Market Hogs with Price Level and Risk in Mind

US - Is it time to pull the trigger on hog prices? That’s a question hog producers should ask themselves at least weekly. You do not have to wait and see what prices turn out to be the week that hogs are ready to move to market, writes Steve Meyer for the National Hog Farmer.There are buyers offering real money every day for CME Lean Hogs futures contracts that effectively place a price on hogs to be delivered during some future period. It’s not an exact process but the opportunity is there.

Any pricing decision should be made with two criteria in mind: Price level and risk.

There are three critical components to the price level: Futures price, basis and context. The simplest is, of course, the futures price which is simply the price being offered at a given point in time by traders at the CME Group.

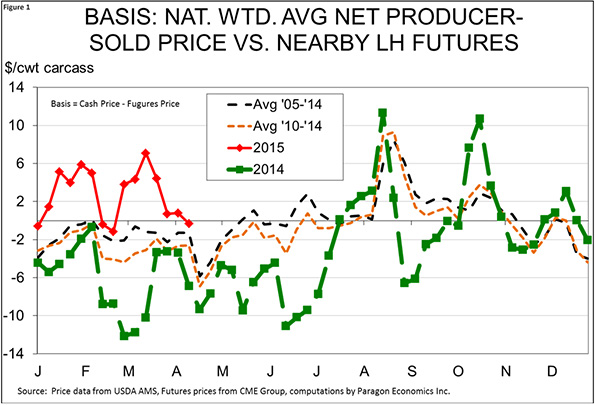

Basis is more complex in that the most applicable basis for any given entity is the difference between what that particular entity receives as a cash price for its hogs and the futures market price on a particular day. I can’t know that for any individual firm since I don’t know how packers bid individual companies for hogs. I can only provide what the basis has been for a particular published price and the nearby futures market price. Figure 1 shows such a basis for the weekly average net price of producer-sold pigs and weekly average nearby futures prices.

As you can see, basis levels have been much stronger this year as the forward-looking view of the futures market has been much more negative. That is good in terms of margin calls (the opposite of last year), but bad in terms of the size of the check you get for your cash-sold hogs (also opposite of last year). But I think the important issue at present is what might happen in coming months.

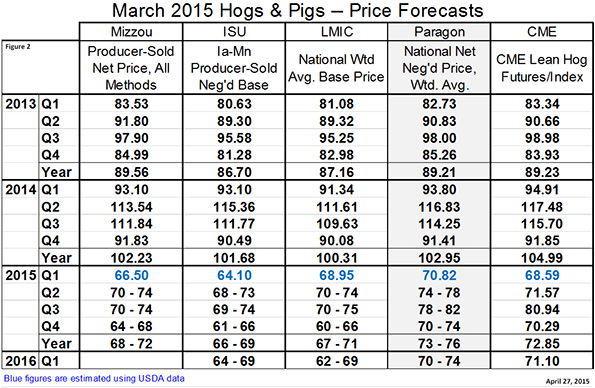

As you can see, basis levels for this price series run negative for the current quarter (-$0.89 average for 2005-14 and -$2.35 for 2010-14), positive for the third quarter (+$2.40 in 2005-14 and +$1.99 for 2010-14) and very close to zero for the fourth quarter (-$0.26 and -$0.35, respectively). Applying those quarterly average basis levels to the average futures prices in Figure 2 shows that futures prices have now moved high enough for cash prices to likely reach the upper levels of my third quarter forecasts and the lower bound for my fourth quarter forecasts. I think producers need to be thinking of making some third quarter pricing plans soon and getting ready to do the same for the fourth quarter.

The average for second quarter futures is still below my forecast price range and I fear it may stay that way. First, the average CME Lean Hog Index for April has been just $62.26, so that number is pretty well fixed in the quarterly average. Therefore, May and June futures will have to continue to rally to pull the average above the $74 low of my second quarter forecast range. That might prove difficult given continuing high slaughter rates.

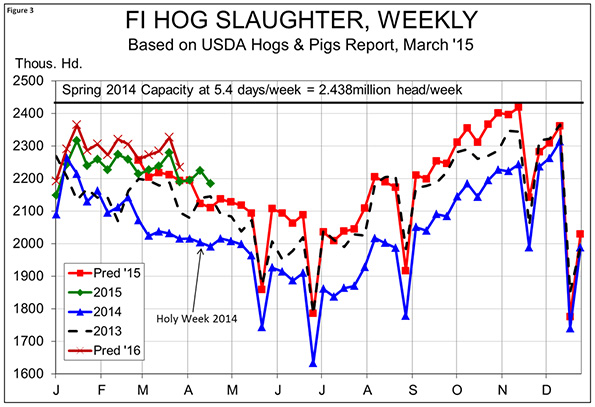

As can be seen in Figure 3, the last two weeks’ totals have been far above (12.0 per cent and 9.7 per cent ) last year’s levels and even well above (4.8 per cent and 3.5 per cent ) the levels I had predicted based on March 1 hog inventories. Weights were basically steady last week and are now running nearly 2 per cent below one year ago but even with that drag on pork output, it will be difficult to rally cash hogs and nearby futures given these supply levels.

The third factor for price consideration is context, and I think the important context is cost of production. You simply have to know what a given price means in profit terms. This factor continues to be good for pork producers. May corn futures touched $3.60 today and new crop December futures are within $0.17 per bushel of their contract life low of $3.70 last September.

Soybean meal is near $310 per ton pretty much across the board. Prices of $3.80 corn and $310 meal puts costs at $70 in my model and likely nearly $64 for the best producers.

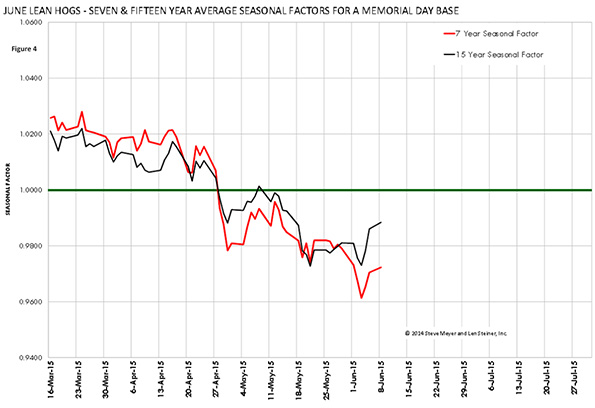

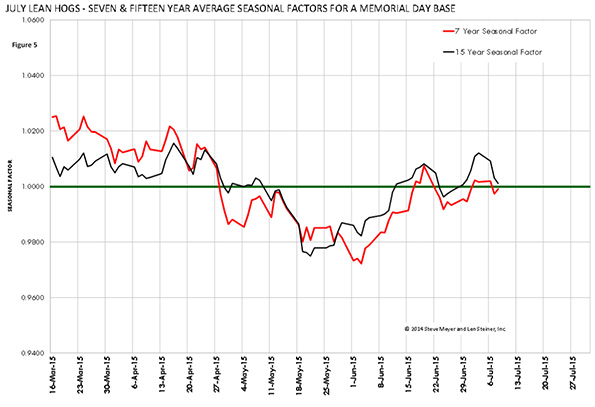

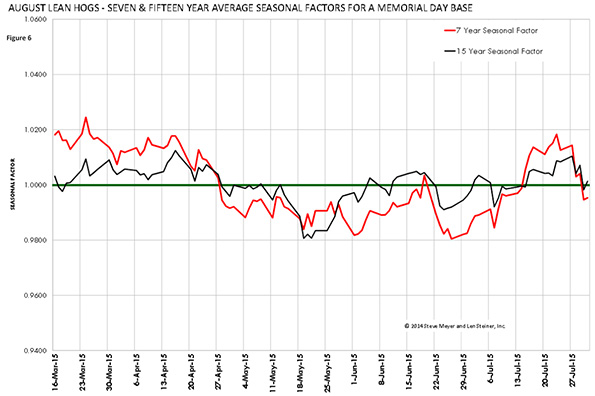

The final pricing factor is risk. I look at two critical factors: Price risk and financial risk. Price risk is the expected variability of the prices under consideration. Since we are looking at futures prices, let’s look at what the futures contracts in question have done historically. Figures 4 through 6 show seasonal patterns for June, July and August Lean Hogs futures from the Seasonal Trader Reports available from The Daily Livestock Report.

They indicate that, at least historically, it is generally downhill for June Lean Hogs futures from April through contract expiration and lower through mid-June and then back to April levels near expiration for July and August Lean Hogs futures. The historical data do not promise much, if any, improvement on price levels near the end of April so it might be time to act from a futures price risk standpoint.

As for financial risk, you need to judge that by looking at your balance sheet and the ability it provides you to withstand financial losses. I believe most producers are in good shape on this count coming off a very good 2014 and with relatively low costs in store for the coming year. Remember the three things they teach you at Harvard Business Schools (according to a friend who went there):

- Don’t run out of cash.

- Don’t run out of cash.

- DO NOT RUN OUT OF CASH.

Whether that cash comes from reserves, operations or credit lines, it must be available when needed if your business is to thrive – or survive to thrive in the future.

It’s about time to sharpen those pencils!