Canada Hog Markets: Lessons from Show Season

CANADA - I have had opportunity to participate in two pork shows in the month of June, the Ontario Pork Congress (OPC) in Stratford Ontario just last week and the World Pork Expo (WPE) in Des Moines Iowa two weeks ahead of that, writes Bob Fraser, Sales & Service, Genesus Ontario.Although two different shows as to scale, reflecting the differences in the size of the industry they are representing. In the case of OPC, the 300,000 sows in Ontario. Where WPE is basically the close to six million sows of the US industry. Therefore, OPC is 5 per cent of WPE. However, both probably work equally well as an excellent place to get the “pulse” of an industry. So what was the reading?

First the similarities. As with any show the attendees tend to be a progressive optimistic lot, otherwise they stay at home. So perhaps you have a skewed sample. But by the same token, they’re off their turf and also looking to get a sense of what’s going on out there and where the opportunities may lie.

This is what I picked up. Both sides of the border have come off a year for the record books that has gone a long way to healing old wounds and rejuvenating their interest in the game for themselves and the next generation. This was very evident in Ontario whereas Jim outlined in his commentary this week the industry remains primarily a diverse family farm driven land based industry. This is not particularly different from the US industry at its core. The “Pork Powerhouses” get a lot of play in the US but there is a large and significant portion that is the same. That is family farm driven, land based pork producers. The primary difference being again the scale. The Ontario group is ballpark 500 to 2500 sows (with always some outliers). The US group you can add a zero i.e. 5,000 to 25,000 sows.

Now the difference in two very similar groups other than the scale. Both as I say are family farm driven usually with a significant land base, as their model is corn to pigs to manure and back around again. A very sustainable model. The other similarity on both sides of the border is many are of Dutch origin or North European extraction and as we like to say have the “livestock gene”. By that, we mean they have a multi-generational history of feeding livestock, they genuinely enjoy livestock and as a result, they tend to be very good at it. This is not an insignificant strength. Therefore, from two shows in two different countries I am looking at what I believe to be a very similar base coming off very similar years but a very different response.

In the US, there is clearly optimism and it is translating into expansion. The age old (for better or worse) common response of successful pork producers. It also although certainly not exclusively but primarily appears to be coming from this group I reference, the family farm driven land base pork producer. Seems that the survivors (don’t know that we have any other kind left) believe they have a robust, sustainable model and whether they have 5,000 sows or 25,000 sows believe they could do more. More seeming to be in many cases twice as much. That was my take away from WPE.

In Ontario (Canada) also clearly optimism but it appears to be translating into caution rather than expansion. As I say a similar base with similar robust, sustainable models but very different responses. At WPE heard of dozens of significant building projects. At OPC, I heard of one. Certainly not aware of everything that goes on in Ontario but it’s a relatively small industry (300,000 sows) and compact (90 per cent all within an 80-mile radius of Stratford). Therefore not a lot of secrets.

Why the different response? Of course a host of factors but as I’ve discussed in previous commentaries the state of our packing industry appears to be at the top of the list. I spoke to numerous producers at OPC that have a desire and ability to expand but question their ability to get their extra pigs processed period. Let alone at a sustainable price. I appreciate in a commodity business the relationship between seller (producer) and buyer (packer) will always have adversarial elements.

However if packer and producer can’t figure out models to sustain each other, neither will survive long term. America appears to be figuring it out, witness a packing plant going into Michigan and now another one going into Iowa. In Canada, the discussion seems to centre more on not losing another one rather than gaining any. It’s a problem and one that will require foresight by the entire industry not to see further decline.

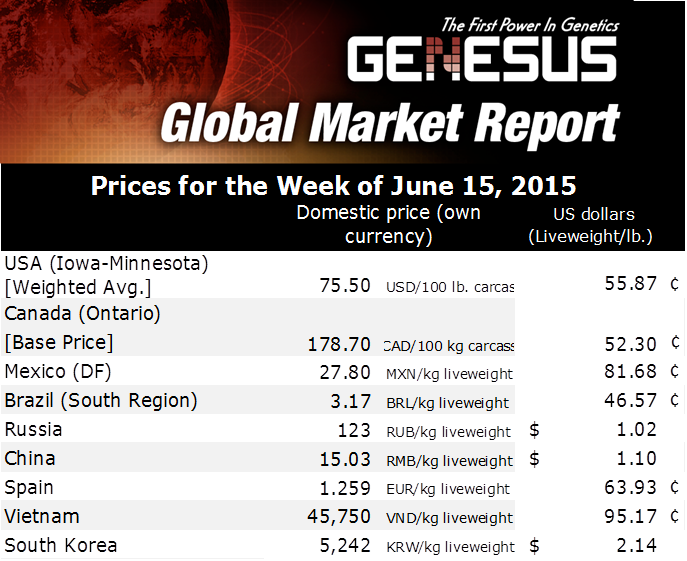

Finally, the hog markets margins continue to be vastly improved and although some concern that market price has run out of gas and may have peaked, declining grain/feed prices have so far offset to maintain margin.