US Pork Exports Start Year Poorly

US - As expected, January was a dismal month for US pork exports, as well as for beef and poultry. The West Coast port slowdown was likely the largest factor in January’s disappointing, but not surprising, totals, writes Steve Meyer in the National Hog Farmer.Total pork exports on a carcass weight basis for January amounted to 347.7 million pounds, 21.4 per cent lower than one year ago. That is the largest year-on-year decline for US exports since June of 2009 when monthly shipments were being compared to the China-driven surge of 2008. It also marks the sixth straight month of double digit year-on-year declines.

It’s a lousy way to start off a new year but these figures were not at all unexpected. They coincide well with the period during which we were hearing frequent discussions of canceled orders or delayed shipments that were having to be re-routed to domestic users as West Coast port workers continued to slow the pace of loading and unloading activity.

This year’s January total was almost 100 million pounds less than last year. That’s about one day’s worth of production or nearly five per cent of January’s 2.105 billion pounds of pork output. Higher slaughter of heavier hogs isn’t the only thing that drove significantly more ample supplies of pork in January.

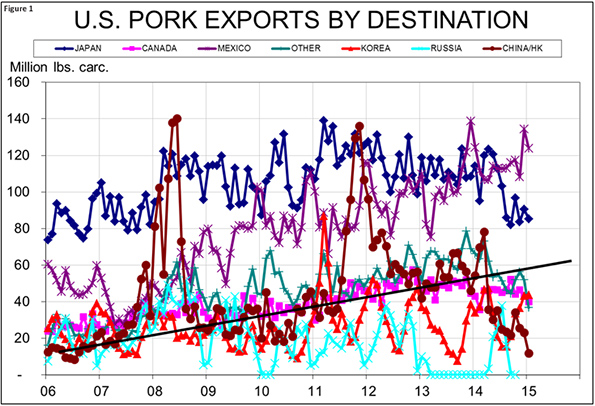

As for US markets, all were down except for Korea and the Caribbean (see Figure 1). Shipments to those markets were 29 per cent and 16 per cent higher, respectively, than last year. Exports to China/Hong Kong were 78 per cent smaller than last year and were the smallest since July 2006. Japan took 25 per cent less pork than one year ago in January, extending the string of double-digit decline months to six.

Shipments to our largest customer, Mexico, were fractionally (0.4 per cent ) lower than one year ago while those to Canada were 7.4 per cent lower. Obviously, neither of these markets was dependent on the West Coast ports but both are being impacted by the strong US dollar which is making all US export products relatively more expensive.

Beef exports were 19 per cent smaller than one year ago in January. Broiler exports were down 12.4 per cent , year-on-year. It is important to note that, while Asia is an important market for US broilers, it doesn’t represent near the proportion of total exports for broilers as it does for beef and pork.

Avian influenza is spreading in the United States, and threatens to have a significant impact on turkey exports. Commercial turkey flocks in Minnesota and, just today, Missouri, have been diagnosed with high-pathogenic avian influenza, and either have been or are in the process of being depopulated. The HPAI is believed to have been spread to the farms by wild birds which can frequently carry the disease without showing any outward symptoms.

These two cases are far more concerning than those earlier detected in the Pacific Northwest and California. Those cases were in small flocks and neither of the areas in question had significant commercial production. But, based on 2014 slaughter, Minnesota is the nation’s No. 1 turkey state and Missouri ranks No. 7. The location of the Missouri case near Carthage in the far southwest corner likely raises some concerns for Arkansas, which was the second largest turkey slaughter state last year. About 40 countries have already banned products from Minnesota and we expect similar bans will come for product from Missouri. The US turkey industry exported just over 14 per cent of its 2014 output.

These regionalised bans are obviously not good for producers and processors in those regions but they do not harm the national industry much since export orders can be filled from other parts of the country and product from the impacted areas can backfill domestic needs. I don’t mean to minimize the gravity of the situation at all, but it is important to realize that state-by-state or plant-by-plant bans are not nearly as impactful. They simply aren’t.

US turkey output was poised to grow sharply this year on the heels of a very profitable 2014. The US Department of Agriculture’s World Agriculture Supply and Demand Estimates for January had 2015 production pegged 5.5 per cent higher than last year.