since the beginning of February.

In the first three weeks of March, weekly hog slaughter has averaged 9.0 per cent above year ago levels. In that context a hog inventory as of 1 March up 6.8 per cent from a year ago makes sense.

Based on current performance, USDA will likely go back and revise both the Jun - Aug pig crop numbers and possibly the Sep - Nov pig crop.

There is a reason why the pig crop and hog slaughter quarterly numbers match so well (see chart). USDA uses the slaughter numbers to true up the quarterly pig crop estimates.

Looking at the first green dot in the estimates section, the pig crop for the Sep - Nov period, which corresponds to the Mar - May quarter, was up 4 per cent from the previous year. Slaughter is running well ahead of that number.

Limited impact from PEDv likely increased the number of pigs saved per litter, resulting in a bigger than expected pig crop.

It is always tough to make estimates coming out of a disease situation. At this point, it appears that the assumptions made about the rate of recovery missed the mark and now we have quite a few more hogs on the ground.

There are two key factors that will drive the hog inventory number for the 1 March report and, depending on what they show, they will also influence the estimates for the pig crop in the next two quarters.

First, analyst expect farrowings for Dec - Feb to be 3.7 per cent higher than a year ago. If analysts are correct, this would imply a ratio of farrowings during the quarter to the breeding herd stock of 48 per cent.

This is about the same ratio as what we have seen in the past two years but in the prior five years the ratio has averaged about 48.8 per cent. If anything, analysts are being somewhat conservative in terms of their farrowing number.

The second item to play close attention is the number of pigs saved per litter. USDA will derive this number from the pig crop but it is important because it will tell us not just the number of hogs coming from the Dec-Feb quarter, but also how quickly industry is returning to the pre-PEDv trend and thus drive the pig crop estimate for the next two quarters.

Analysts expect the pig crop for Dec-Feb to be up 5.3 per cent from a year ago. The number, in our view, still has some PEDv impact built into it but it is not as large as previously feared.

Finally, pay close attention to the breeding herd. Analysts expect the breeding herd to be up 3.5 per cent and yet they have Mar - May farrowings up 3.1 per cent.

If they are right about the breeding herd, then a larger farrowing coupled with continued increases in pigs per litter set the stage for significant supply increases into the fall.