Russia Hog Markets

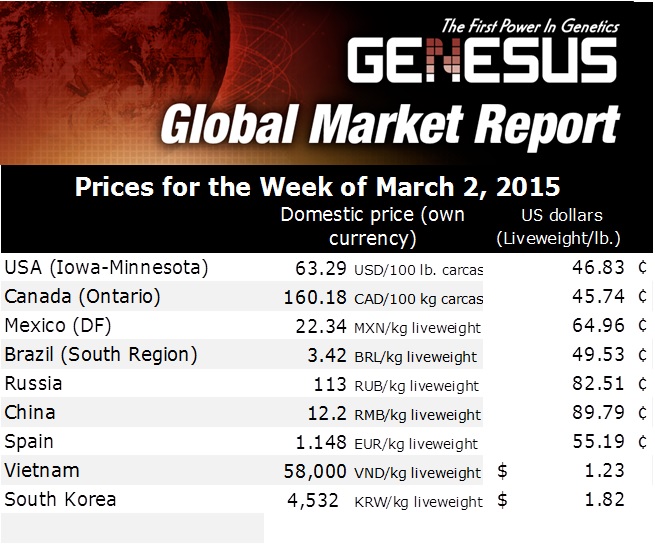

RUSSIA - For Russian Pig farmers, sanctions and Rouble devaluation have been excellent for profits. Pig prices have been at record highs for a considerable time, reports John McIntosh.Current prices are 106 Roubles per kg live. This is down a little from the pre-Christmas peak of 111 Roubles. Rouble devaluation is causing inflation in the shops, consumers are being careful!

Cost of production has risen on the back of increased feed raw material prices and increased cost of importing feed micro ingredients and medicines. This has been a downside of the falling Rouble, which made exporting grain very profitable. The government recently introduced export levies to keep Russian grain in Russia.

The result of this is today a margin per kg of around 30 Roubles or 3,450 Roubles for a 115kg pig. This at today exchange rate is still $56 per pig. How the rest of the pig world would like profits at that level!

What next?

Russia has announced another phase of investment in new farms, feed mills and slaughter plants. This expansion in new production will give Russia more food security for the future reducing further its reliance on imported pig-meat.

The majority of this expansion will be by the new and already successful Russian integrators.

With sanctions there are always winners and losers. It seems in the pig world the Russian integrators will win and the countries that traditionally have exported to Russia will lose.

Challenges

Despite the growth of new and efficient pig business’s in Russia in the last 9 year there are still many challenges.

ASF still keeps appearing. With it in the wild boar population and a large and difficult to control back yard pig population in a massive land mass it will be very difficult to eradicate. A new vaccine is undergoing live pig testing. I am sure now ASF is in the EU and has the potential to affect many more pigs that vaccine manufacturers are more interested in a solution.

New Vs Old Vs Domestic. Although there has been massive investment in new farms the majority of sows are still on old farms or in back yards. The difference in performance between these and the new farms is considerable. Today there will be old farms that struggle to be profitable. Domestic production is reducing year on year due to both ASF control measures and the effect of a developing economy. Many old units, built in the communist era have very low performance and very high costs. These farms are only in business due to very high pig price. Its not if, but when these business’s fail.

Genetics. Despite the importation of a lot of pigs into Russia from Europe and Canada, Russia remains very, very short of high quality Nucleus animals. Back of envelope maths tells us to be self-sufficient in 2020 Russia will need 2 million high performing sows (26 pigs per year sold and 85kg carcass) or 2.65 million average performing (22 pigs per year sold and 75kg carcass). This needs a Nucleus of between 20,000 and 30,000 (assuming all pigs used). Reality is normally between 60% and 70% of the potential breeding pigs produced are used meaning a nucleus of 30,000 to 40,000 is required.

Remember also that this is just to supply Russia’s domestic market. We know Russia and Ukraine are Europe’s bread basket and as such should mean pig meat can be produced at low cost of production. Rather than being a major importer of pig-meat, Russia could become a net exporter. It is already a major exported of wheat, why not add value to that wheat by turning it into pig-meat.

Quality genetics is a big part of a profitable pig business. To grow a successful pig industry requires profitability. This comes from excellent production and low cost of production. It also requires year on year improvements which come from having world class nucleus farms within Russia.

Closing the borders to imported pig meat is helping the Russian pig industry. Closing to importation of top quality Nucleus animals is hindering future production!