China Hog Markets

CHINA - China: it is the pork powerhouse of the world with over 51 per cent of the world’s population of pigs raised within China, writes Ron Lane, Business Director Asia Pacific.Looking at the size of the breakdown of the inventory for February 2015, the adjusted information from MOA is indicating 389.93 million on-farm pigs and a 41.124 million sow herd.

For March 2015, the adjusted information from MOA is indicating 387.20 million on-farm pigs and a 40.425 million sow herd. (January 2015, there was 405.75 million on farm inventory and a 41.92 million sow herd. The March 2015 387.20 million on farm inventory is down 0.7 per cent from last month (February 2015) and February, in turn, was down 3.9 per cent from January 2015).

This is a further drop of almost 18.55 million on-farm pigs in the first quarter of 2015.

The total drop in on-farm pigs as compared to March 2014 is 10.1 per cent . The February sow herd was down 1.90 per cent from January 2015 and was down 15.5 per cent from one year ago. Looking at the March 2015 sow herd, it was down 1.7 per cent from February and was down 15.3 per cent from one year ago. Again in February, almost 800,000 sows disappeared and in March, a further 700,000 sows were eliminated from the national herd.

With January’s total at about 1 million sows, then, during the 1st quarter of 2015, a total of 2.5 million sows have been culled and/or eliminated from the total national herd. Since April 2014 (the past 12 months), the China sow herd has seen more than 7.52 million sows eliminated.

The current sow inventory is the lowest level in more than four years. Poor market prices cause nervous farmers to sell off inventory. The 15.3 per cent loss in sow numbers is more than the total number of sows in the USA (number two in the world) and Canada combined for sow numbers.

Several farm households are deep in financial difficulty and bankruptcies of large farms are beginning to happen. Some large-scale farms are being shut down or being bought up by larger scale systems. However, with excessive elimination of sow production and with lower supply of market hogs, there has been a steady rise in pork prices during the month of April.

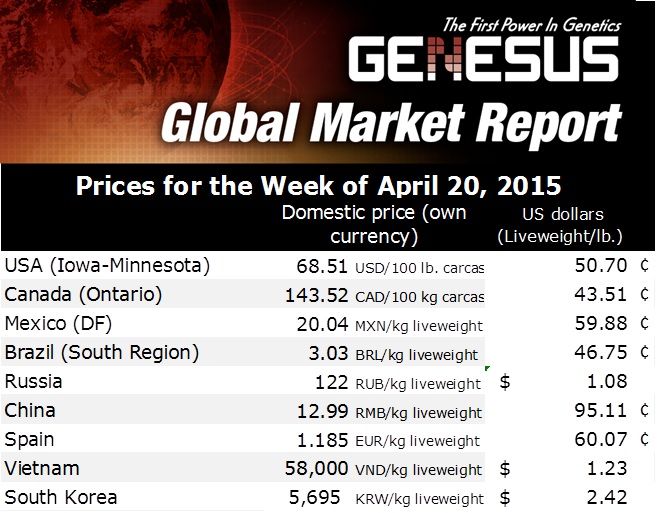

After April, and during the next few months, market pig producers should see 2015 prices continue to rebound. The highest point of the year should be over 17 RMB/kg ($ 2.74 USD/kg-$ 1.25 USD/lb).

- The National Statistics Bureau indicated that the GDP for China in 2014 was 7.4 per cent year on year-the lowest growth in 24 years. Agricultural sales were about 5.8332 trillion RMB (or $ 942.054 billion USD) and this was up 4.1 per cent from the previous year. The total number of market pigs in 2014 was 735.1 million head, up 2.7 per cent from last year. The live pig inventory for 2014 was 465.83 million head and this was up 1.7 per cent compared to the same period in 2013. Pork production was 56.71 million tonnes, up 3.2 per cent over last year.

- Large-scale permanent site slaughtering plants killed 236.533 million head in 2014-up 1.45 per cent as compared to 2013. The peak slaughtering times are always close to Spring Festival. In January, 2014, these plants killed 23.87 million head and in December 2014 was also a high slaughtered number. The lowest number killed is usually after Spring Festival (February 2014 with only 13.92million head). In addition, during the summer months, this period can be a low number.

During 2014, a total of 735.1 million pigs were slaughtered in China. Large-scale plants slaughter about 1/3 of the pigs in China. The National Government is pushing to increase the slaughtering done by the large-scale plants and to remove the small, poorly inspected mobile or permanent plants. - China Meat Association reported that at the beginning of 2014, there were 3,786 large scale slaughtering and meat processing enterprises in China. During the year, a total of 351 (9.3 per cent of the total) plants failed or shutdown. All large-scale enterprises account for 20 per cent of all animals slaughtered (includes pigs, poultry, beef, etc.). These plants have to compete with small enterprises that have lower fixed costs, are usually poorly regulated and are locally situated for convenience to the small producers.

- Recently, Romania received the right to export frozen pork to China and became the 16th country that can export pork into China. The Smithfield Group, who have a large-scale farm in Romania and who is owned by the WH Group (part of the Shuanghui group of China) have been given authority to export frozen pork.

- In 2014, the total domestic grain production in China reached 600 million tonnes, with corn production reaching 215.673 million tonnes (the second highest production ever recorded). With this, China is now having surplus carryover for corn-with 24.89 million tonnes (2013); 39.76 million tonnes (2014) and is projected to be 29.5 million tonnes in 2015.

During the week of April 17th, the national corn price ranged from a high of 2,653 RMB/tonne to a low of 2,151 RMB/tonne ($ 428.25 USD to $ 347.22 USD/tonne); the national wheat price ranged from a high of 2,460 RMB/tonne to 1,500 RMB/tonne ($ 397.09 USD to $ 242.13 USD/tonne) and the national soybean meal price ranged from 3,773 RMB/tonne to 2,820 RMB/tonne ($ 609.04 USD to 455.21 USD/tonne). - According to a recently released Rabobank report and for the first quarter of 2015, the report saw global pork prices down sharply. An increase in supply in the US, Russia and Brazil has surpassed the demand which is not as strong as previous years. Pork prices in China reached a bottom (so far this year) in March and are now starting to increase. Exports to China will see rapid growth during the second half of this year. EU countries like Germany, Netherlands, Denmark and Spain, as well as Brazil are in a good position to take advantage of the China demand. The US and Canada will likely increase imports into China.

Pork prices in China had fallen continuously for about the past 8 months, but have risen during the past six weeks. The rise is slight (increase by about six per cent), but farmers in China are optimistic for further increases during the second quarter. - The Harbin Weike Biotechnology Company has introduced China’s first vaccine for PEDv. This vaccine also offers protection from TGE and Type G rotavirus. Last year, US pork farms suffered huge losses with PED affecting about 76 per cent of the US pig farms. China also has frequent losses from PEDv. The new vaccine was developed at the Harbin Veterinary Research Institute-by a team led by Dr Feng Li. Last December (2014), the Institute imported Yorkshire and Landrace GGP gilts and boars from Genesus Inc. for research purposes. The domestic swine industry is cautious but optimistic with this newly released vaccine.

- The Consumer Price Index (CPI) continues to be quite interesting for the national government. The CPI is made up of about 31.8 per cent food found in the consumers’ basket. Pork is estimated to be about 1/3 of the food portion of the basket or in other words, about 10 per cent of CPI as a whole. CPI was 1.2 per cent for the first three months of 2015 (the lowest reading since the fourth quarter of 2009). This is one of the signals for deflationary risk, which is part of the weak total demand in China. This could cause further room for policy easing within the sluggish economic activities.

March inflation rate was the same as February at 1.4 per cent -better than the market expected (January was the lowest in five years at 0.8 per cent ). Food prices (including pork) weakened significantly after Spring Festival with a 4.5 per cent decline. Currently, the pork prices are keeping the CPI lower, but a substantial increase, as is now starting to happen, with more likely towards the mid-half of this year, will cause the national government concern. As a measure, when pig prices increase, CPI should increase.